Business brokers are stuck. While digital platforms streamline sales and cut costs, traditional brokers cling to outdated systems and high commissions.

At Unbroker, we’ve watched this broker resistance play out across the industry. Business owners are tired of hidden fees, slow processes, and lack of transparency. The market is shifting fast, and those who don’t adapt will lose.

What Traditional Brokers Actually Cost You

Commission Fees That Drain Business Value

Traditional brokerage fees destroy business value before a sale even closes. Commission rates typically between 10 and 20 percent of the sale price mean a $5 million business sale costs the owner significantly more in fees alone. That money could fund growth, pay down debt, or reward employees instead. Hidden costs pile up fast beyond the headline commission. Due diligence fees, transaction fees, and administrative charges add another 2 to 3 percent. Business owners often discover these extras buried in closing documents, too late to negotiate.

The Time Sink That Kills Deals

The real damage extends far beyond the fee percentage-it’s the time sink. Traditional brokers manage processes through spreadsheets, email chains, and phone calls. A single transaction stretches across nine to twelve months, with weeks lost to back-and-forth communication over basic tasks like document collection or buyer qualification. That delay costs real money. Every month the business sits on the market, revenue opportunity disappears and buyer interest cools.

Outdated systems also mean zero visibility into what’s actually happening. Owners can’t track buyer conversations, document status, or negotiation progress in real time. They’re forced to call their broker repeatedly for updates, creating friction and anxiety throughout the process.

The Opacity Problem

Transparency problems run deeper than fees. Traditional brokers rarely disclose exactly how they price a business or why certain valuations matter. They control the buyer list, the marketing approach, and the negotiation strategy without showing their work. If a deal falls apart, owners never learn why or what went wrong. This opacity breeds distrust and leaves business owners feeling powerless.

Modern platforms flip this model entirely. They show upfront pricing, eliminate surprise fees, and give owners real-time access to their transaction data. The market has already spoken-business owners are exhausted with the old way. Digital solutions that promise speed, clarity, and fair pricing are winning market share precisely because traditional brokers have ignored these pain points for decades.

The question isn’t whether change will happen in brokerage. The question is whether legacy brokers will lead that change or resist it until the market forces their hand.

Why Legacy Brokers Can’t Let Go

Legacy brokers resist digital transformation because their entire business model depends on opacity and high commissions. A 10 to 20 percent fee on a $5 million deal generates $500,000 to $1 million in revenue for a single transaction. Moving to transparent, low-cost digital platforms means those brokers lose that income stream almost entirely. They cannot absorb a 90 percent revenue cut and survive, so they rationalize why the old way still works. They tell clients that personal relationships and local market knowledge justify premium fees, conveniently ignoring that digital platforms now provide better data access, wider buyer networks, and faster sales cycles. The resistance stems not from quality or service concerns-it stems from protecting a revenue model that fails to scale with modern business needs.

The Sunk Cost Trap

Brokers who invested decades building relationships, hiring staff, and establishing office networks face a brutal choice: abandon those investments or defend them against market pressure. A traditional brokerage with ten agents, office overhead, and years of accumulated client relationships represents millions in sunk costs. Switching to a digital-first model requires laying off staff, closing offices, and essentially admitting the old system was inefficient. That admission feels psychologically impossible for many brokers. Instead, they double down on what they know, convincing themselves that business owners still prefer talking to a human rather than accessing real-time data through a platform. The math does not support this claim, but admitting it would mean dismantling everything they built.

Market Share Fear Masquerading as Confidence

Brokers watch competitors and digital platforms poach clients, yet paralysis sets in when they consider disrupting their existing book of business. If a traditional broker suddenly cuts commissions or moves to a transparent pricing model, existing clients might demand retroactive refunds or renegotiation. Switching to digital operations could trigger staff departures to competitors who still offer steady income. That fear of internal collapse keeps brokers locked in place, even as the market shifts around them. They tell themselves that business owners will always need personal service, that technology cannot replace relationships, that their local market position remains defensible. None of these claims hold up against the reality that digital platforms already win deals faster and cheaper, without the overhead traditional brokers carry.

What Happens When Brokers Finally Move

The brokers who do attempt digital transformation often stumble because they try to bolt technology onto outdated processes rather than rethinking their entire operation. They add a website, launch email campaigns, and call themselves “modern” while still managing deals through spreadsheets and manual workflows. Real transformation requires abandoning the commission-heavy model entirely and rebuilding around speed, transparency, and efficiency. Those who make this shift discover that lower fees actually attract higher volume, and higher volume compensates for lower margins. The brokers stuck in the middle-too invested in the old model to fully commit, yet aware enough to sense the threat-face the worst outcome. They lose market share to both traditional competitors who maintain premium positioning and digital platforms that offer genuine innovation.

The real question facing legacy brokers is not whether digital transformation will happen. The question is whether they will lead that transformation or watch it happen to them while their client base migrates to platforms that already operate at the speed and transparency business owners now demand. Understanding how selling your business to a competitor works in modern markets reveals just how far ahead digital platforms have moved in serving business owners’ actual needs.

What Makes Digital Platforms Unstoppable

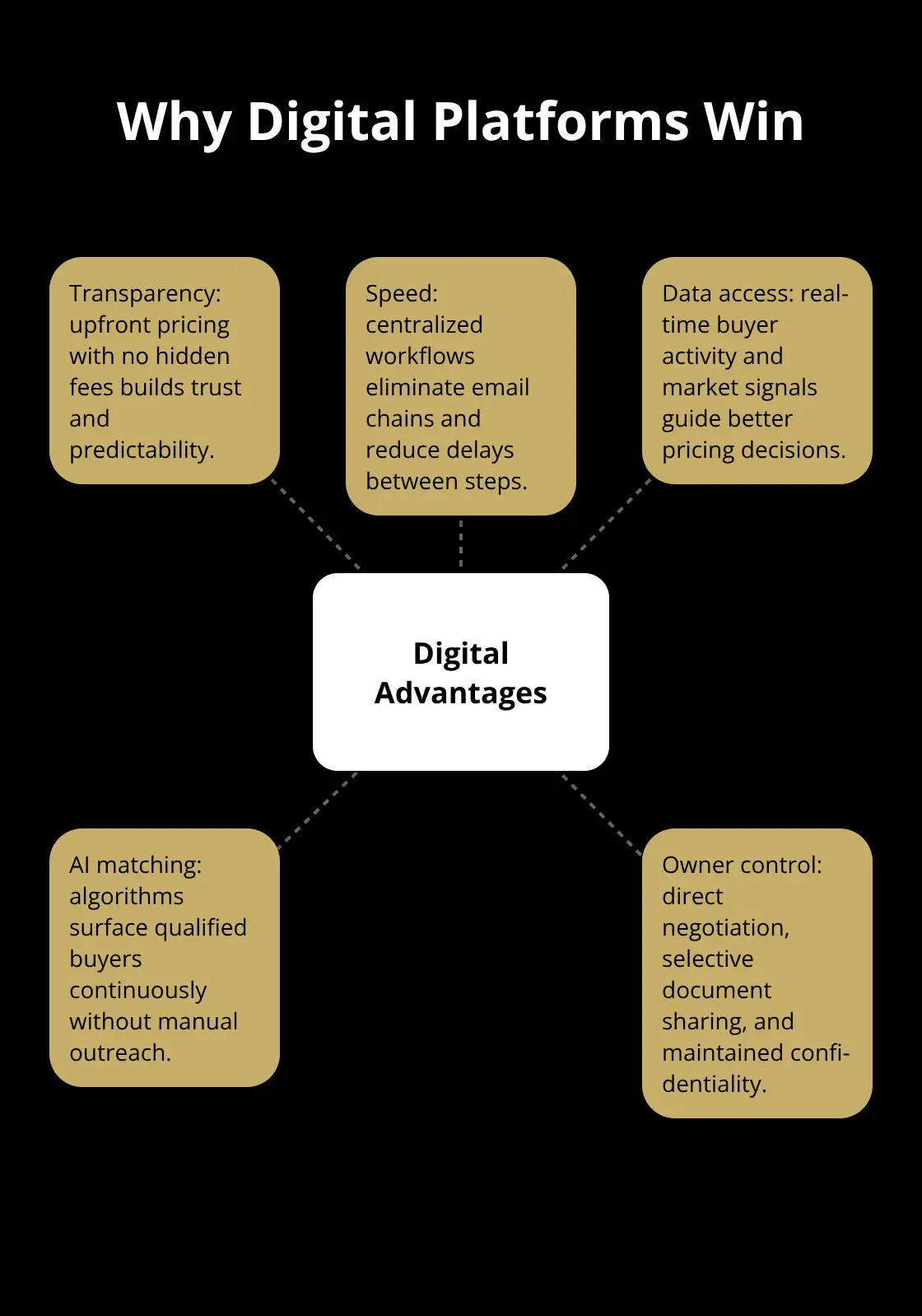

Digital platforms win because they operate on fundamentals that traditional brokers abandoned long ago: showing your work, moving fast, and letting owners see what’s happening. When a business owner lists on a digital platform, they know the exact cost upfront. No surprise fees buried in closing documents. No negotiation over administrative charges that appear weeks before closing. Fixed fees replace the traditional commission structure, which on a $5 million business means significant savings compared to traditional approaches. Digital platforms compress that into low, predictable numbers. The math is so stark that once business owners see both options side by side, they rarely choose the traditional route.

Speed follows naturally from transparency. Digital platforms manage transactions through centralized software, not email chains and spreadsheets. A buyer inquiry moves through qualification, documentation, and negotiation without weeks of delay between steps. 66% of REALTORS® report that they embrace new technology primarily to save time, according to the 2025 REALTORS® Technology Survey. That same dynamic applies to business sales. Owners track their deal status in real time, see which buyers viewed their listing, access documents instantly, and negotiate without waiting for their broker to call back. Traditional brokers lose deals because they can’t match this speed. A deal that takes nine months on a traditional timeline might close in three to four months on a digital platform, which means the owner reaches their exit goal faster and the buyer gains certainty sooner.

Where Data Changes Everything

Digital platforms give owners access to information that traditional brokers hoard. An owner on a digital platform sees exactly how many qualified buyers viewed their listing, which industries show the strongest buyer interest, what price ranges attract the most serious offers, and how timing affects buyer behavior. That data transforms a passive experience into an active one. Owners who understand their market position negotiate better and make smarter decisions about accepting or rejecting offers. Traditional brokers control this information and use it to justify their role as essential intermediaries. They claim only their market expertise and relationships matter. Digital platforms prove otherwise by publishing the data directly to owners. An owner who knows five serious buyers viewed their listing at $4.2 million but only two viewed it at $4.8 million has real information to guide their pricing strategy. A traditional broker might tell them the same thing verbally, but the owner has no way to verify it or access it again later.

AI-Driven Matching at Scale

AI-driven matching on digital platforms adds another layer that brokers cannot replicate at scale. These systems analyze buyer profiles, industry preferences, and deal structures to surface the most qualified matches for each listing. That reduces wasted time on unqualified buyers and speeds the path to serious negotiations. The technology works continuously, identifying new buyer opportunities without human intervention delays. Traditional brokers rely on their personal network and manual outreach, which limits the buyer pool they can reach and slows the matching process significantly.

Direct Control and Aligned Incentives

Direct control matters more than owners realize until they experience it. On a digital platform, an owner decides when to accept meetings, which documents to share, and how to respond to offers. They maintain confidentiality through their own account rather than trusting a broker to keep sensitive information private. They negotiate directly or with professional support they hire themselves, rather than having a broker control the conversation. That autonomy reduces conflicts of interest. A traditional broker profits from a quick sale at any price. An owner profits from the highest possible price. Digital platforms align incentives by charging fixed fees regardless of sale price, so the platform’s success depends on owner satisfaction, not deal velocity or final valuation.

Final Thoughts

The market has already decided. Digital platforms are becoming the standard because they deliver what business owners actually want: speed, transparency, and fair pricing. Traditional brokers built their empires on information asymmetry and high commissions, yet that model is collapsing not because relationships don’t matter, but because digital platforms prove that relationships work better when aligned with owner interests rather than broker profits. Broker resistance to this shift stems from real pressure-a broker who invested thirty years building a local reputation faces genuine disruption when a digital platform offers the same buyer access without the overhead.

Business owners have tasted what modern selling looks like and won’t return to the old way. They’ve seen fixed fees instead of surprise charges, experienced real-time deal tracking instead of calling for updates, and accessed buyer data instead of trusting broker claims. Once that experience becomes normal, the expectation for efficiency and honesty transforms from preference into baseline requirement. The psychological weight of abandoning outdated systems keeps many brokers frozen, yet the market doesn’t reward loyalty to inefficient processes-it rewards speed, data access, and honest pricing.

We at Unbroker built our platform on this reality by eliminating high brokerage fees with transparent pricing and AI-driven buyer matching. Whether you choose full-service selling or assisted support, you gain confidentiality, no hidden fees, and access to a vast buyer network through our transparent platform. The future of business sales belongs to platforms that put owners in control and remove the friction traditional brokers created.

![Business Sale Disasters That Could Have Been Prevented [Case Studies]](https://vvlpm4xwtlb.c.updraftclone.com/wp-content/uploads/emplibot/sale-disasters-hero-1768631158.jpeg)