Selling a business shouldn’t mean paying 5-10% commissions to a broker who does little more than answer emails. Traditional brokers have controlled the market for decades, but broker disruption is finally here.

At Unbroker, we’ve seen firsthand how outdated fee structures drain value from sellers. Technology now offers a better path forward-one with transparent pricing, real control, and direct access to buyers.

What Business Brokers Actually Cost You

Commission Structures That Drain Your Sale Price

The standard broker commission sits between 10% and 15% of your sale price. On a $1 million business, that’s $100,000 to $150,000 going to someone who largely coordinates emails and schedules meetings. Traditional brokers justify this by claiming they handle everything, but the reality is far messier. Most of their time goes toward basic administration rather than actively selling your business. They post your listing on their database, wait for inbound inquiries, and then manage conversations that could happen just as efficiently through digital tools.

Hidden Fees That Add Up Fast

The problem compounds when you factor in what happens after the commission. Many brokers layer on hidden fees that sellers discover only after signing. Legal review fees, document preparation charges, marketing expenses, and transaction fees can add another 2-5% to your total cost.

A seller paying 12% commission might actually pay closer to 17% when everything is tallied. On that same $1 million business, you’ve lost $170,000 instead of $120,000. Small business owners absorb these costs because they assume no alternative exists, but that assumption is increasingly outdated.

Misaligned Incentives Cost You Money

When you sell a business, you’re not just losing commission percentages-you’re losing negotiating power. Misaligned incentives mean brokers have no financial incentive to push for higher valuations or to spend weeks courting serious buyers. If your business sells for $800,000 instead of $1 million due to weak marketing or poor buyer vetting, the broker still collects their percentage on the lower amount. This misalignment of interests means sellers often accept lower offers simply to close the deal and pay the broker.

Technology-Enabled Alternatives Change the Game

Technology-driven platforms flip this model entirely. Modern platforms offer flat fees or monthly subscriptions instead of percentage-based commissions, which means sellers keep substantially more capital from their sale. These platforms provide transparent pricing upfront (no hidden charges), maintain better control over confidentiality, and work with tools designed for transparency rather than opacity. The shift toward low-cost, technology-enabled alternatives isn’t coming-it’s already here, and brokers clinging to outdated fee structures will find themselves increasingly irrelevant as more sellers discover what they’ve been overpaying for all along.

How Technology Rewires What Sellers Actually Pay

Flat Fees Replace Commission Percentages

The shift from commission-based brokers to technology-enabled platforms fundamentally changes seller economics. Platforms offering transparent, flat-fee models eliminate the percentage game entirely. Instead of losing a percentage of your sale price, you pay a fixed amount regardless of valuation. Flat-fee platforms cost a fraction of traditional broker commissions, meaning you keep substantially more capital from your sale. The math becomes even more compelling for smaller exits. This pricing transparency matters because hidden fees vanish. You know exactly what you’ll pay before listing, with no surprise charges appearing mid-sale.

Confidentiality Stays in Your Control

Traditional brokers shop deals to dozens of potential buyers, leaking your business information and weakening your negotiating position. Modern platforms protect confidentiality by controlling who sees your listing and when. You decide which buyers receive access to sensitive financial data, preventing information leakage that damages your negotiating power. This control matters more than most sellers realize. A leaked business sale signals weakness to competitors and can trigger employee departures before you’ve even closed. Technology platforms eliminate this risk through structured access controls and audit trails that show exactly who viewed what information.

AI Surfaces Qualified Buyers Faster Than Traditional Methods

Technology platforms use AI to handle tasks that traditional brokers perform manually and inefficiently. These systems analyze hundreds of variables-industry trends, buyer profiles, geographic fit, financial capacity-to surface genuinely qualified buyers rather than fishing for inbound inquiries. Smart buyer matching algorithms identify high-probability deals that brokers might miss during manual reviews. The result is faster matching and higher-quality conversations from day one. AI also powers instant preliminary valuations using standardized financial inputs and comparable sales data, eliminating weeks of back-and-forth with brokers who drag out initial assessments. Marketing tools built into modern platforms let you control your narrative and reach targeted buyer networks without middlemen.

Real-Time Visibility Replaces Information Gatekeeping

Direct access to buyer networks means serious buyers find your listing quickly, and you maintain confidentiality until discussions progress. Traditional brokers rely on opacity to justify their fees; platforms thrive on transparency, giving you real-time visibility into buyer engagement and deal readiness. You see exactly who’s interested, what they’re saying, and how serious they are-information brokers historically gatekeep.

This visibility transforms your role from passive seller to active participant in your own sale. You spot trends in buyer feedback, adjust your positioning, and make informed decisions about which offers merit serious consideration. When you control the information flow, you control the negotiation.

The economics of selling a business have shifted permanently. What matters now is understanding which platform model aligns with your timeline, expertise, and comfort level with hands-on involvement. Some sellers want complete support; others prefer managing the process themselves with expert guidance. The next section explores what different sellers should actually demand from their chosen path.

What Smart Sellers Actually Demand

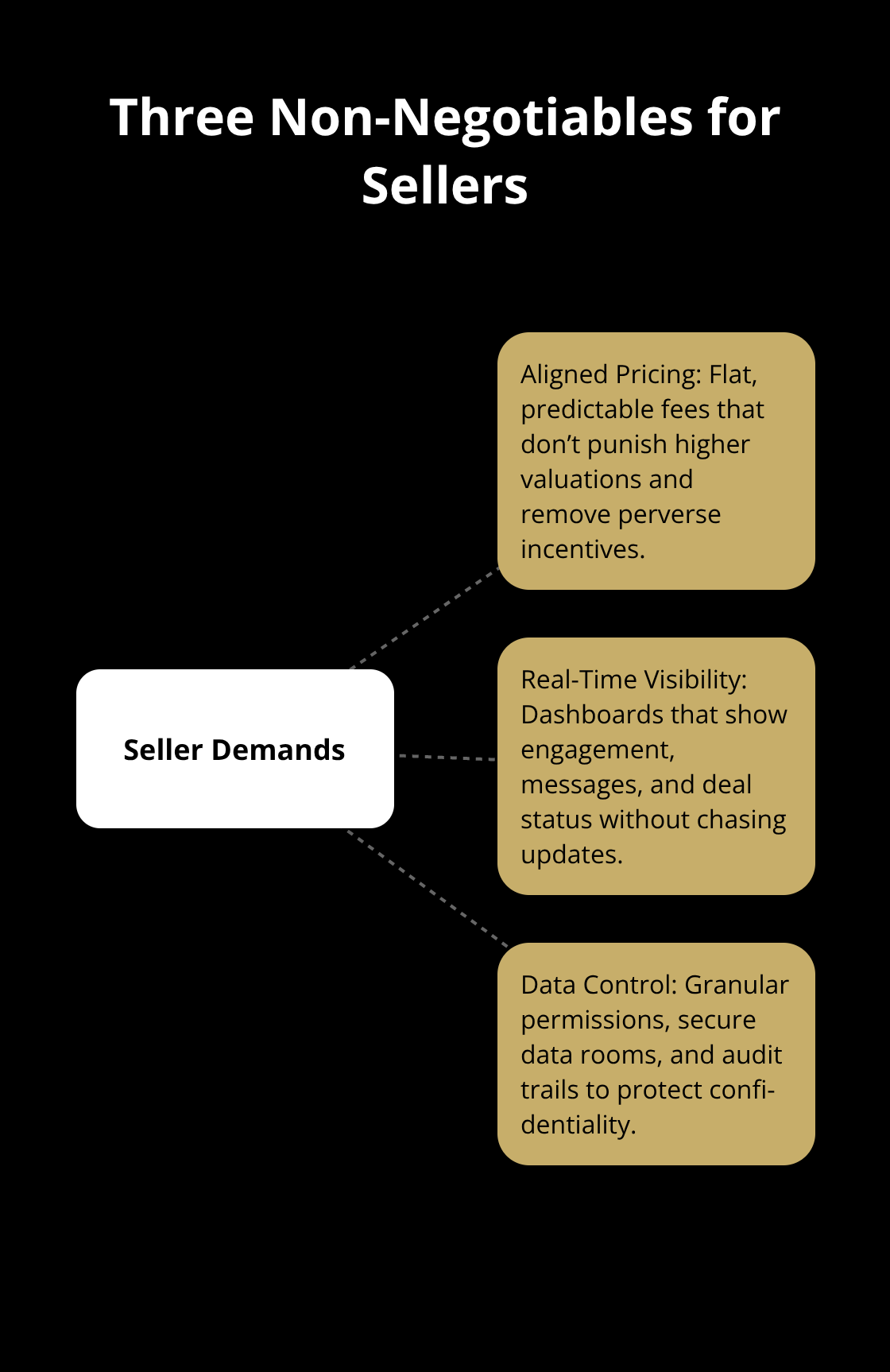

Sellers today have moved beyond accepting whatever terms brokers offer. The shift toward technology platforms means you can now demand pricing structures that align your interests with the platform’s, visibility into every step of your sale, and complete control over who accesses your sensitive business information. These aren’t luxury requests-they’re baseline expectations that separate modern platforms from outdated brokers.

Pricing That Rewards You, Not the Platform

The first demand sellers should make is transparent, predictable costs that don’t punish you for achieving a higher valuation. You need pricing that eliminates the perverse incentive problem entirely. Flat upfront fees and post-sale fees (regardless of whether your business sells for $500,000 or $5 million) align the platform’s success with your success at the valuation you deserve, not when you accept a discount to close quickly. Compare this to traditional brokers who pocket 10-15% regardless of outcome. On a $2 million sale, a broker takes $200,000 to $300,000; a flat-fee platform costs a fraction of that. The difference isn’t minor-it’s the capital that stays in your business or funds your next venture. When evaluating any platform, demand a complete fee schedule upfront with no hidden charges, no surprise legal fees, no document preparation markups. If a platform can’t provide this in writing before you list, that’s a red flag that opacity is still part of their model.

Real-Time Insight Into Buyer Engagement and Deal Movement

The second demand is visibility that traditional brokers actively withhold. You need to see exactly who expressed interest, what feedback they provided, and how serious conversations are progressing. Modern platforms provide dashboards showing buyer engagement metrics, message history, and deal status without requiring you to chase your broker for updates. This visibility matters because it shifts power to you. When a buyer goes silent, you spot it immediately and can adjust your positioning or reach out directly rather than waiting for a broker to eventually mention it. When multiple serious buyers emerge, you see it in real time and can orchestrate competitive tension that improves your offer. Demand access to these tools before committing to any platform. Test whether you can log in and see buyer activity without calling someone. If the platform requires you to email for updates or schedule calls to learn what’s happening with your own sale, they’re still operating under the old broker model.

Data Control That Protects Your Competitive Position

The third demand is absolute control over confidentiality and data access. Your financial statements, customer lists, and operational details are competitive weapons. A platform should let you decide which buyers see what information, at what stage, and for how long. You should see an audit trail showing exactly who accessed your data and when. This control prevents the information leakage that traditional brokers enable when they shop your deal to dozens of potential buyers indiscriminately. Controlling data access directly improves deal outcomes because serious buyers receive information strategically rather than all at once. Demand that the platform uses secure data rooms with granular permission controls, not email attachments or generic file-sharing services. Demand that your information is deleted or returned after a buyer relationship ends. Demand that the platform has clear policies about what happens to your data if you decide to work with a traditional broker instead.

These three demands-aligned pricing, real-time visibility, and data control-separate platforms that genuinely serve sellers from those that still operate under broker assumptions. When you evaluate any platform, use these as your evaluation criteria.

Final Thoughts

The business brokerage industry is experiencing genuine disruption, and sellers are the primary beneficiaries. Traditional brokers built their model on information asymmetry and percentage-based fees that punish sellers for achieving higher valuations. Technology platforms now demonstrate a fundamentally different approach: transparent pricing, real-time visibility, and buyer networks powered by AI rather than phone calls and email chains.

Sellers now have concrete alternatives that cost a fraction of traditional commissions while giving them substantially more control over their own sales process. The shift from 10-15% commissions to flat fees means keeping hundreds of thousands of dollars that previously went to brokers. The shift from information gatekeeping to real-time dashboards means understanding exactly what happens with your sale at any moment.

Broker disruption will accelerate because the economics are undeniable. Early adopters who move to technology-enabled platforms close deals faster, pay less, and maintain better control over confidentiality. Explore how transparent pricing and AI-driven buyer matching can work for your business and join the sellers who demand better terms instead of accepting outdated fee structures.

![Business Sale Disasters That Could Have Been Prevented [Case Studies]](https://vvlpm4xwtlb.c.updraftclone.com/wp-content/uploads/emplibot/sale-disasters-hero-1768631158.jpeg)