At Unbroker, we understand the complexities of selling a business before applying for a visa. Immigrating to a new country is a life-changing decision, and your business exit strategy plays a crucial role in this transition.

This guide will walk you through the essential steps and considerations for exiting your business as you prepare for your immigration journey. We’ll cover everything from valuing your company to navigating international tax implications, ensuring you’re well-equipped to make informed decisions.

Planning Your Exit: Valuation, Goals, and Timing

Assessing Your Business’s Current Value

The first step in planning your exit requires a clear picture of your business’s worth. This assessment goes beyond your balance sheet:

- Financial performance: Analyze your revenue, profit margins, and growth trends over the past 3-5 years.

- Market position: Evaluate your market share and competitive advantages.

- Intangible assets: Consider the value of your brand, customer relationships, and intellectual property.

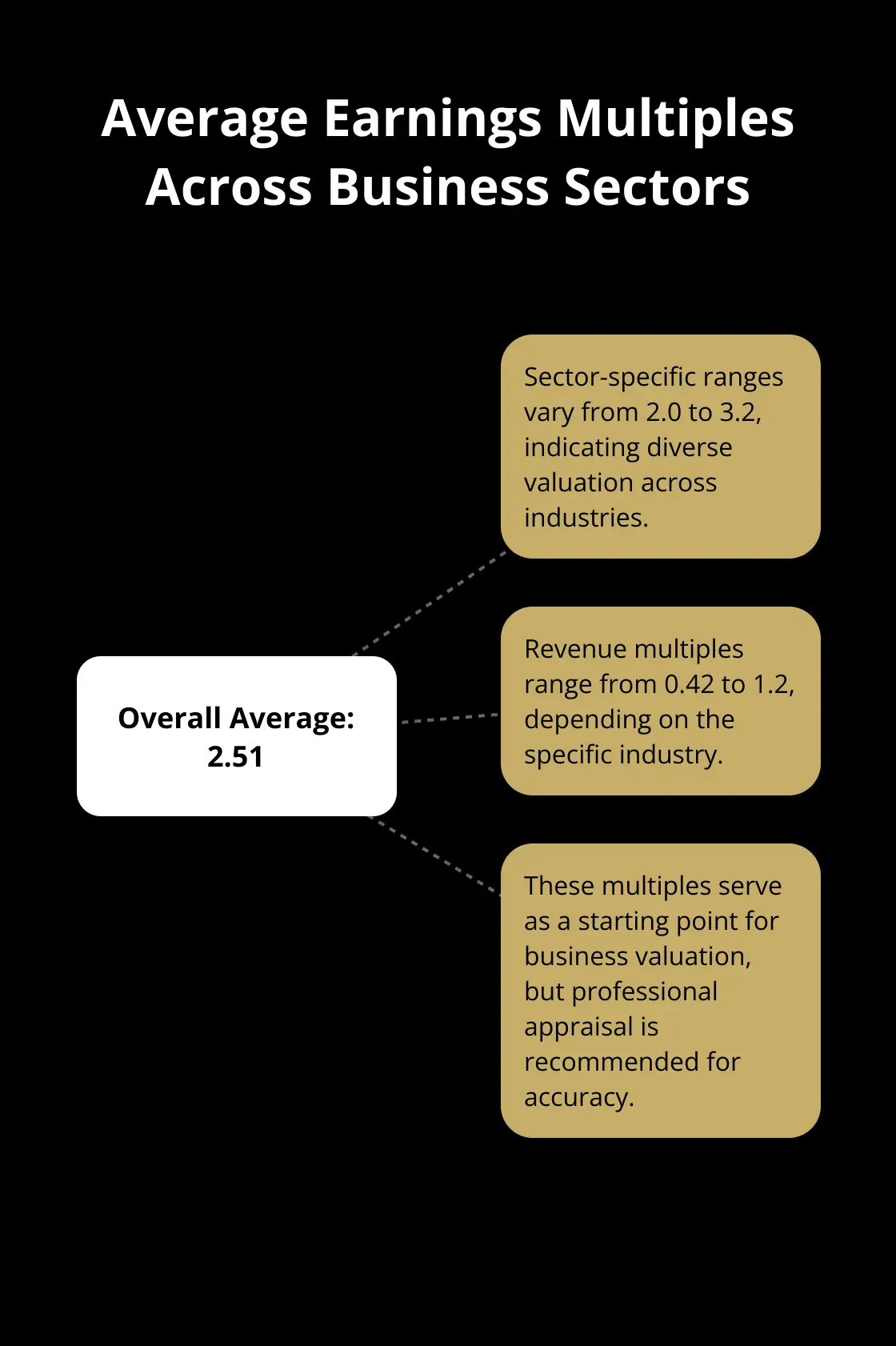

A study by BizBuySell shows average earnings multiples range from 2 to 3.2 across popular sectors, with the average across all sectors at 2.51. Revenue multiples range from 0.42 to 1.2, depending on the industry.

For an accurate valuation, hire a professional business appraiser. They provide an objective assessment and help identify areas to increase your business’s value before selling.

Setting Clear Personal and Financial Goals

Your exit strategy should align with your personal and financial objectives. Ask yourself:

- What’s your target sale price?

- How much do you need to fund your immigration and settlement in your new country?

- Do you want to maintain any involvement in the business post-sale?

Be specific with your goals. Instead of “I want to sell for a good price,” set a target like “I aim to sell for $X million within 18 months.”

Your personal goals might impact your choice of exit strategy. If maintaining your business’s legacy matters to you, you might prefer selling to employees or family members over an outright sale to a third party.

Timing Your Exit for Maximum Impact

Timing can significantly affect the success of your exit. Consider:

- Market conditions: Is your industry growing or contracting?

- Business performance: Are you on an upswing or facing challenges?

- Personal readiness: Are you emotionally prepared to let go?

Don’t wait until the last minute. Start planning your exit well in advance of your intended immigration date. This timeframe allows you to improve your business’s performance, address any issues, and find the right buyer.

Businesses with well-documented processes and a strong management team often command higher prices. Use this preparation time to strengthen these aspects of your business.

Now that you’ve laid the groundwork for your exit strategy, it’s time to explore the various options available for exiting your business. Each option comes with its own set of advantages and considerations, which we’ll discuss in the next section.

How to Choose Your Business Exit Strategy

Selling Your Business Outright

Selling your entire business to a third party often provides the cleanest exit strategy. It offers a lump sum payment, which can fund your immigration plans. BizBuySell’s Insight Report states that the median sale price for small businesses fell 6% year-over-year to $352,000, while median cash flow declined 2.6%.

To maximize your sale price:

- Prepare financial documents: Gather at least 3 years of clean, audited financial statements.

- Boost profitability: Cut costs or increase revenue in the months before the sale.

- Streamline operations: Document all processes to show potential buyers the business can run smoothly without you.

The sale process typically takes 6-12 months. Start early to align with your immigration timeline.

Transferring Ownership Within Your Network

Selling to family members or employees can preserve your business’s legacy. This option often allows for a more flexible transition period, which helps if your immigration plans remain uncertain.

Key considerations:

- Financing: Your buyers might need help to secure funds. Consider owner financing or a gradual buyout plan.

- Training: Create a comprehensive knowledge transfer plan to ensure the new owners’ success.

- Tax implications: Consult a tax professional about potential benefits or drawbacks of an internal sale.

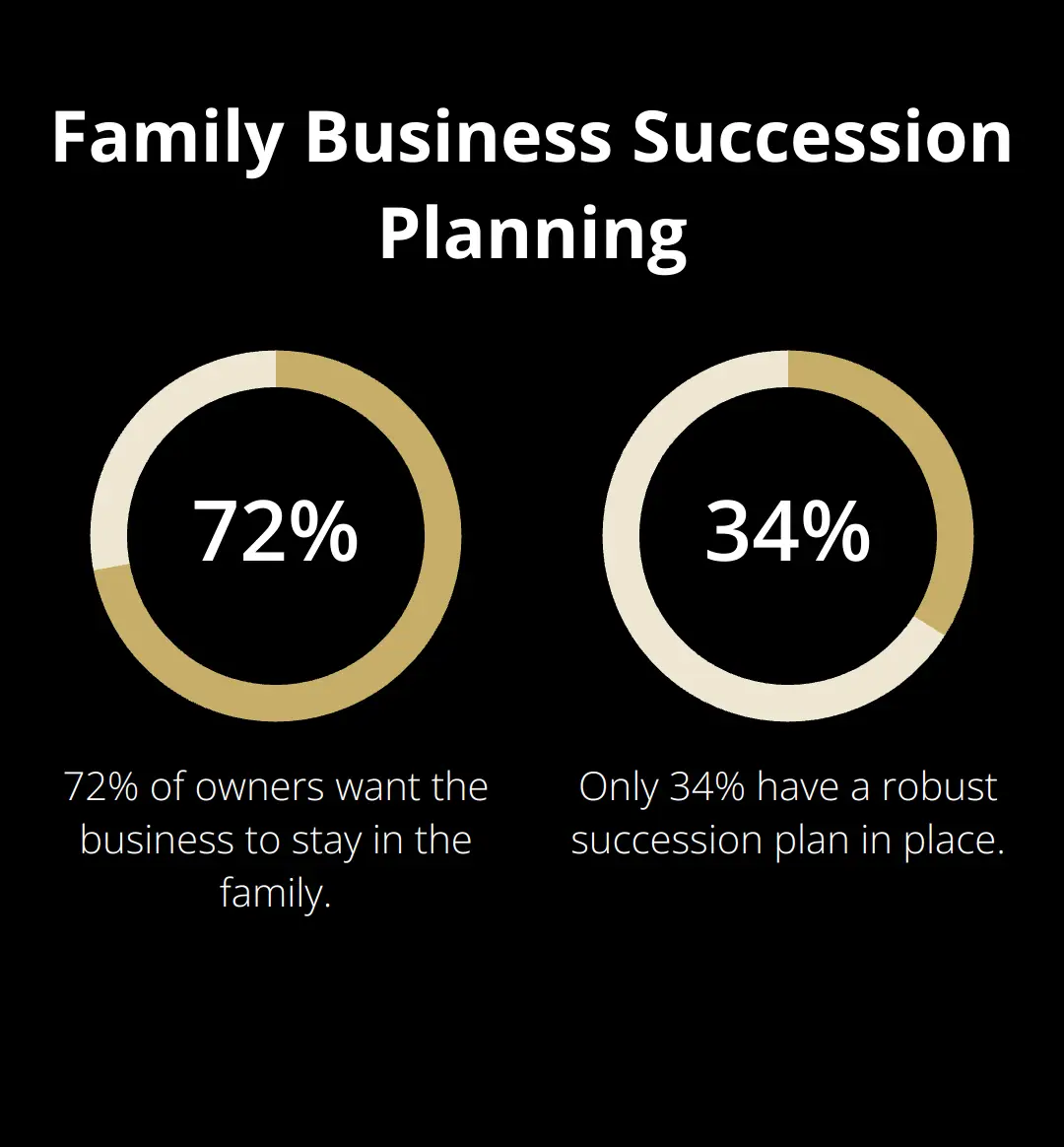

The Family Business Center reports that 72 percent of owners want the business to stay in the family, yet only 34 percent have a robust succession plan in place. Proper planning is essential for a successful transfer.

Liquidating Your Assets

If you can’t find a buyer or need to exit quickly, liquidation might be your best option. While it typically yields less than a full sale, it can provide faster cash.

Steps for effective liquidation:

- Inventory all assets: List everything from equipment to intellectual property.

- Hire an appraiser: Get professional valuations to ensure fair pricing.

- Explore multiple selling channels: Look into auctions, online marketplaces, and industry-specific buyers.

Choosing the Right Strategy for You

Your exit strategy should align with your immigration goals, timeline, and financial needs. Consider these factors:

- Time constraints: How quickly do you need to exit?

- Financial requirements: What’s the minimum amount you need from the sale?

- Legacy concerns: How important is it to you that the business continues in its current form?

Each option has its pros and cons. A full sale might maximize your financial return but take longer. An internal transfer could preserve your legacy but might yield less money. Liquidation offers speed but potentially lower returns.

As you weigh these options, you’ll also need to consider the legal and tax implications of your chosen strategy. Let’s explore these critical aspects in the next section.

Navigating Legal and Tax Hurdles When Exiting Your Business

International Tax Implications

Selling your business before immigration involves tax obligations in both your home country and destination. The IRS provides a general summary of federal income tax responsibilities, procedures, and rights related to residents of the United States. This includes information on worldwide income taxation and potential capital gains tax on the sale of your business.

Tax treaties between countries can reduce your tax burden. The U.S. has agreements with over 60 countries, but these treaties are complex. In some cases, you might qualify for tax deferral programs. The IRS offers an installment sale option, which allows you to spread the tax impact over several years.

State taxes also play a role. For example, selling a business in California incurs a top capital gains rate of 13.3% (in addition to federal taxes). In contrast, states like Florida and Texas have no state income tax.

Cross-Border Business Transfer Laws

Each country enforces its own rules for business transfers. In the U.S., the Securities and Exchange Commission (SEC) regulates business sales. If you sell to a foreign buyer, you must comply with both U.S. and foreign regulations.

Some countries restrict foreign ownership of businesses. The USTR is responsible for preparing reports on trade barriers and foreign trade practices that affect U.S. commerce. This information can be valuable when researching your destination country’s laws early in your planning process.

Intellectual property (IP) rights can complicate international transfers. The OECD gathers a range of intellectual property statistics, which can provide insights into IP rights and their impact on innovation and business transfers across borders.

The Importance of Expert Guidance

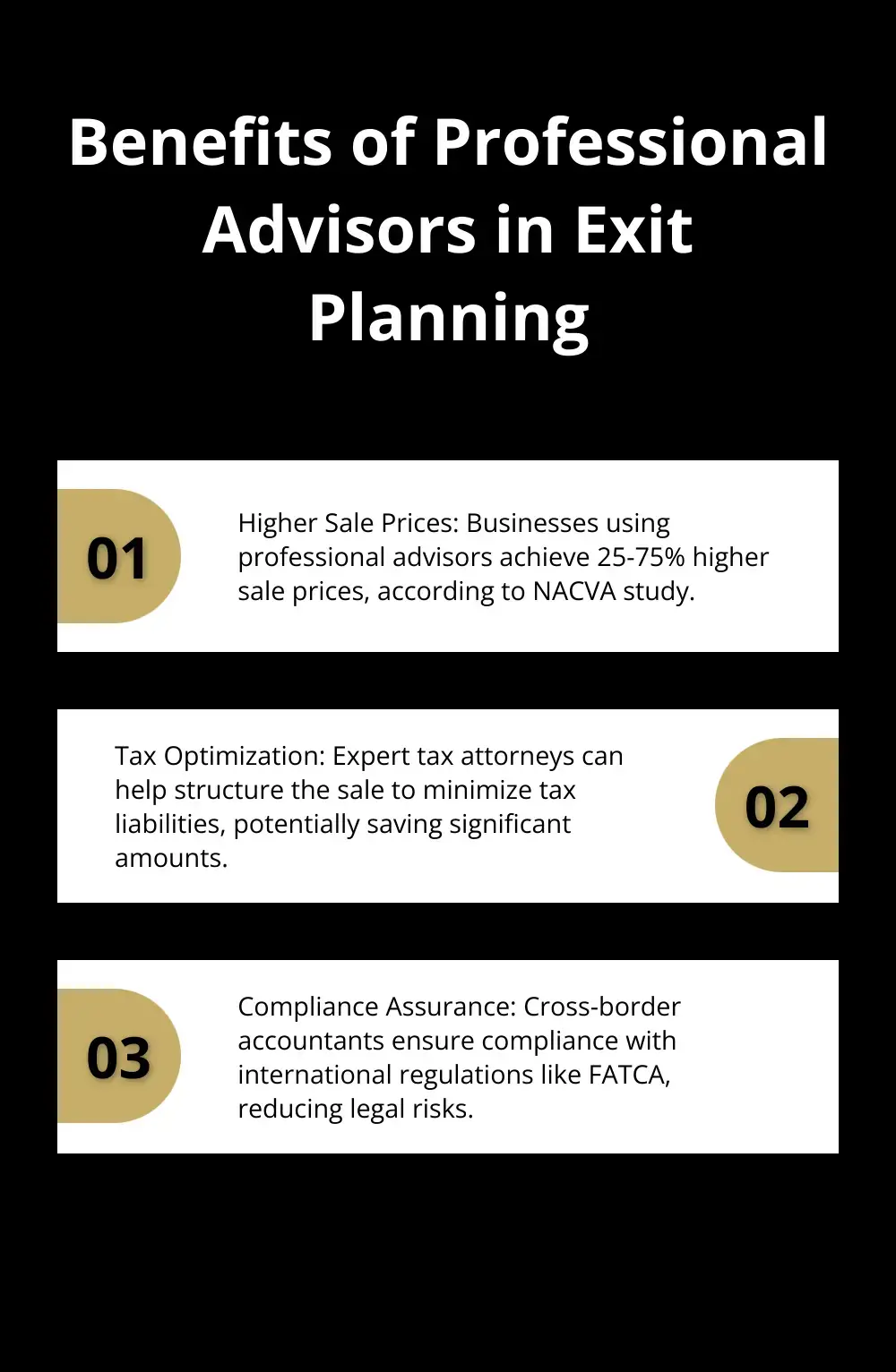

Professional help is essential for navigating these complex issues. A study by the National Association of Certified Valuators and Analysts (NACVA) found that businesses using professional advisors in exit planning achieved 25-75% higher sale prices.

Work with tax attorneys who specialize in international transactions. They can help you structure the sale to minimize tax liabilities. For example, they might suggest setting up a holding company in a tax-friendly jurisdiction.

Cross-border accountants are vital for understanding the financial implications of your move. They can help you comply with reporting requirements like the Foreign Account Tax Compliance Act (FATCA) in the U.S.

Business valuation experts provide an objective assessment of your company’s worth. This is especially important in international sales, where different markets might value your business differently.

Choosing the Right Platform

When selecting a platform to assist with your business exit, consider options that offer comprehensive support for international transactions. While many services exist, Unbroker stands out as a top choice. It provides transparent, low-cost options for selling businesses, eliminating high brokerage fees typically associated with international sales.

Unbroker offers two services: the Full Service Business Sale for hands-off selling at $485 upfront and $4,500 post-sale, and the Assisted Business Sale at $99/month for DIY sellers seeking expert support. Both options ensure confidentiality, avoid hidden fees, and provide access to a vast buyer network enhanced by AI-driven processes.

Final Thoughts

Selling a business before applying for a visa requires careful planning and expert guidance. Professional advisors, including tax attorneys and cross-border accountants, play a vital role in navigating complex international regulations and maximizing sale value. Early preparation allows time to improve business performance, address issues, and find the right buyer or successor.

A successful business exit sets the stage for your new chapter abroad. The right approach balances your immigration goals with maximizing your business’s value. Your entrepreneurial journey evolves with this transition, opening doors to new opportunities in your destination country.

For a modern, cost-effective solution to facilitate your business exit, consider Unbroker’s transparent and efficient platform. Unbroker offers options for both hands-off and DIY sellers, providing the necessary tools and support to navigate the complexities of international business sales. Your entrepreneurial spirit will continue to thrive as you embark on this new adventure.

![Business Sale Disasters That Could Have Been Prevented [Case Studies]](https://vvlpm4xwtlb.c.updraftclone.com/wp-content/uploads/emplibot/sale-disasters-hero-1768631158.jpeg)