Selling a business is stressful, and getting the valuation right matters more than most founders realize. At Unbroker, we’ve seen countless business owners either overprice their companies or leave money on the table because they didn’t know which valuation method to use.

The good news is you don’t need a fancy investment banker to value your business. We’ll walk you through three valuation shortcuts that actually work, so you can understand what your company is worth before you talk to buyers.

Revenue Multiples: The Fastest Way to Value Your Business

The revenue multiples method offers the quickest shortcut to get a ballpark valuation, and it’s what most buyers use when they first assess your business. Here’s how it works: you take your annual revenue and multiply it by an industry-specific number. That number-the multiple-varies dramatically depending on what business you operate. Software companies command multiples between 24x and 32x revenue for system and application software, while oil and gas production firms sit closer to 5x to 6x. This massive gap exists because buyers perceive software as recurring, scalable, and low-capital-intensive, whereas oil and gas requires constant reinvestment and carries commodity risk. Your job is to find the right multiple for your industry and then adjust it based on your specific situation.

Finding Your Industry Multiple

Start by researching recent sales in your sector. If you can’t find exact comps, look at publicly traded companies in your space and check their EV-to-revenue ratios on financial sites. The data from NYU Stern’s Damodaran dataset shows that the total market EV-to-EBITDA multiple hovers around 19.7x to 23.9x across all sectors, which gives you a rough anchor. For non-financial businesses, that number drops to about 16.95x, which is more practical when you’re comparing smaller firms. Healthcare information and technology businesses, for example, trade at roughly 21x to 26x EBITDA, reflecting their growth potential and recurring revenue streams. The key insight is this: don’t use a generic multiple. A SaaS company with 90% customer retention deserves a higher multiple than one losing customers every quarter.

Adjusting Your Multiple for Growth and Risk

Once you have a baseline multiple, you need to adjust it up or down based on your growth rate, customer concentration, and market conditions. Fast-growing businesses command premiums. If your revenue grows 30% year-over-year and your industry average is 10%, you can justify a higher multiple. Conversely, if you operate in a declining market or lose market share, expect buyers to apply a discount. PwC reported that deal value jumped about 45% in 2025 to over 1.6 trillion dollars across more than 10,000 transactions, but that activity masks a hard truth: buyers are selective. They prioritize stability, scalability, and defensible value. If your business depends entirely on you or a handful of customers, that’s a red flag that reduces your multiple. If you’ve documented your processes, built a management team, and maintain a diversified customer base, you earn a premium.

Customer Concentration and Financial Cleanliness

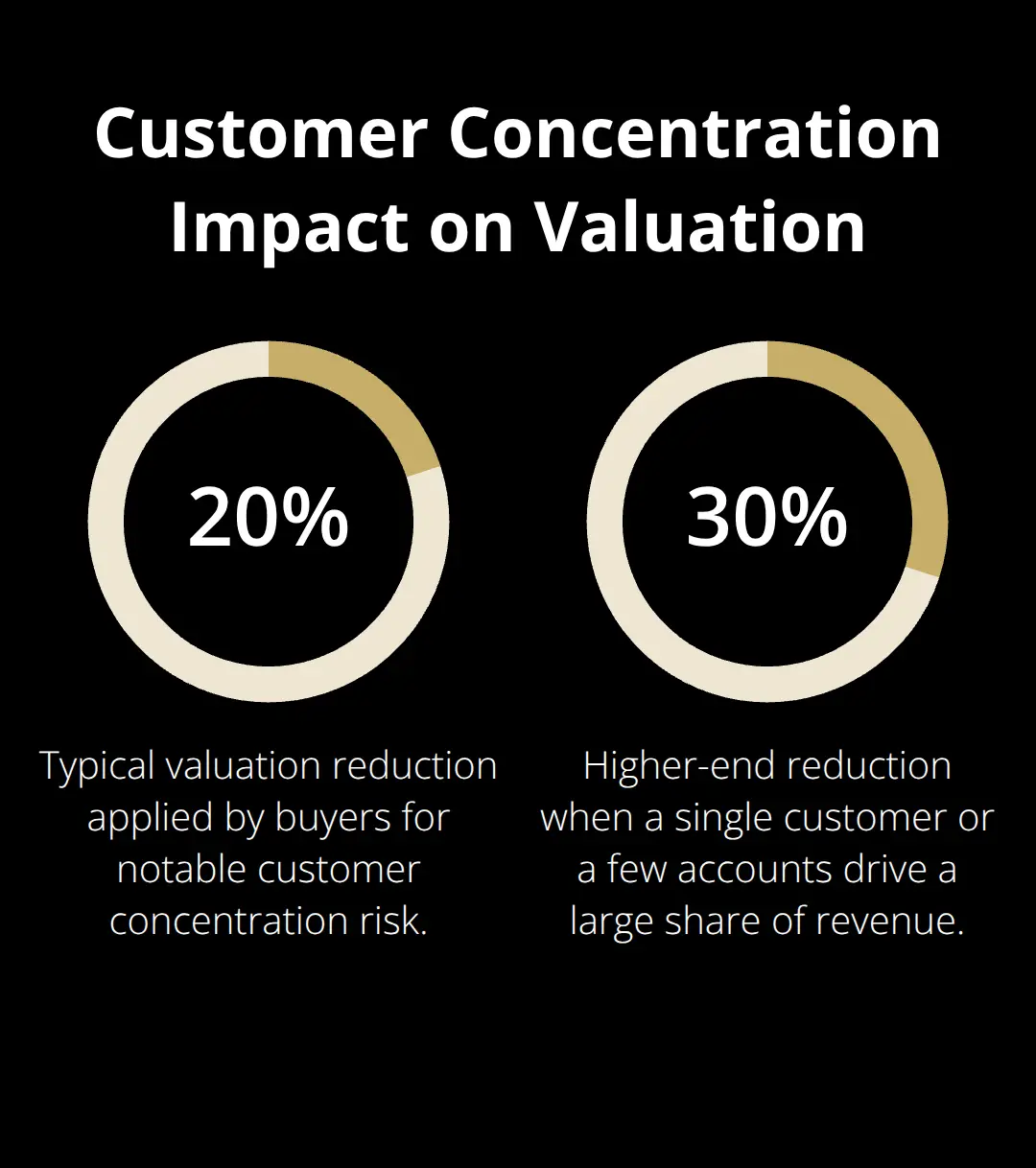

Look at your customer concentration closely. If one customer represents 30% of revenue, most buyers apply a customer concentration reduces valuation by 20% to 30% haircut to your valuation because losing that customer would crater the business. Clean financials also matter significantly. If your books are disorganized, buyers assume hidden problems and discount accordingly. The revenue multiples method works best when you have three to five years of clean, audited or reviewed financial statements showing consistent or growing revenue. Without that track record, even the best multiple won’t convince a serious buyer.

This foundation of financial credibility sets you up to move beyond simple revenue multiples and explore asset-based approaches that reveal deeper value in your business.

Asset-Based Valuation When Revenue Multiples Fall Short

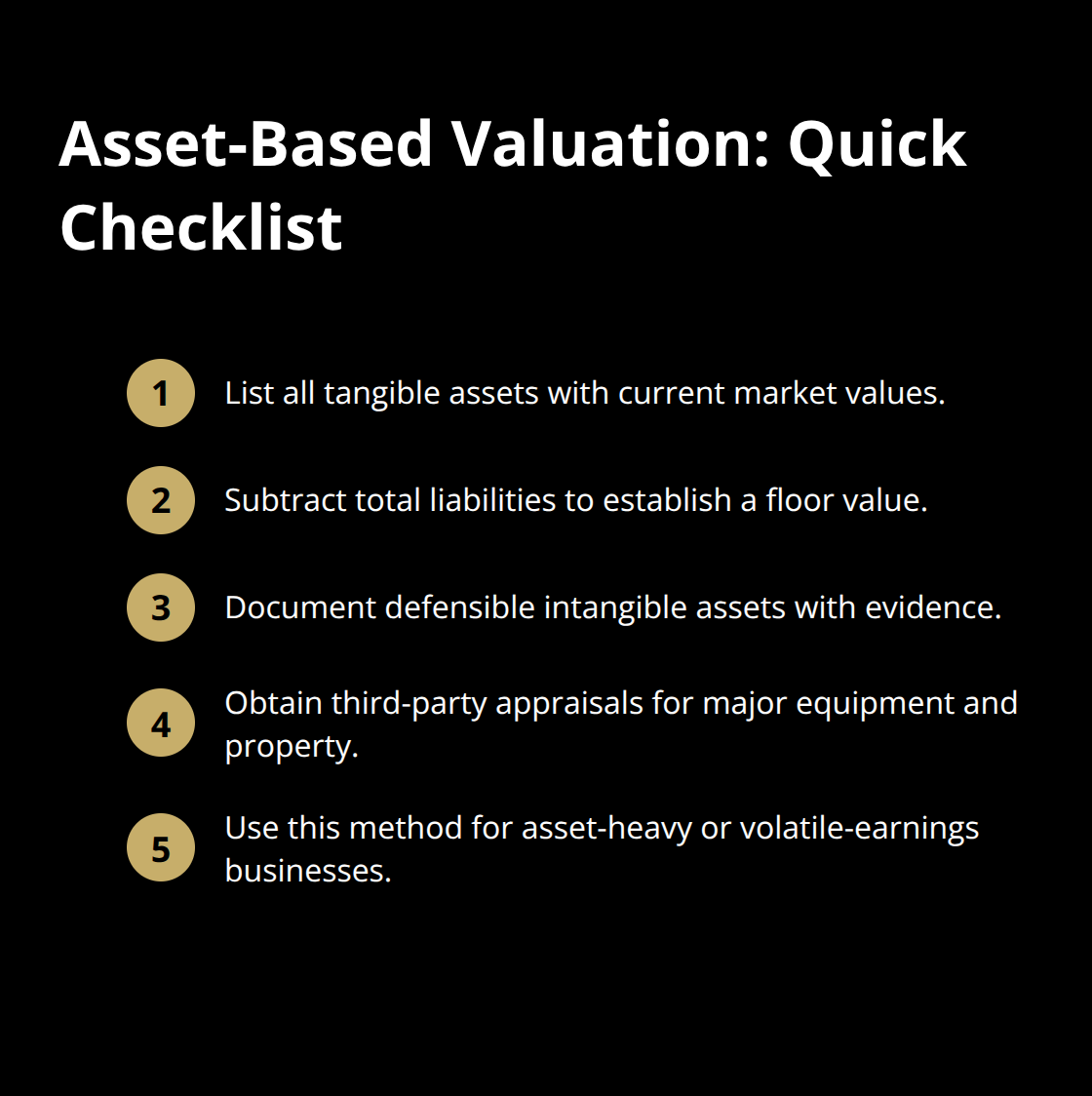

Asset-based valuation works differently than revenue multiples because it focuses on what your business owns rather than what it earns. This method adds up your tangible assets like equipment, inventory, and real estate, then factors in intangible assets like customer lists, brand reputation, and proprietary processes. The formula is straightforward: total assets minus total liabilities equals your business value. However, this approach has a critical flaw that most founders miss.

Asset-based valuation typically undervalues businesses whose real strength lies in cash flow and customer relationships rather than physical inventory. A software company with minimal equipment but millions in annual recurring revenue will look artificially cheap under asset-based valuation. That’s why this method works best for asset-heavy businesses like manufacturing, distribution, or real estate operations where physical assets represent the primary source of value.

When Asset-Based Valuation Makes Sense

If you operate a retail store with significant inventory and real estate holdings, asset-based valuation gives you a floor value that protects you from buyers who want to lowball based on weak earnings. This approach also works well for businesses with substantial equipment, machinery, or property holdings that represent genuine economic value. Asset-based valuation provides a safety net when earnings are inconsistent or when the business model relies heavily on tangible resources rather than intangible customer relationships.

Calculating Tangible Assets Accurately

To calculate your tangible assets accurately, start by listing everything your business owns with a current market value. The book value reflects historical cost, not what those assets are worth today. Equipment depreciates, so a machine worth $50,000 five years ago might fetch only $20,000 in a used equipment market. Get professional appraisals for major assets like real estate or specialized machinery because buyers will do the same during their due diligence.

Cleaning Up Your Balance Sheet

Next, address your balance sheet cleanup. Remove obsolete assets you no longer use, write off bad accounts receivable that customers won’t pay, and reclassify any shareholder loans as equity to present a cleaner picture. This cleanup directly improves your valuation because every dollar in false or worthless assets creates buyer skepticism. A tighter balance sheet signals financial discipline and reduces the risk that buyers perceive hidden problems lurking in your records.

Valuing Intangible Assets Without Inflating Them

For intangible assets, the math gets trickier. Customer relationships, brand loyalty, and documented processes do have real value, but quantifying them requires discipline. If you have a customer list with predictable annual spending, you can value that list based on the lifetime revenue those customers generate. If your business operates under a recognized brand that commands price premiums, that’s an intangible asset with measurable value. However, avoid inflating intangible asset values without evidence. Buyers verify everything, and overstating goodwill kills your credibility faster than any other mistake. The strength of your intangible assets depends on whether you can prove their contribution to revenue and whether they survive without you as the owner. Once you’ve calculated both tangible and intangible assets, you’ll have a solid floor value. But asset-based valuation alone rarely captures the full picture. The next method-discounted cash flow analysis-reveals what your future earnings potential actually means in today’s dollars.

Discounted Cash Flow Analysis Reveals What Your Business Actually Earns

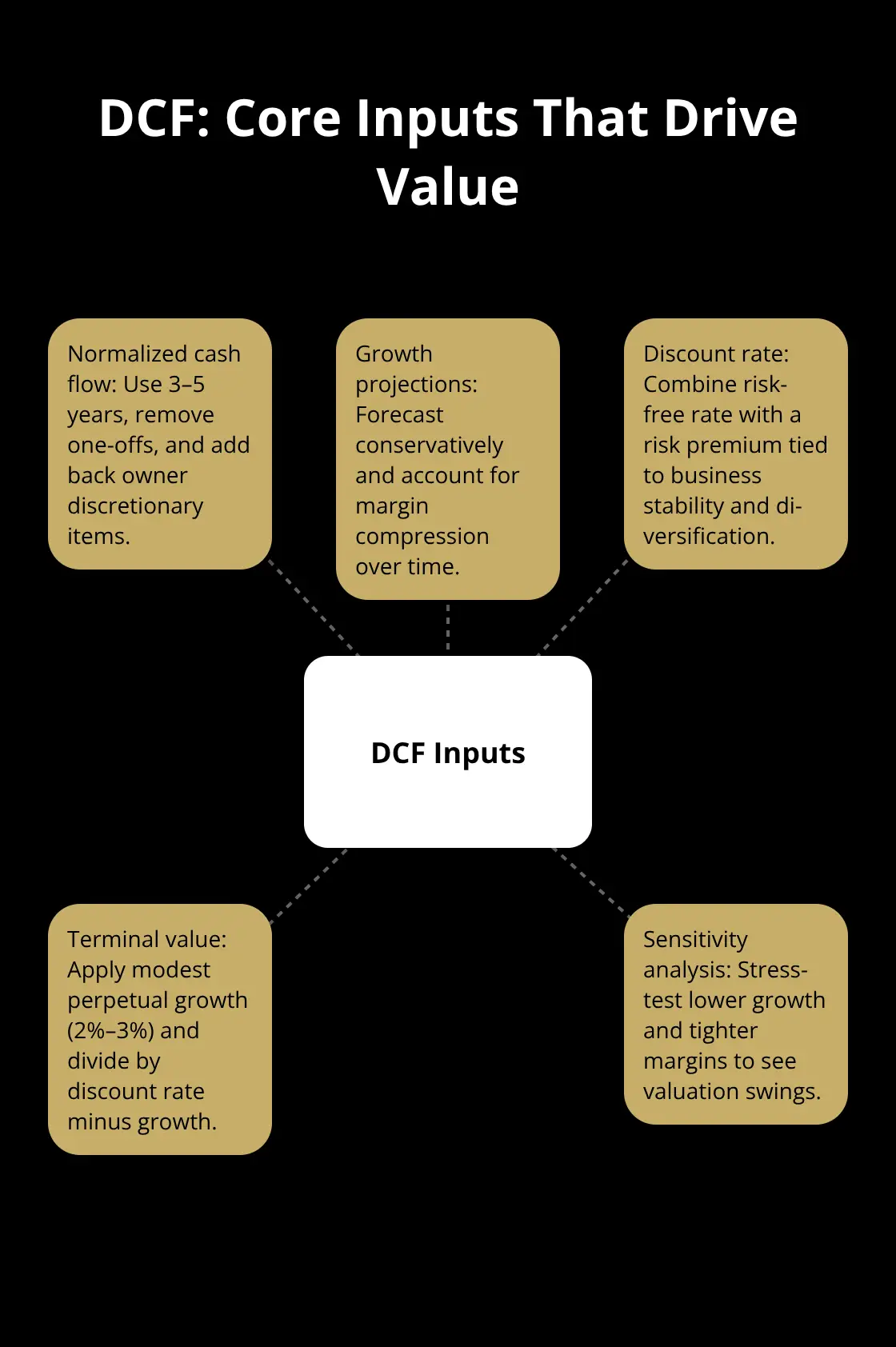

Discounted cash flow analysis transforms valuation from guesswork into reality. Revenue multiples and asset-based approaches offer rough estimates, but DCF forces you to answer the question buyers ask constantly: what will this business actually earn in the future, and what is that worth today? The mechanics work simply but powerfully. You project cash flows for the next five years, select a discount rate reflecting your business’s risk profile, then calculate what those future dollars equal in today’s money. Most founders avoid DCF because it seems too complex, but that’s a critical mistake. Buyers apply DCF constantly, especially for mid-market businesses where cash flow visibility outweighs physical assets. If you can’t articulate your future earnings potential, you negotiate without leverage.

Start With Normalized Historical Cash Flow

Start with your historical financials-collect three to five years of actual cash flows and establish your baseline. Use operating cash flow, not net income, because that’s what an owner actually receives. Strip out one-time expenses like major software migrations or lawsuit settlements that won’t repeat. Add back owner draws and discretionary spending that a new owner wouldn’t incur. This normalized historical cash flow becomes your foundation. Your normalized baseline proves you understand your business and can project realistically.

Project Conservative Growth Over Five Years

Now forecast conservatively for the next five years. If your revenue grew 20% last year, don’t assume 20% forever. Most businesses face headwinds as they scale-competition intensifies, market saturation emerges, customer acquisition costs rise. Project margins that reflect realistic cost structures, not your best-case scenario. Margin compression is normal as businesses mature. If you’re currently at 35% EBITDA margins and the industry average is 22%, assume you’ll drift toward the mean over five years. This conservative approach actually builds credibility with buyers because it shows you understand your market dynamics rather than chasing fantasy numbers.

Calculate Your Discount Rate With Precision

The discount rate calculation business valuation reflects two components-the risk-free rate of return (what you’d earn in a Treasury bond, roughly 4% to 5% today) plus a risk premium accounting for your business’s specific vulnerabilities. A stable, recurring revenue business with diversified customers and proven management deserves a lower discount rate, maybe 10% to 12%. A business dependent on a single customer, facing new competition, or run entirely by you should carry a higher rate, perhaps 15% to 20%. The discount rate directly impacts your valuation significantly. A 2% difference in discount rate can swing your valuation by 15% to 20%, which translates to serious money. Lock in your normalized cash flows and discount rate carefully because these inputs drive everything that follows.

Build Your DCF Model in Excel

Once you’ve established your normalized cash flows and discount rate, the final step is mechanical. Sum up the present value of each year’s projected cash flow, then add a terminal value-this represents what the business is worth at the end of year five, perpetually. Calculate terminal value by taking your year-five cash flow, growing it by 2% to 3% annually forever, and dividing by your discount rate minus that growth rate.

Discount that terminal value back to today using the same rate. The sum of your five-year cash flows plus the discounted terminal value equals your DCF valuation. Use Excel with linked statements so that if your growth assumptions or margins shift, the entire model updates automatically. Sensitivity analysis proves critical-test what happens if your growth rate drops 5% or your margins compress an additional 2%. These scenarios reveal which assumptions drive your valuation and where your business is most vulnerable. Buyers will stress-test your model aggressively, so test it first and own the results rather than getting blindsided during negotiations.

Final Thoughts

You now have three valuation shortcuts that work in the real world. Revenue multiples give you speed and market context, asset-based valuation protects you if your business is asset-heavy or earnings are inconsistent, and discounted cash flow analysis reveals what your future earnings actually mean in today’s dollars. Most serious buyers blend all three methods anyway, so your job is to calculate them first and own the narrative before they do.

The real power of these valuation shortcuts is that they force you to think like a buyer. You stop guessing and start analyzing, identify which assumptions drive your value, and recognize where your business is vulnerable. You clean up your financials and document your processes because you understand what buyers actually scrutinize. Getting your valuation right shapes your entire exit strategy-overprice and you’ll sit on the market while buyers walk away, underprice and you leave serious money on the table.

When you’re ready to move forward, Unbroker offers transparent, low-cost options for selling your business without the high brokerage fees that eat into your proceeds. Start with your valuation, then connect with buyers who understand what you’ve built.

![Business Sale Disasters That Could Have Been Prevented [Case Studies]](https://vvlpm4xwtlb.c.updraftclone.com/wp-content/uploads/emplibot/sale-disasters-hero-1768631158.jpeg)