Selling a business is one of the biggest financial decisions you’ll make. Yet many sellers still don’t know whether the platform they’re using is actually reliable.

At Unbroker, we’ve seen firsthand how platform reliability can make or break a sale. The difference between a transparent, trustworthy platform and a sketchy one often comes down to hidden fees, buyer quality, and how well your information stays protected.

How Brokers and Platforms Differ on Cost and Speed

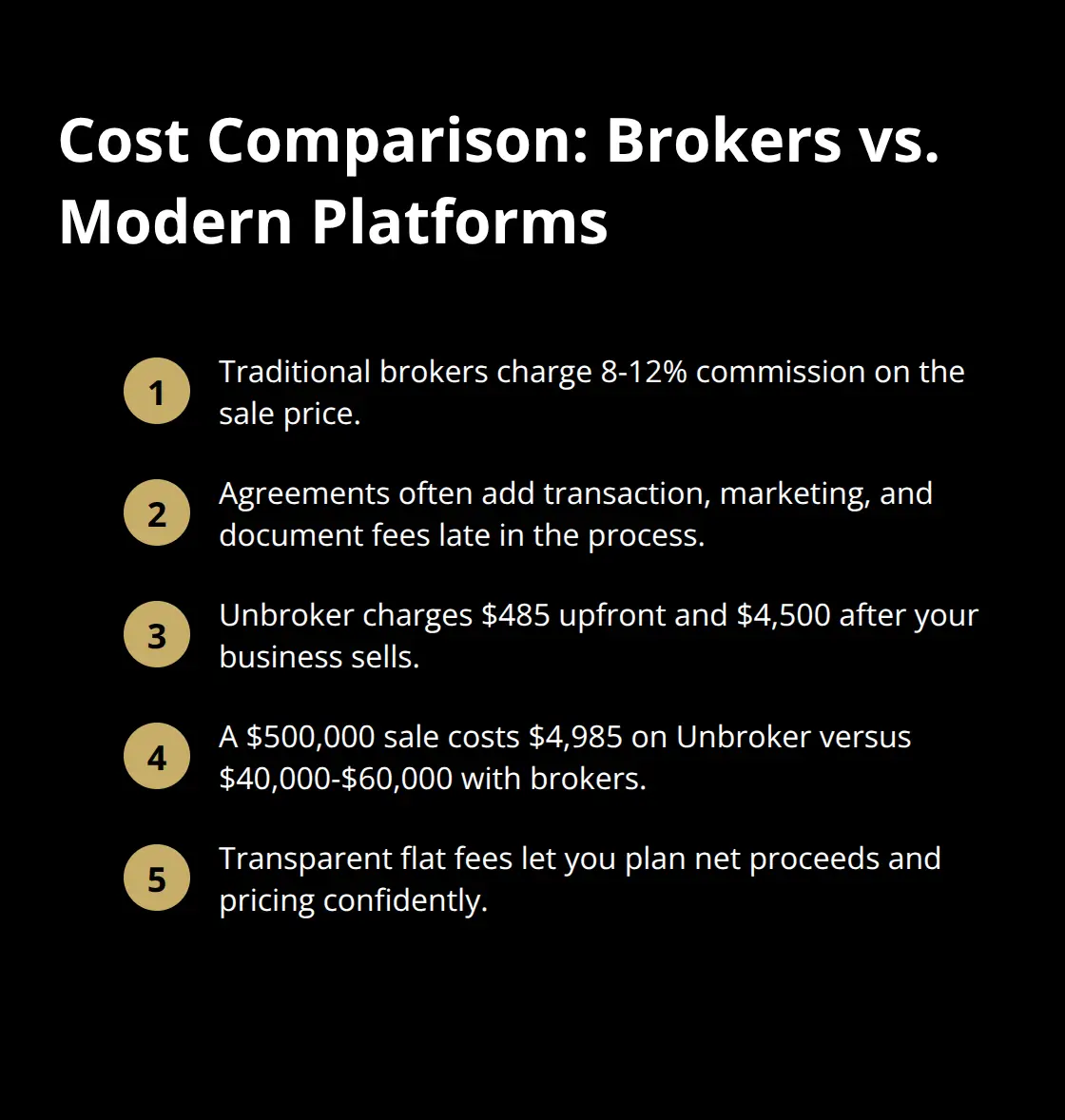

Traditional business brokers typically charge 8-12% of the sale price as their commission, often split between buyer and seller representatives. A $500,000 sale costs you $40,000-$60,000 in fees alone. Beyond the headline commission, many brokers bury additional costs in their agreements: transaction fees, marketing expenses, document preparation charges, and sometimes even success bonuses that only appear after closing. Sellers rarely see a detailed breakdown upfront, which is why many don’t realize the true cost until late in the process.

Modern platforms have fundamentally changed this model. Unbroker charges $485 upfront and $4,500 after your business sells, eliminating the percentage-based structure entirely. This flat-fee approach means a $500,000 sale costs you $4,985 instead of $40,000-$60,000. The difference is substantial and transparent from day one. When you know exactly what you’ll pay, you can actually calculate your net proceeds and make informed decisions about listing price and negotiation strategy.

Where Speed Becomes Real Money

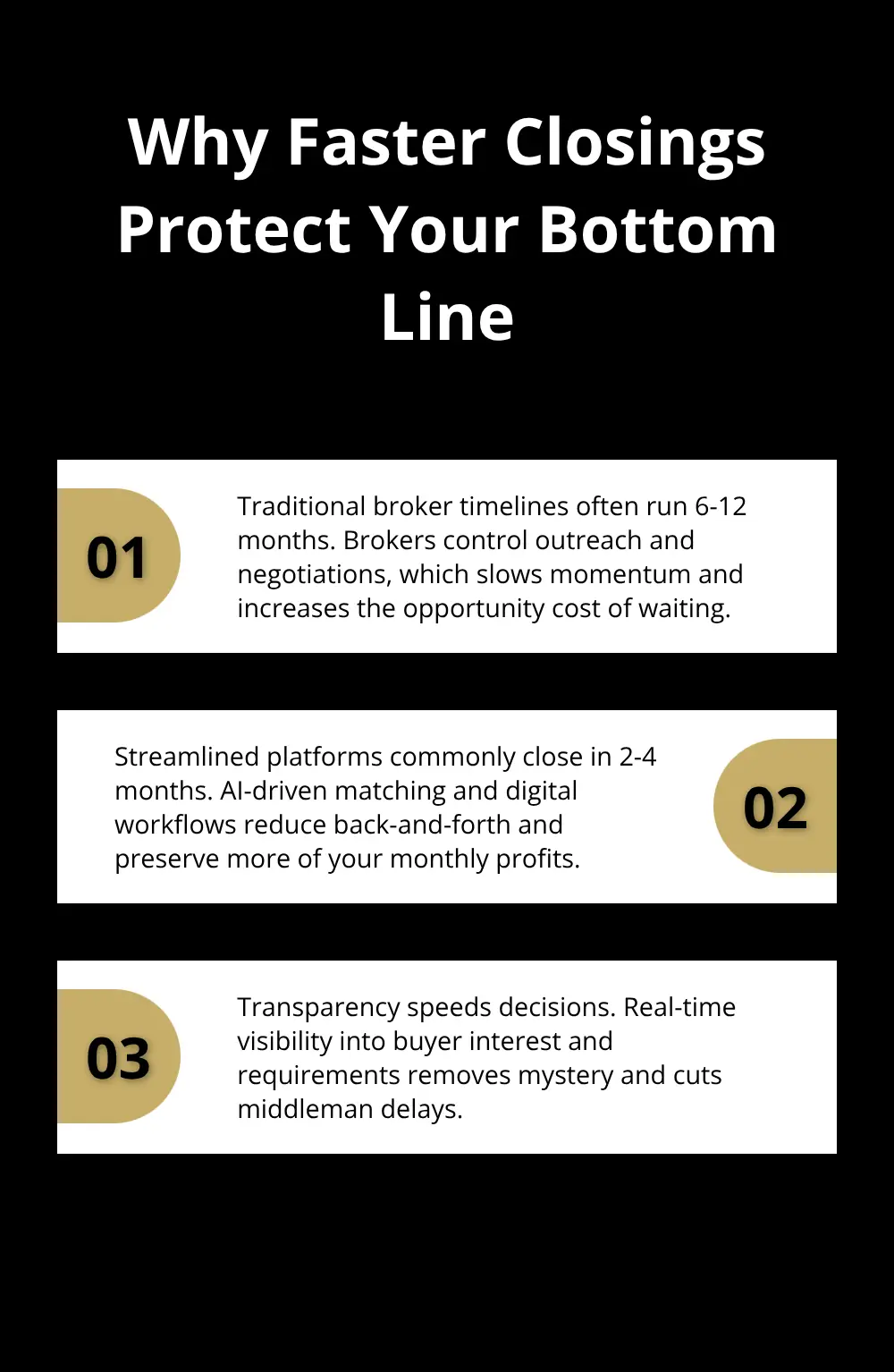

Time matters because every month your business sits on the market costs you cash flow and opportunity. Traditional brokers average 6-12 months to close a deal, partly because they control the process and move at their own pace. They manage buyer outreach, vetting, and negotiations on their schedule, not yours.

Modern platforms with AI-driven buyer matching and digital workflows compress this timeline significantly. Sellers using streamlined platforms report closings in 2-4 months, sometimes faster. This speed advantage directly impacts your bottom line: a business producing $10,000 monthly profit loses $20,000-$60,000 in earnings while waiting for a traditional broker to find the right buyer.

The transparency in modern platforms also accelerates timelines. You see exactly which buyers are interested, what stage they’re at, and what documentation they need. There’s no mystery, no middleman delays, and no waiting for your broker to return calls.

Pricing Models That Actually Make Sense

Traditional brokers rarely disclose their full pricing until you sign an exclusive listing agreement, which creates an information disadvantage for sellers. You might discover hidden clauses about who pays for appraisals, legal reviews, or marketing materials only after committing. Some brokers charge transaction fees on top of commission or require you to pay for professional photography and listing sites out of pocket.

Modern platforms publish their pricing publicly and keep it simple. Unbroker’s model includes premium marketing tools, legal document templates, and negotiation assistance as part of the service, not as add-ons. This all-inclusive approach means no surprise invoices arrive after closing. Sellers can compare pricing across platforms instantly and choose based on actual value, not promises.

The shift toward transparent pricing has forced the entire industry to compete on honesty rather than opacity. When you sell a business worth hundreds of thousands of dollars, knowing the exact cost structure upfront isn’t a luxury-it’s essential to protecting your financial outcome. This clarity also raises a critical question: beyond cost and speed, what actually makes a platform trustworthy when it comes to protecting your confidential information and attracting serious buyers?

How Trustworthy Platforms Protect Your Interests

What Separates Real Confidentiality from Empty Promises

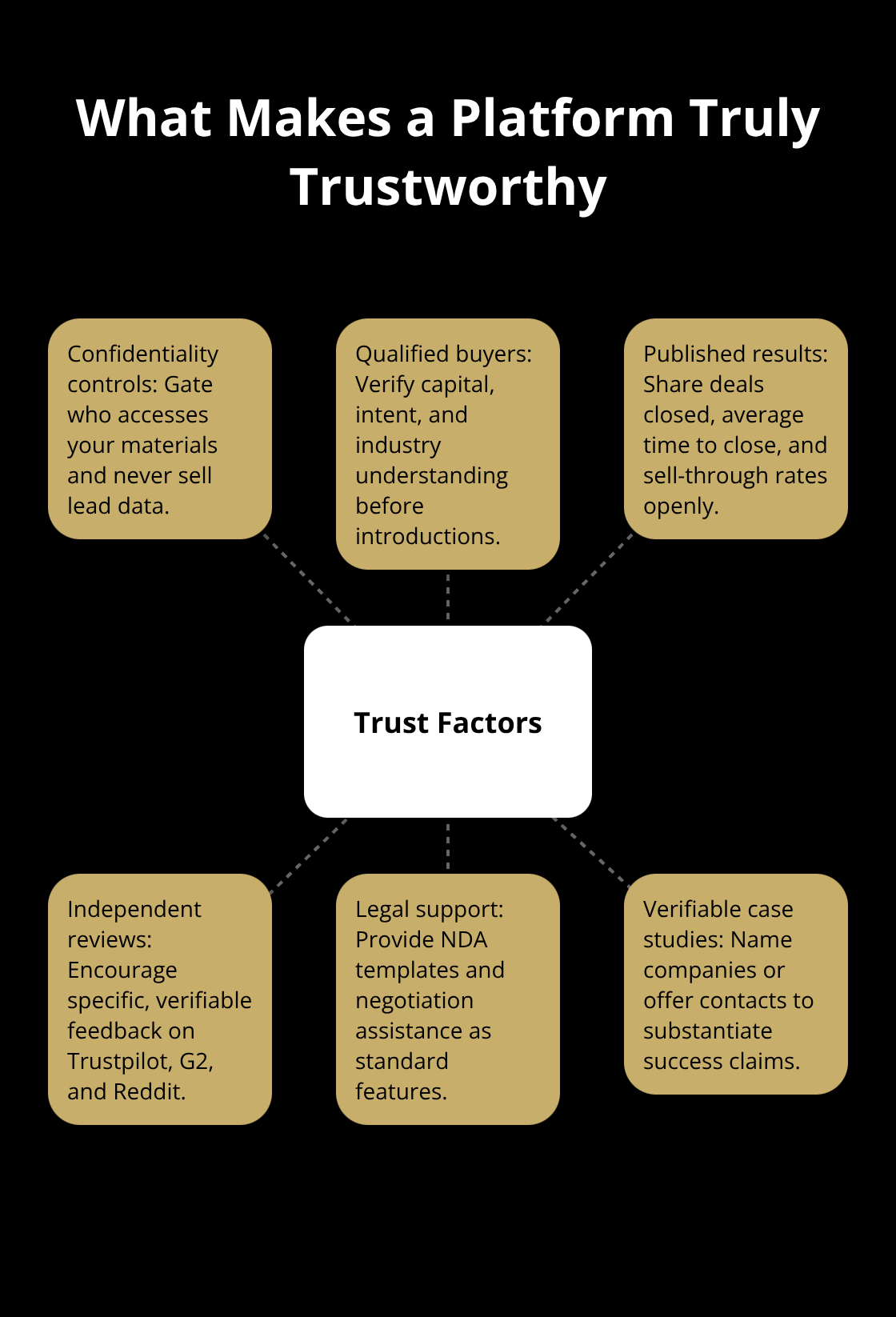

Trust in a business sale platform rests on three concrete elements: who accesses your information, whether the buyers contacting you are genuinely qualified, and what evidence exists that the platform actually closes deals. A platform can claim transparency and low fees all day, but if your confidential financial data leaks to competitors or unqualified tire-kickers flood your inbox, you lose control of your sale before negotiations even start.

Most platforms handle confidentiality poorly. They share buyer inquiries with multiple brokers, sell lead data to adjacent services, or fail to vet buyers before passing along your details. This carelessness exposes your information and creates noise that obscures serious offers from real buyers ready to move.

Platforms that control buyer access directly and refuse to sell or share your data with third parties maintain strict confidentiality. When a buyer expresses interest, the platform has already confirmed they have capital, are genuinely motivated, and understand your industry. This filtering reduces the volume of conversations you have but dramatically increases their quality. You spend time only with buyers who matter, which accelerates the entire process.

Verify Track Records with Real Numbers

Track record matters far more than marketing claims. Ask any platform directly: how many businesses did you sell last year, what was the average time to close, and what percentage of listed businesses actually sold? Legitimate platforms publish these numbers because they take pride in them. If a platform dodges the question or claims their data is proprietary, walk away.

You also need to verify whether their success stories are real or fabricated. A platform claiming they sold a software company for $2 million in three months should provide the company name, the buyer’s name, or at minimum a verifiable case study you can contact. Anonymous success stories prove nothing and signal that the platform has something to hide.

Check Independent Reviews and Seller Feedback

Check independent reviews on platforms like Trustpilot, G2, or Reddit communities focused on business sales. Real sellers leave detailed feedback about their experience, the professionalism of the team, whether promised timelines were met, and whether the final sale price matched expectations. A platform with hundreds of five-star reviews but zero critical feedback is suspicious-every platform has unhappy customers.

Look instead for platforms with 4.3 to 4.7 average ratings, where you can read both positive and negative feedback and see how the company responds to complaints. This transparency tells you the platform is honest about its shortcomings and committed to improving. The platforms worth your time have nothing to hide. When you evaluate a platform’s reliability, you’re really asking whether it will protect your confidentiality, connect you with serious buyers, and deliver on its promises. The next section examines the warning signs that reveal when a platform falls short on all three fronts.

Red Flags That Reveal Unreliable Platforms

Opaque Fee Structures Hide True Costs

Spotting a problematic platform starts with examining how it charges you. Phrases like “miscellaneous expenses,” “transaction support fees,” or “marketing coordination charges” signal that the platform hasn’t fully disclosed what you’ll actually pay. Legitimate platforms list every cost upfront with no asterisks or footnotes. When you contact a platform and they can’t provide a written fee schedule immediately, that’s a warning sign they’re hiding something.

Ask directly: What do you charge if my business doesn’t sell? What happens if I want to withdraw my listing early? Are there any other fees beyond what’s listed on your website? Platforms that hesitate to answer these questions in writing should be eliminated from consideration. The strongest platforms publish transparent pricing that you can verify before committing to anything.

Legal Support Separates Serious Platforms from Corner-Cutters

Documentation and legal support reveal which platforms take your protection seriously. When you list your business, you expose financial records, customer contracts, intellectual property details, and operational information worth protecting. A platform that provides no legal templates, refuses to help you draft confidentiality agreements, or leaves you to handle all documentation alone shifts risk directly to you.

Some platforms won’t take responsibility if a buyer breaches confidentiality or misuses information they received through the platform. Ask any platform: Do you provide legal document templates as part of your service? Will you help negotiate non-disclosure agreements with interested buyers? What’s your liability if a buyer leaks my confidential information? Platforms that offer zero legal support or claim they can’t provide legal assistance are essentially telling you they won’t protect you when something goes wrong. The strongest platforms include professional document templates and negotiation assistance as standard features, not premium add-ons.

Authentic Reviews Contain Specific Details and Honest Criticism

Customer reviews reveal how platforms perform under real pressure. Fake reviews tend to be uniformly positive, use generic praise like “amazing” or “fantastic,” and avoid specific details about timelines or outcomes. Authentic reviews mention exact numbers: how long the sale took, what the final price was relative to the asking price, and whether the platform delivered on promised features.

Check platforms like Trustpilot or G2 and look for reviews that mention specific problems (slow response times, inaccurate buyer qualification, fees that differed from quotes). A platform with hundreds of five-star reviews and zero critical feedback is almost certainly manipulating its ratings. Real platforms have ratings between 4.2 and 4.7 stars where you can read both satisfied and dissatisfied sellers describing their actual experience. If a platform has fewer than 50 verified reviews or reviews that all sound like they came from the same person, the platform hasn’t been operating long enough or transparently enough to trust with your sale.

Final Thoughts

Platform reliability comes down to three measurable factors: transparent pricing that matches what you actually pay, verified buyer networks that filter out unqualified prospects, and documented proof that the platform closes deals. Request written fee schedules from any platform you consider, and ask for their annual sale volume, average time to close, and percentage of listed businesses that actually sold. Legitimate platforms provide these numbers without hesitation because they stand behind their track record.

Check independent reviews on Trustpilot and G2, but read critically for reviews with specific details about timelines and outcomes rather than generic praise. A platform with ratings between 4.2 and 4.7 stars where you can read both positive and negative feedback proves far more trustworthy than one claiming perfect scores. Verify that your chosen platform provides legal document templates and negotiation assistance as standard services, since the strongest platforms include these protections automatically.

We at Unbroker built our platform around the standards outlined here: transparent fees upfront ($485 to list, $4,500 after your business sells), protected confidential information, and serious buyers who can actually close. Start your evaluation at Unbroker and compare what you find against these criteria to make your decision straightforward.

![Business Sale Disasters That Could Have Been Prevented [Case Studies]](https://vvlpm4xwtlb.c.updraftclone.com/wp-content/uploads/emplibot/sale-disasters-hero-1768631158.jpeg)