Selling your business is one of the biggest financial decisions you’ll make. Most sellers walk into negotiations unprepared, which costs them hundreds of thousands of dollars.

At Unbroker, we’ve seen firsthand how the right sale negotiation strategy separates sellers who get fair deals from those who leave money on the table. This guide shows you exactly what to do.

Know What Your Business Is Actually Worth

You cannot negotiate effectively without knowing your business’s real value. Too many sellers guess or rely on what they think is fair, then get blindsided when a buyer’s offer comes in lower than expected. The gap between what you think your business is worth and what a buyer will actually pay often comes down to poor preparation on your side. You need three concrete data points before walking into any negotiation: a professional valuation, your financial metrics, and industry comparables.

Get a Professional Valuation

Hire a business appraiser or M&A advisor to value your company. This costs between $2,000 and $10,000 depending on your business size and complexity, but it’s money well spent. A professional valuation uses methods like discounted cash flow analysis, which projects your future cash flows and discounts them to present value. Another common approach is the earnings multiplier method, which applies a multiple to your EBITDA or net earnings. A software company with $2 million in annual earnings might be valued at $16 million using an 8x multiple, while a service business with the same earnings might only command a 4x multiple. The specific multiple depends entirely on your industry. Tech firms typically trade at around 3x revenue, while services businesses might be valued closer to 0.5x revenue. A professional valuation gives you a defensible number that you can cite during negotiations, which shifts the conversation away from arbitrary anchoring and toward documented facts.

Know Your Numbers Inside Out

Before you meet with any buyer, you need to know your financial metrics cold. Prepare your last three years of tax returns, profit and loss statements, and cash flow projections. Buyers will ask about your revenue growth rate, gross margins, customer acquisition cost, churn rate, and cash conversion cycle. If you cannot answer these questions with precision, you lose credibility immediately. Document which customers account for your revenue, how dependent you are on any single customer, and what your recurring revenue looks like versus one-time sales. A buyer will pay more for a business with predictable, recurring revenue than for one heavily dependent on project work or single large contracts. If your business has grown 40 percent year-over-year for the last three years, that’s a powerful negotiation point. If your margins have expanded from 20 percent to 35 percent, that shows operational improvement and justifies a premium valuation.

Prepare a one-page summary of your key metrics and growth trajectory that you can share with serious buyers. This positions you as organized and professional, which influences how buyers perceive your business quality.

Research What Similar Businesses Actually Sold For

Look at recent sales of comparable businesses in your industry. This is harder than it sounds because most sales data is private, but you can find patterns through industry databases, broker reports, and SEC filings if your business operates in a regulated sector. If you operate a digital marketing agency, research what other agencies with similar revenue, client base, and service offerings have sold for in the last two years. If you run an e-commerce store, look at recent exits in your product category. Talk to business brokers in your industry, not to sell with them necessarily, but to understand the market. They see deal flow regularly and can tell you realistic multiples and price ranges. If comparable businesses are selling at 3.5x EBITDA and you’re being offered 2.8x, you have a concrete reason to push back. The more recent and similar your comparables, the stronger your position. If you find three recent sales of businesses like yours that averaged 4x revenue, that becomes your baseline for negotiation, not a wishful starting point.

With these three data points in hand-a professional valuation, your financial metrics, and industry comparables-you walk into negotiations with facts instead of guesses. This foundation shifts power in your direction and prevents buyers from anchoring you to artificially low numbers. The next step is understanding the mistakes most sellers make when they sit down at the negotiation table.

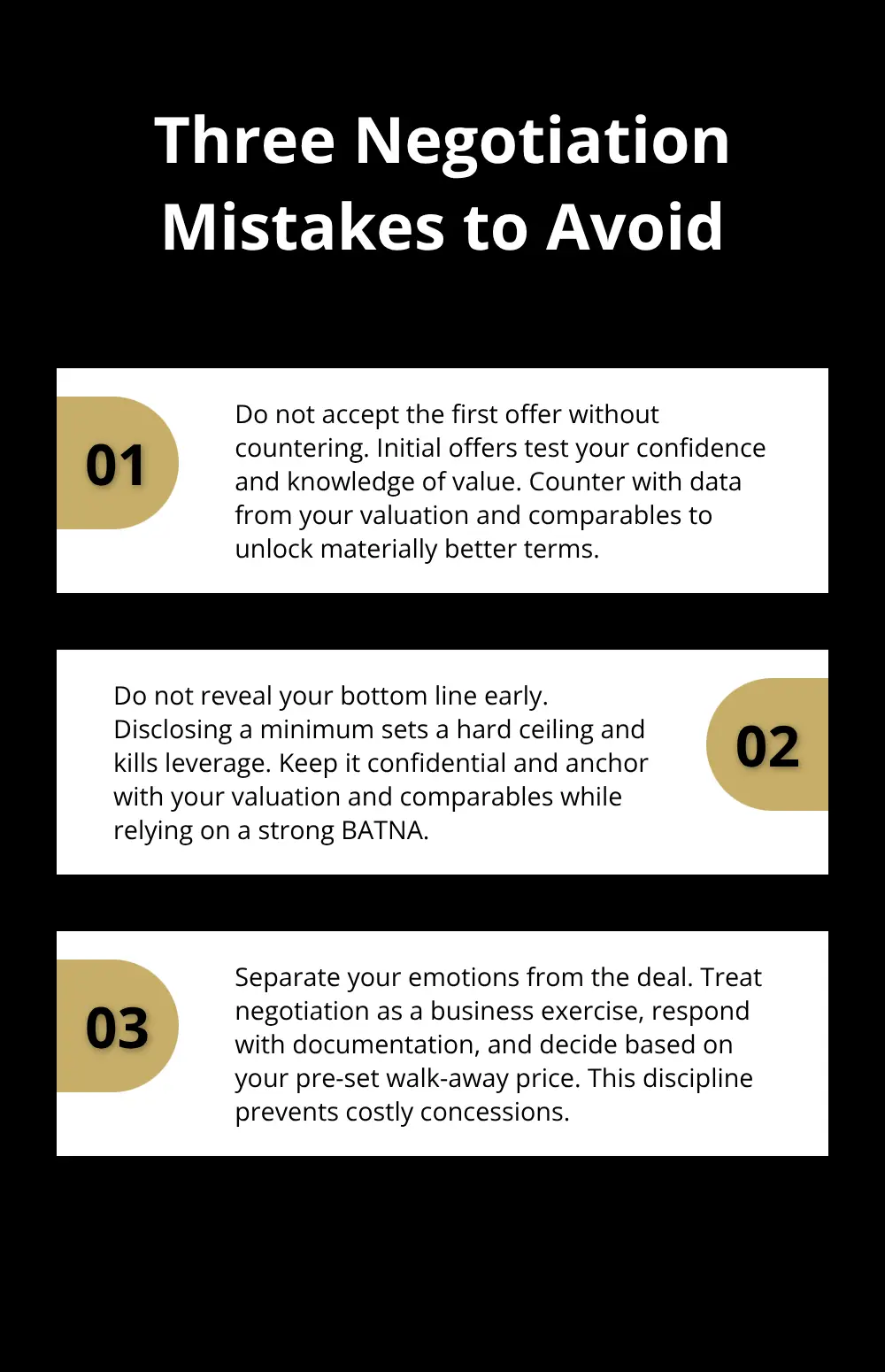

Common Negotiation Mistakes Sellers Make

Don’t Accept the First Offer Without Countering

The first offer a buyer makes is almost never their best offer. Yet many sellers accept it without pushing back, treating the initial number as opening position. A buyer who offers $2 million for your business is testing your confidence and your knowledge of what you’re worth. If you accept immediately, they know they undershot. If you counter with $2.8 million based on your comparables and valuation, you signal that you’ve done your homework and you’re not desperate. The difference between accepting the first offer and countering effectively can easily exceed $500,000 on a $5 million sale. Sellers who counter effectively understand that buyers expect negotiation and budget for it accordingly.

Never Reveal Your Bottom Line Early

The second fatal mistake is revealing your bottom line too early. Sellers often make this error out of anxiety, thinking that transparency builds trust. In reality, it destroys your negotiating position instantly. Once a buyer knows you’ll accept $1.8 million, they stop at $1.8 million. They have no incentive to go higher. You’ve handed them the finish line before the race even started. Keep your minimum acceptable price confidential. Instead, anchor the conversation with your valuation and comparables, then respond to their offers with reasoned counters. A strong BATNA gives you leverage in negotiations and provides a benchmark against which any offer must be measured. This approach protects your negotiating room and forces the buyer to justify why they believe their offer reflects fair value.

Separate Your Emotions From the Deal

The third mistake sellers make is letting emotions hijack the negotiation. You’ve built this business over years or decades. It’s personal. When a buyer questions your valuation or challenges your growth numbers, it stings. Sellers who react emotionally often make concessions they regret or walk away from deals that were actually fair. Separate your ego from the transaction. A buyer’s skepticism about your numbers isn’t skepticism about you as a person. Their lowball offer isn’t a personal insult; it’s a negotiating tactic. Treat the negotiation as a business exercise where you present facts, respond to objections with data, and make decisions based on your predetermined walk-away price, not on how you feel in the moment.

This mental discipline prevents costly mistakes and keeps you focused on the actual numbers that matter.

With these three pitfalls behind you, you’re ready to move into the strategies that actually shift power in your favor during negotiations.

How to Build Real Negotiating Power

Control the Negotiation With Multiple Buyers

The most powerful position you can occupy in a sale negotiation is having multiple buyers genuinely interested in your business. This single factor shifts every conversation in your favor. When a buyer knows they’re competing against others, they stop testing your resolve and start competing on terms. A seller with one interested buyer has zero leverage. A seller with three competing buyers controls the entire negotiation.

Start building this leverage months before you’re ready to sell. Talk to potential buyers in your industry, reach out to private equity firms that acquire businesses like yours, contact strategic competitors who might roll up your revenue, and work with brokers who have buyer lists. The goal is to have genuine interest from at least two buyers before you formally enter negotiations. This means running a quiet market process where you’re not officially for sale but you’re testing the waters.

When you sit down at the negotiation table with one buyer’s offer in hand and another buyer waiting in the wings, that buyer knows their window is closing. They either move forward at a reasonable price or they lose the deal. Auctioning your business is one structured way to formalize this competitive dynamic.

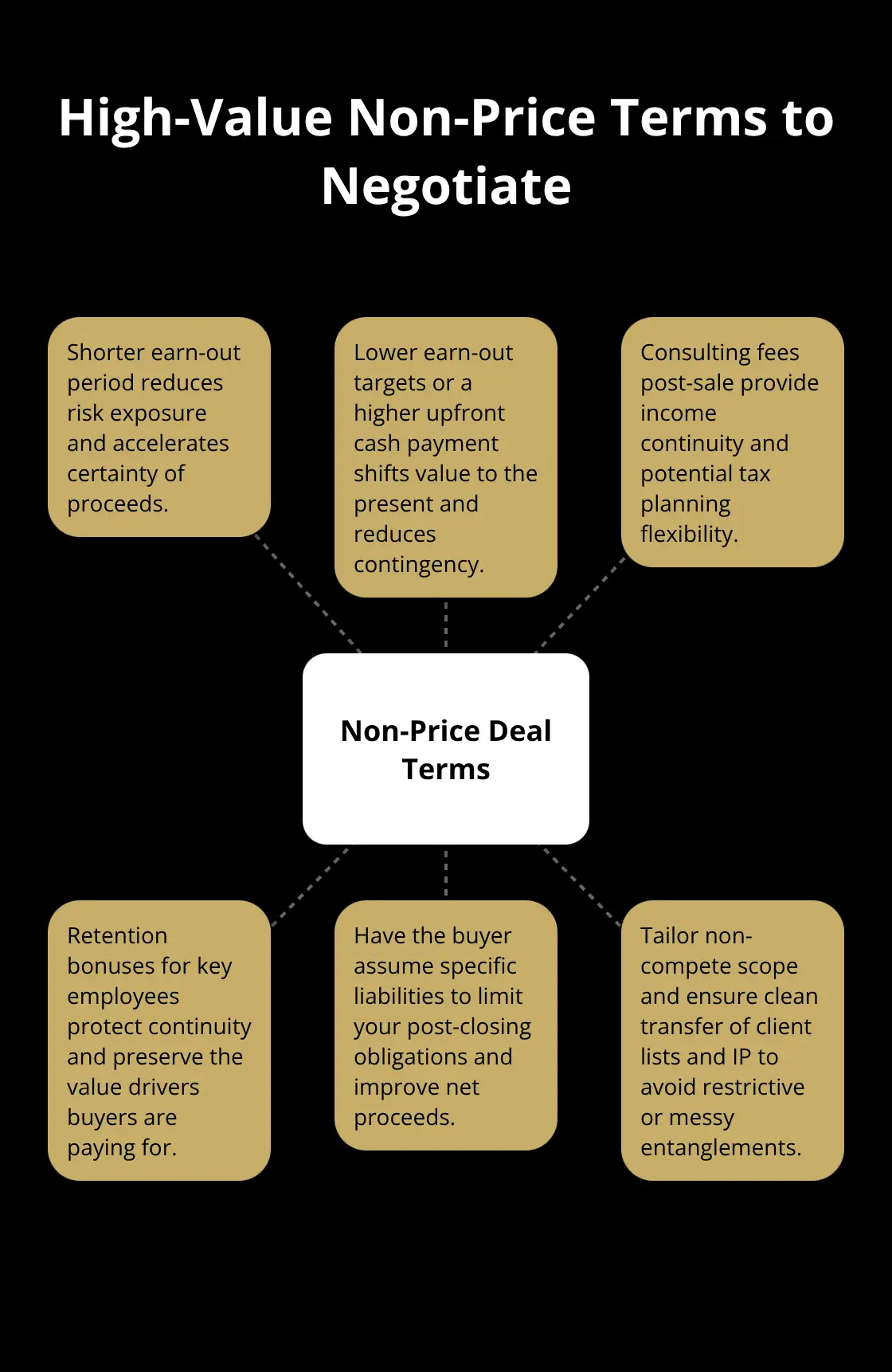

Shift Away From Price When Negotiations Stall

When price conversations stall, most sellers panic and drop their asking price. This is the exact wrong move. Instead, shift the negotiation to non-price terms that matter to you. If a buyer won’t budge on purchase price, ask for a shorter earn-out period, lower earn-out targets, or a higher upfront cash payment with less contingent on future performance.

Ask for consulting fees that keep you involved post-sale, which provides both income and tax planning flexibility. Request that key employees receive retention bonuses, protecting the business value you’ve built. Negotiate for the buyer to assume specific liabilities rather than you carrying them forward. Push for favorable non-compete terms, perhaps geographic or industry restrictions that don’t lock you out of future opportunities. Request that certain assets like your client list or intellectual property transfer cleanly without licensing complications. Each of these terms has real dollar value, yet buyers often concede them more easily than they concede price.

Use Documentation as Your Negotiating Weapon

Documentation and data become your ammunition in these conversations. Prepare a clean folder with your last three years of audited financials, customer contracts, employee agreements, intellectual property registrations, and a detailed customer concentration analysis. Show the buyer exactly which customers drive your revenue, what the contract terms are, and what the churn rate looks like.

If you’ve invested in systems, compliance, or process documentation, present that as evidence of operational maturity. Buyers pay premiums for businesses that run without depending entirely on the owner’s presence. If you have regulatory certifications, industry accreditations, or clean compliance records, document this thoroughly. A buyer facing regulatory risk will discount your valuation; a buyer seeing a clean compliance file will pay closer to fair value. Avoiding valuation mistakes strengthens your position considerably.

When a buyer challenges your growth numbers, you don’t argue-you show them the bank deposits, the customer contracts proving recurring revenue, and the third-party data supporting your market position. This approach removes emotion from the conversation and forces the buyer to either accept your documentation or explain specifically where they disagree with the facts you’ve presented.

Final Thoughts

You now have the framework to negotiate your business sale without leaving money on the table. The three pillars are straightforward: know your value through professional valuation and market research, avoid the emotional and strategic mistakes that sink most sellers, and build real leverage through multiple buyers and strong documentation. These aren’t theoretical concepts-they’re the difference between accepting $2 million and walking away with $2.8 million.

Most sellers underestimate how much preparation matters in sale negotiations. Buyers expect negotiation and budget for it accordingly. They test your confidence by anchoring low, push back on your numbers to see if you’ll fold, and exploit any sign of desperation. The sellers who win these conversations are the ones who complete their homework beforehand and stay disciplined throughout the process.

We at Unbroker have built tools and services specifically to help sellers navigate this complexity without paying traditional brokerage fees, and our platform provides legal document templates, negotiation assistance, and access to a vast buyer network. Work with experienced legal counsel to handle your closing checklist properly, plan your tax strategy around the deal structure, and define any consulting agreement terms clearly upfront. The business you’ve built deserves a fair price, and preparation combined with the right support makes that outcome achievable.

![Business Sale Disasters That Could Have Been Prevented [Case Studies]](https://vvlpm4xwtlb.c.updraftclone.com/wp-content/uploads/emplibot/sale-disasters-hero-1768631158.jpeg)