Reaching financial freedom is a milestone many entrepreneurs dream of. But what happens when you’ve hit that “enough” number and are ready to move on?

At Unbroker, we’ve guided countless business owners through the process of selling a business after hitting their “enough” number. This guide will walk you through the key steps to evaluate your goals, prepare your business for sale, and choose the right exit strategy.

Is Your Financial Freedom Goal Within Reach?

Define Your Financial Freedom

Financial freedom is a state where your passive income (from investments, savings, or other sources) covers your essential expenses. You must define what financial freedom means to you.

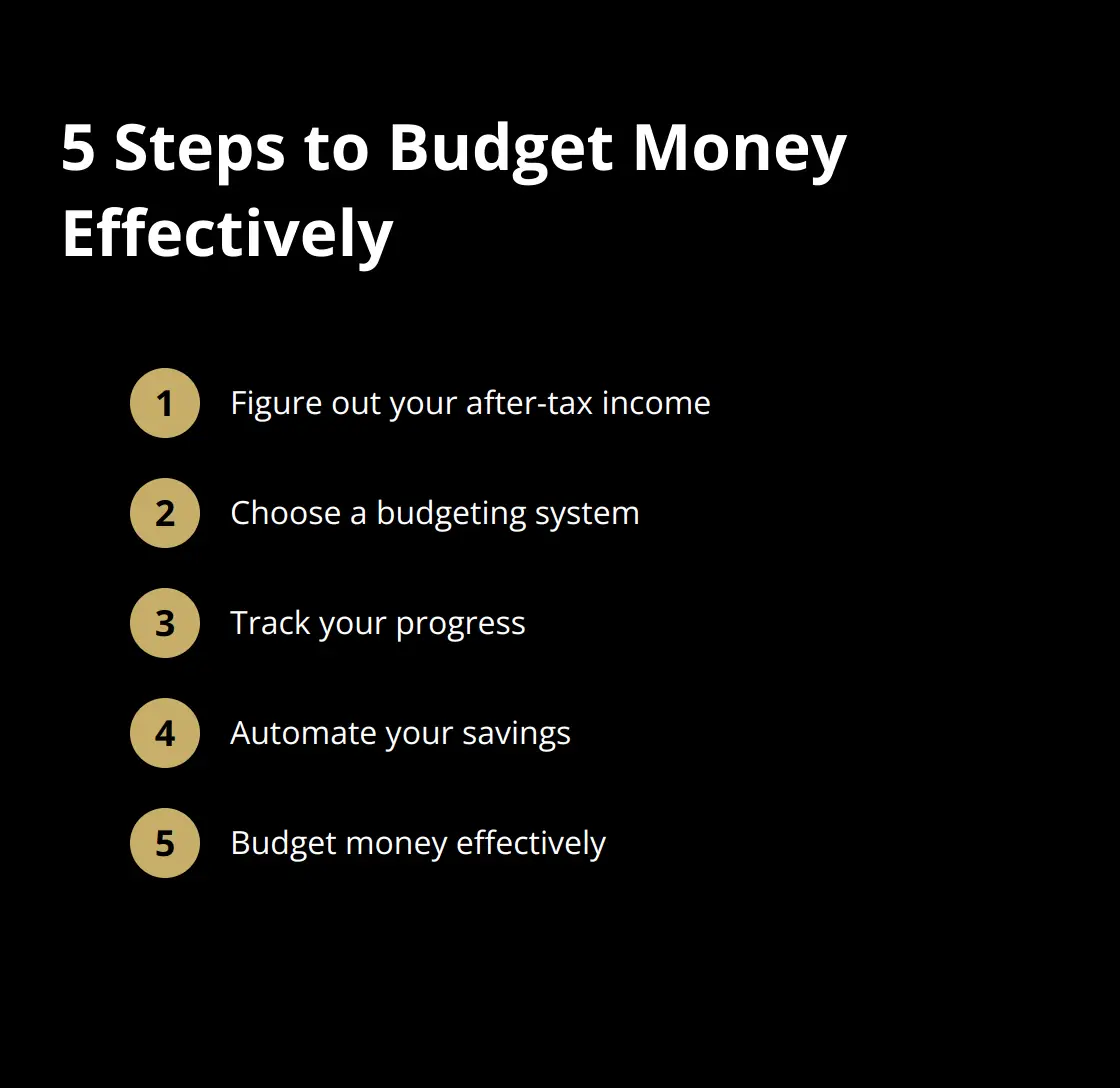

Put a Number on Your Goal

Start by quantifying your goal. To budget money: 1. Figure out your after-tax income 2. Choose a budgeting system 3. Track your progress 4. Automate your savings 5. Budget money effectively. Multiply this by 25 to estimate the nest egg you need (assuming a 4% annual withdrawal rate).

Take Stock of Your Assets

Next, assess your current financial picture. Include your business value, investments, real estate, and cash savings. Subtract any debts to determine your net worth. Compare this to your target number. You might be closer than you thought (or further away).

Check Your Cash Flow

Financial freedom isn’t just about hitting a number-it’s about sustainable cash flow. Review your income sources. Do they reliably cover your expenses without depleting your principal? If not, you may need to adjust your strategy or timeline.

Factor in Future Changes

Consider inflation and potential lifestyle changes. A goal that seems sufficient today might fall short in 10 years. Many financial advisors recommend building in a 20% buffer to account for unforeseen expenses and market fluctuations.

Assess Your Emotional Readiness

Reflect on your emotional preparedness. Are you ready to step away from your business? Some entrepreneurs find they’re not prepared even after hitting their financial targets. It’s important to align your financial and personal goals before you decide to sell your business.

As you evaluate your financial freedom goal, you’ll need to start thinking about preparing your business for sale. This process involves several key steps to maximize your business’s value and appeal to potential buyers.

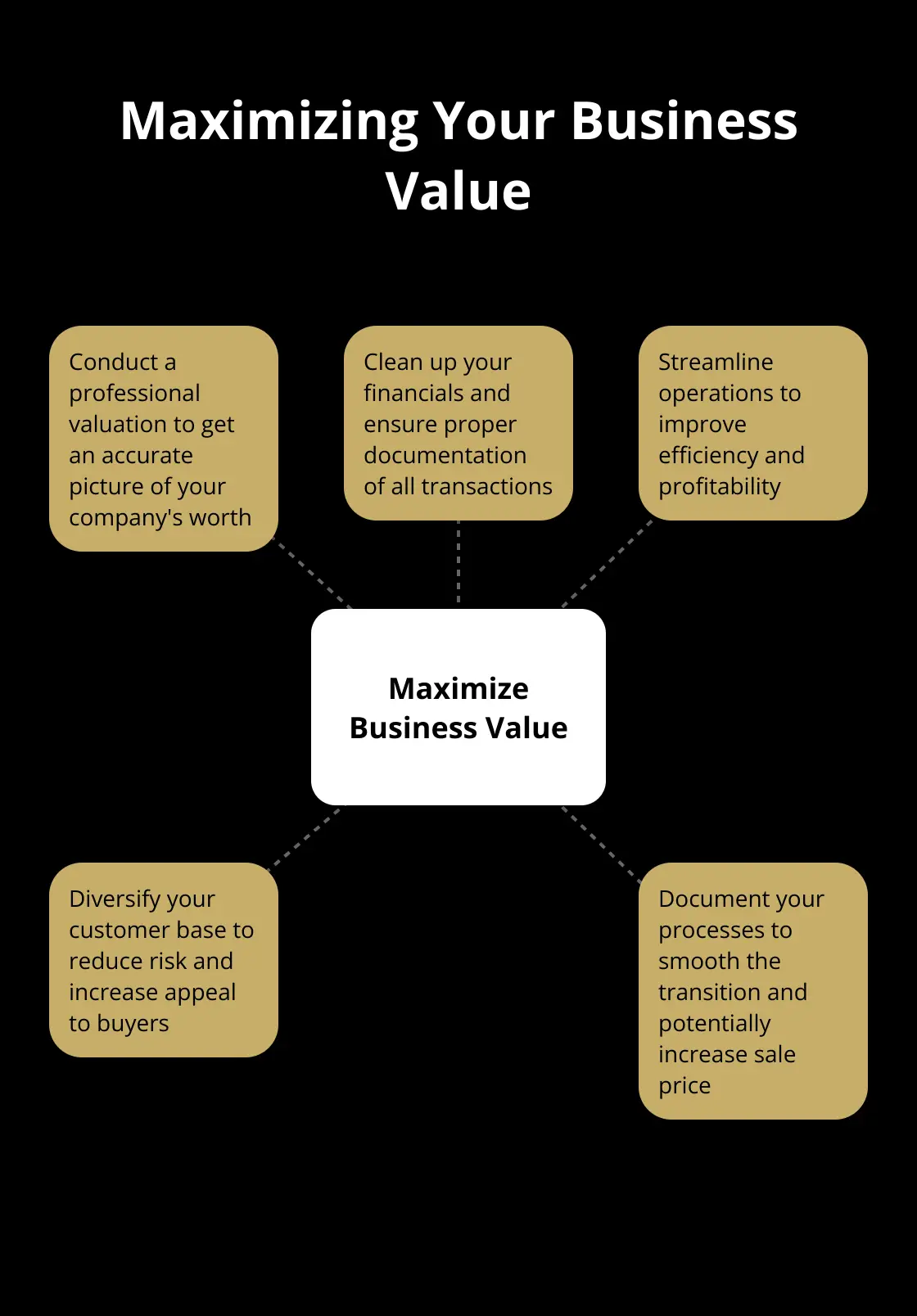

Maximizing Your Business Value

To maximize your business value, consider the following key steps:

Conduct a Professional Valuation

Start with a professional business valuation. A certified business appraiser will give you a more accurate picture of your company’s worth. This step can help enhance the value of your company and identify various levers in the process.

Clean Up Your Financials

Buyers want clear, organized financial records. Clean up your books and ensure proper categorization and documentation of all transactions. If possible, have a reputable accounting firm audit your financial statements. This step increases buyer confidence and can potentially boost your sale price.

Streamline Operations

Improve efficiency and profitability. This might involve process automation, expense reduction, or supplier contract renegotiation. Focus on initiatives that show immediate results.

Diversify Your Customer Base

A business heavily reliant on a few key customers presents higher risk to buyers. Work on diversifying your client portfolio. This diversification can increase business value by developing a robust lead generation and sales system, thus mitigating risk.

Document Your Processes

Create detailed documentation of your business processes (from daily operations to strategic planning). This information proves invaluable to potential buyers and can smooth the transition process. Well-documented businesses often sell faster and for higher prices. Consider using process mapping software to create visual representations of your workflows.

As you prepare your business for sale, the next crucial step involves exploring different strategies to maximize your exit. Let’s examine various approaches to selling your business and how to choose the right one for your situation.

Choosing Your Exit Strategy

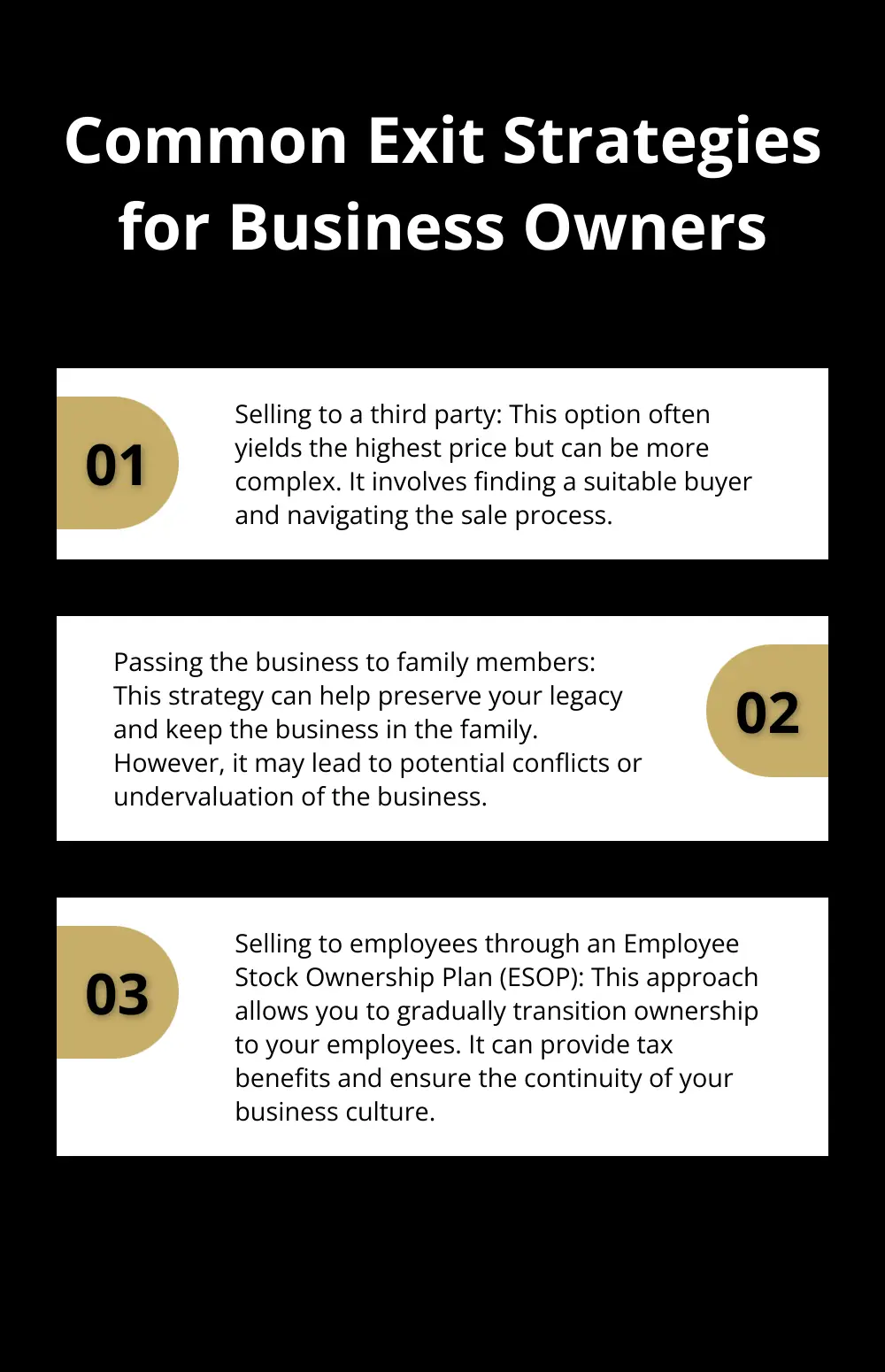

Assessing Your Options

When you sell your business, you must select the right exit strategy. Your choice will impact the sale price, timeline, and overall success of the transition.

The most common exit strategies include:

- Selling to a third party

- Passing the business to family members

- Selling to employees through an Employee Stock Ownership Plan (ESOP)

Each option has advantages and disadvantages. Selling to a third party often yields the highest price but can be more complex. Family succession might preserve your legacy but could lead to potential conflicts or undervaluation.

Leveraging Modern Platforms

Traditional business brokers often charge high commissions (up to 10% of the sale price). This can significantly reduce your profits. Modern platforms offer more cost-effective alternatives.

Timing the Market

Market conditions play a key role in maximizing your sale price. The median sale price for small businesses fluctuates based on economic conditions, industry trends, and buyer demand. You should consult with financial advisors and industry experts to identify the optimal time to list your business.

Preparing for Due Diligence

Thorough preparation for due diligence is essential (regardless of your chosen strategy). Approximately half of all deals fall apart during the formal due diligence stage. To avoid this, ensure all your financial records, legal documents, and operational processes are well-organized and readily available. This transparency can speed up the sale process and instill confidence in potential buyers.

Considering Professional Assistance

While some business owners opt for a DIY approach, professional assistance can be invaluable. Experts can guide you through complex negotiations, help you navigate legal requirements, and connect you with a wider pool of potential buyers. Their experience can prove particularly useful in challenging market conditions or for businesses with unique characteristics.

Final Thoughts

Selling a business after hitting your “enough” number marks a significant milestone in an entrepreneur’s journey. This process demands careful planning, from evaluating financial freedom goals to preparing the business for sale. The right exit strategy plays a key role in maximizing value and ensuring a smooth transition.

Modern platforms offer cost-effective alternatives to traditional business brokers. Unbroker provides transparent, low-cost options for selling your business, eliminating high brokerage fees. We also offer expert support and access to a vast buyer network.

Take action now to define your financial freedom goals and assess your current situation. Prepare your business for sale, explore your options, and seek professional advice when needed. This transition marks the beginning of a new chapter in your life, so approach it with confidence and thorough preparation.

![Business Sale Disasters That Could Have Been Prevented [Case Studies]](https://vvlpm4xwtlb.c.updraftclone.com/wp-content/uploads/emplibot/sale-disasters-hero-1768631158.jpeg)