Selling your business is one of the biggest financial decisions you’ll make. Yet most founders focus only on valuation and terms, ignoring the psychological forces that actually determine deal success.

At Unbroker, we’ve seen countless exits fail or underperform because founders weren’t mentally prepared. Exit psychology isn’t about being tough-it’s about understanding your emotions, recognizing buyer tactics, and staying clear when it matters most.

Emotional Intelligence in Exit Planning

The Founder’s Burden: Why Letting Go Determines Your Exit Price

Most founders underestimate how their emotional attachment to the business directly impacts deal outcomes. Behavioral economics research shows that founders who remain emotionally tied to their company set unrealistic valuations, reject reasonable offers, and negotiate from a defensive position rather than a strategic one. The result is predictable: they either walk away from deals that would have worked or accept terms far worse than what the market would bear. Your attachment isn’t weakness-it’s a real psychological force that sabotages negotiations if left unmanaged.

The founder who built something meaningful faces a specific challenge: separating the business’s objective value from the personal identity wrapped around it. Studies on business transitions show that owners who explicitly acknowledge their emotional investment actually perform better in negotiations because they can identify when feelings drive decisions rather than facts. Start by writing down what the business means to you beyond revenue. This forces the emotional component into the open where you can examine it rationally. Once you’ve named what you’re losing, you can address it separately from what you’re selling.

Decision Fatigue Depletes Your Negotiating Power

Exit processes stretch across months. During this time, founders face constant micro-decisions-responding to buyer questions, reviewing contracts, managing due diligence requests-that deplete mental energy. Cognitive psychology documents decision fatigue: after making many decisions, your judgment deteriorates significantly. Founders in this state make concessions they wouldn’t normally accept and miss red flags in buyer behavior.

One practical solution involves batching decisions rather than responding immediately to every request. Set specific windows-Tuesday and Thursday afternoons, for example-for reviewing buyer communications and making responses. Outside those windows, you’re off limits. This creates psychological distance and prevents reactive decision-making.

Delegate Decisions to Preserve Your Mental Energy

Another tactic involves delegating non-core decisions to your advisory team. Your solicitor, accountant, and financial adviser should handle routine contract language and compliance questions. You should reserve your mental energy for the three to five truly consequential decisions: valuation framework, payment structure, earnout terms, and buyer fit. Data on successful exits shows that founders who used structured advisory teams completed sales 23% faster than those managing everything themselves. The speed reduction alone reduces decision fatigue significantly.

Finally, protect your confidence in your valuation by establishing it before negotiations begin. Work with your financial adviser to model three scenarios: conservative, realistic, and optimistic valuations based on comparable exits in your sector. When a buyer makes an offer below your realistic scenario, you already know it’s undervalued-you’re not second-guessing yourself mid-negotiation. This anchoring effect, well-documented in behavioral science, means the first number discussed shapes all subsequent discussions. Present your valuation with confidence and specificity, not as a suggestion.

Your emotional state during negotiations directly influences how buyers perceive your resolve and your business’s true value. The next section examines how to recognize and counter the psychological tactics buyers deploy to shift negotiations in their favor.

Negotiation Psychology and Deal Dynamics

Successful negotiations begin with understanding what drives the other side. Most founders assume buyers care primarily about revenue and profit margins. The reality is more complex. Buyers evaluate acquisitions through multiple lenses, and knowing which ones matter most shifts the entire dynamic in your favor. When you understand a buyer’s true priorities, you stop negotiating defensively and start controlling the conversation.

Different Buyers, Different Pressures

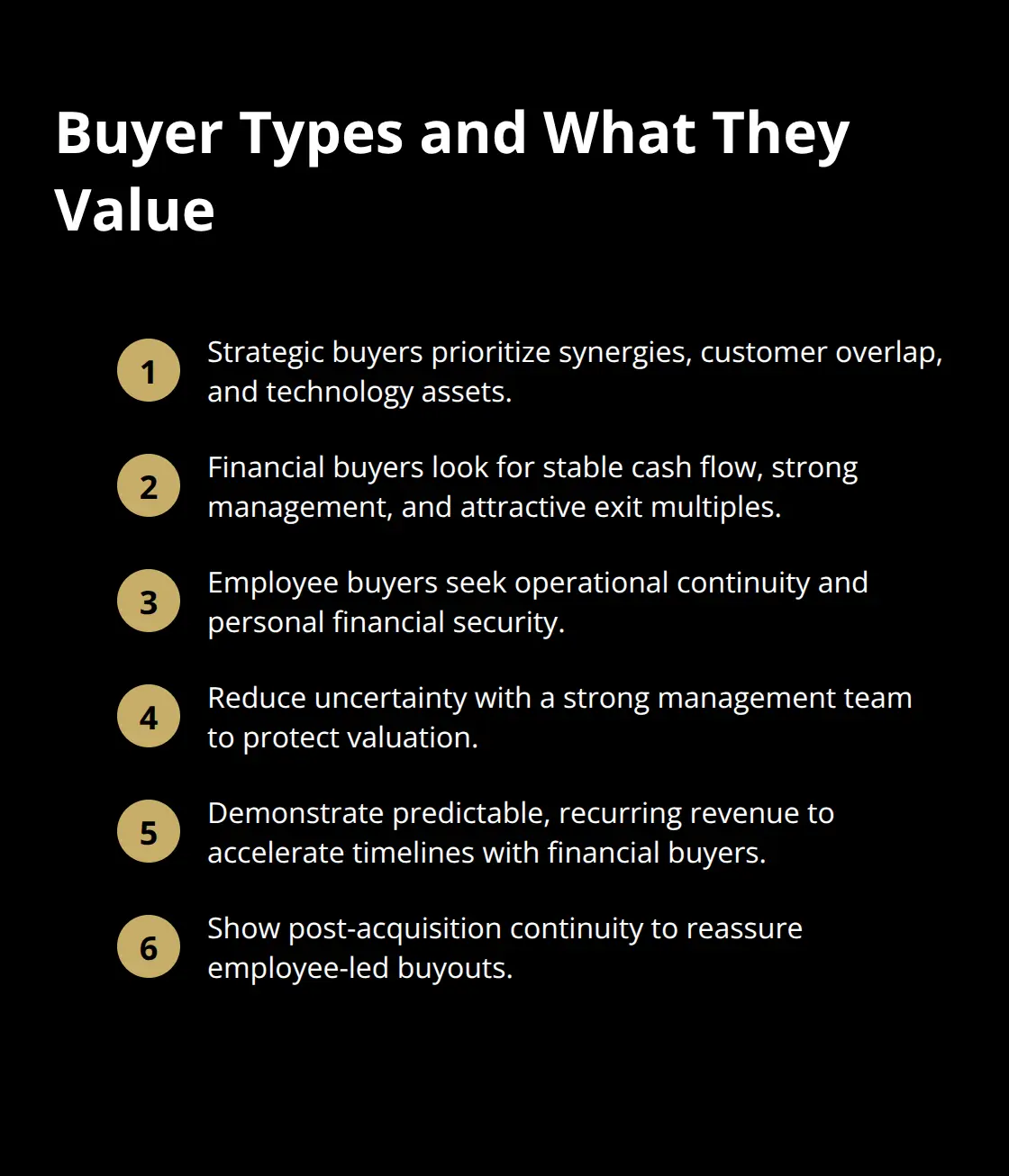

Different buyer types have fundamentally different motivations. Strategic buyers acquiring in their own sector prioritize revenue synergies, customer overlap, and technology assets that accelerate their growth. Financial buyers focus on cash flow stability, management quality, and exit multiples relative to their acquisition cost.

Employees buying through management buyouts care about operational continuity and their own financial security post-acquisition. Each type has pressure points. A strategic buyer worried about customer retention after your departure will pay more for a strong management team in place. A financial buyer facing pressure to hit return targets will move faster if you demonstrate predictable, recurring revenue. An employee buyer needs confidence that the business will sustain their salaries and growth. Research from Harvard Business School on M&A psychology found that buyers who felt uncertain about operational continuity after acquisition offered lower valuations than those with confidence in the management structure. This means your strongest negotiating position comes from reducing buyer anxiety, not from aggressive posturing.

How You Respond to the Opening Offer

When the first offer arrives, most founders react emotionally. They feel insulted, defensive, or suddenly uncertain whether their valuation was realistic. This emotional spike is precisely when you lose control of negotiations. Behavioral economics research on anchoring shows that the opening offer shapes all subsequent discussions, regardless of how unrealistic it initially seems. If a buyer offers 30% below your asking price and you react with shock and rejection, you’ve signaled that their offer is in the ballpark for negotiation. Instead, treat the opening offer as data, not an attack. Write down the offer, review it with your advisory team within 24 hours, and respond with specificity about where it falls short. Reference comparable exits in your sector with similar revenue, margins, and growth rates. If your business generated 2 million pounds in revenue with 35% EBITDA margins and similar exits in your industry commanded 6.5x EBITDA multiples, state that clearly: your valuation expectation sits at 45.5 million pounds before adjustments. This framing separates emotion from calculation. The buyer now negotiates against market data, not your ego.

Control the Frame Before Serious Talks Start

Framing determines how buyers perceive value. A business that lost a major customer last year looks risky to most buyers. The same business positioned as having diversified its customer base after identifying concentration risk looks strategically managed. Both statements can be true; framing shapes which truth the buyer emphasizes. Prepare your narrative before serious negotiations start. Document your business’s competitive advantages, technology moat, customer retention metrics, and market position using concrete numbers. If your customer retention rate sits at 92%, that’s a powerful data point. If your product development cycle delivers new features 40% faster than competitors, quantify it. Build a narrative where your business solves a specific problem that buyers desperately need solved. This shifts the conversation from what you’re selling to what the buyer gains. When you control the frame, the buyer negotiates within the boundaries you’ve set rather than introducing new criteria that undermine your position.

Managing Your Emotional Responses Under Pressure

Negotiations test your composure. Buyers deploy tactics designed to create urgency, doubt, or frustration. They may introduce new concerns mid-process, threaten to walk away, or pressure you for concessions on terms you’ve already settled. Your emotional response in these moments determines whether you hold your position or capitulate. The key is separating the buyer’s tactics from the actual negotiation. When a buyer says “We need a 20% price reduction or we’re out,” that’s pressure, not a fact. Pause. Consult your advisory team. Respond with data about your valuation and market comparables rather than reacting defensively. This approach accomplishes two things: it signals that you won’t be rattled into poor decisions, and it forces the buyer to justify their position with substance rather than pressure. Founders who maintain emotional control throughout negotiations close deals faster because buyers recognize they’re dealing with someone rational and prepared, not someone they can manipulate through emotional tactics.

The psychological dynamics shift once you understand buyer motivations and control your own responses. Yet the real test arrives after the deal closes, when you face an entirely different psychological challenge: building a life and identity beyond the business you’ve spent years building.

Preparing Your Mindset for Post-Sale Life

The Identity Crisis That Arrives After Closing

The moment a deal closes, founders face an unexpected crisis: identity collapse. You’ve spent years defining yourself through the business. Your calendar revolved around it. Your conversations centered on it. Your sense of accomplishment came from it. Now it’s gone, and you’re left asking questions that feel absurd from the outside but devastating from within: Who am I now? What gives my life structure?

Psychological research on career transitions shows that founders experience a measurable identity void in the months following an exit. This isn’t weakness or ingratitude. It’s a predictable psychological response to losing the primary source of your identity and daily structure.

Construct Your Post-Exit Identity Before the Sale Closes

The solution isn’t to pretend this doesn’t matter or to jump immediately into the next venture. It’s to deliberately construct a post-exit identity before the sale closes. Start now by identifying three to five areas of your life that exist outside the business. These might be skills you’ve developed, hobbies you’ve neglected, relationships you want to deepen, or problems in your community you care about solving.

Document them specifically. If you care about mentoring, don’t just write mentoring. Write: meet with three founders monthly to discuss their exit strategy and help them avoid the mistakes I made. If you’re interested in fitness, don’t write fitness. Write: train for a half-marathon and establish a weekly running group with other founders. Specificity creates commitment and structure. This becomes your post-exit roadmap.

Model Your Financial Reality and Separate Spending from Investment

Research shows that most business owners have plans to sell or transfer ownership of their business as they think about retirement. This creates intense pressure to make the right decisions immediately after closing. Before you invest a single pound of sale proceeds, work with a wealth planner to model your actual spending needs across the next twenty years. Include major life events: children’s education, property purchases, potential health costs, travel.

Once you know your genuine financial requirements, you can separate that amount from discretionary capital available for investment or new ventures. This mental separation reduces financial anxiety significantly. Many founders sabotage their post-exit lives by either spending recklessly to fill the void or hoarding capital obsessively because they fear running out. Clear financial modeling eliminates both extremes. You now have specific spending boundaries and investment capital, removing the ambiguity that triggers poor decisions.

Coordinate Your Advisory Team for Tax Efficiency and Investment Strategy

The advisory team that helped you negotiate the exit should now shift focus. Your solicitor and accountant should coordinate with your wealth planner to optimize tax efficiency from the sale. If you structured the sale with earnout provisions, your accountant needs to track those carefully and flag tax implications. Simultaneously, your wealth planner should introduce you to investment specialists who understand your risk tolerance and time horizon.

At this stage, most founders benefit from external perspective because the emotional intensity of the exit process leaves them vulnerable to overconfidence or paralysis. An experienced adviser can help you identify whether a new business opportunity excites you or simply fills the identity void you’re experiencing. That distinction matters enormously. 90% of global startups fail at some point in their lifecycle, making it critical to ensure new ventures are driven by genuine market insight rather than emotional need.

Final Thoughts

Exit psychology shapes your deal outcomes far more than most founders realize. The three psychological forces we’ve covered-emotional attachment, negotiation dynamics, and post-exit identity-operate throughout your entire exit journey, and founders who acknowledge these forces rather than ignore them consistently achieve better results. Buyers offered higher valuations when they felt confident in your management structure, negotiations moved faster when you maintained emotional control, and advisory teams helped you complete sales 23% faster than solo efforts.

Your emotional readiness directly impacts your financial outcomes and long-term satisfaction. A founder who separates personal identity from business value negotiates from strength rather than fear, while a founder who models post-exit finances stops making desperate concessions to close quickly. Understanding buyer motivations allows you to control conversations instead of reacting defensively to pressure tactics, and these psychological advantages compound throughout your exit process to affect your final valuation, payment terms, and post-sale confidence.

We at Unbroker understand that selling a business involves far more than financial mechanics, which is why we’ve built a platform designed to reduce friction and cost while keeping you in control. Whether you choose our Full Service Business Sale or Assisted Business Sale, you gain access to expert support, transparent pricing, and a buyer network enhanced by AI-driven processes. Visit Unbroker to explore how we can support your exit with clarity and confidence.

![Business Sale Disasters That Could Have Been Prevented [Case Studies]](https://vvlpm4xwtlb.c.updraftclone.com/wp-content/uploads/emplibot/sale-disasters-hero-1768631158.jpeg)