Selling your business shouldn’t mean losing thousands to unexpected fees. Most platforms bury their platform costs deep in contracts, leaving sellers shocked when they see their final proceeds.

At Unbroker, we built our service around complete transparency. Every fee is listed upfront, so you know exactly what you’ll pay before you commit.

How Brokers Bury Their Real Costs

The Commission Trap

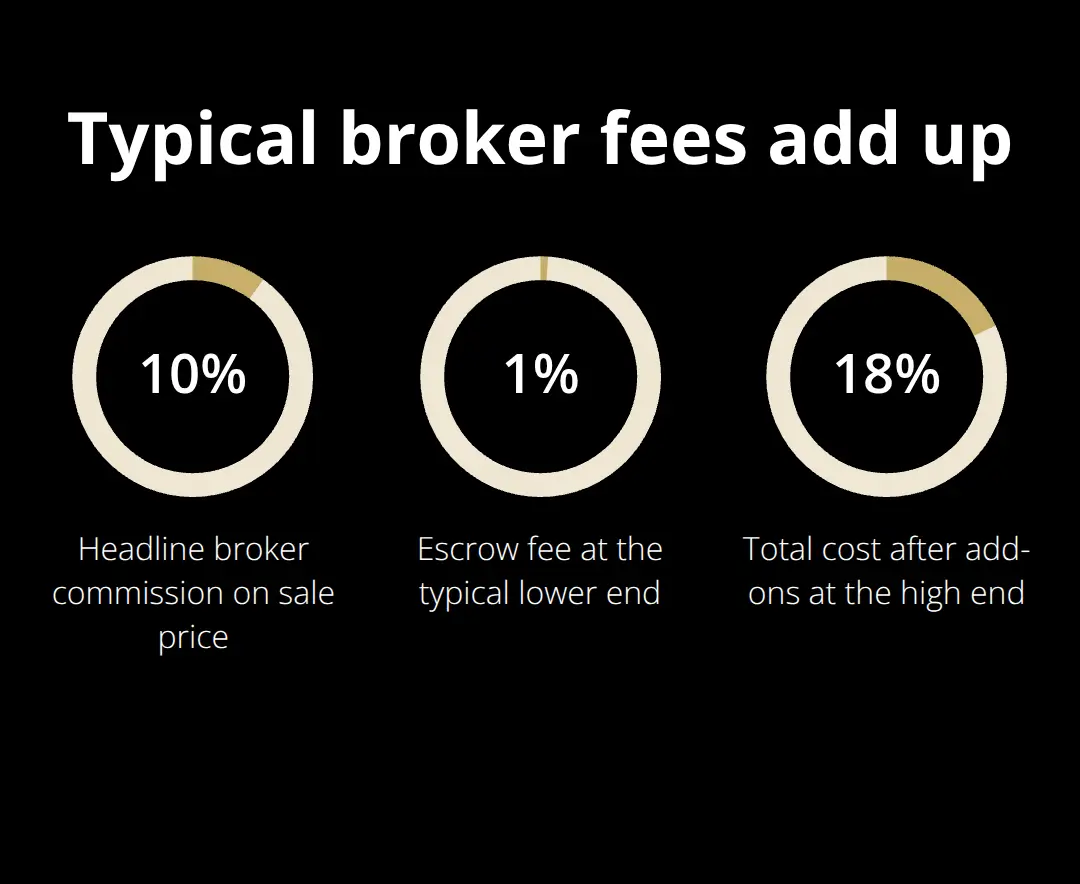

Traditional business brokers quote you a headline commission rate-usually 10% of the sale price-and call it a day. What they don’t mention is that this percentage applies only to the gross proceeds, not the net amount you receive. A $1 million sale at 10% looks like $100,000 in commissions, but brokers layer on commission rates and hidden escrow fees (typically 1–2% of the sale price), transaction processing fees ($500–$2,000), document preparation and legal review charges ($1,500–$5,000), and sometimes marketing reimbursements you never authorized. That 10% quietly balloons to 15–18% of your sale price.

Hidden Fees in the Fine Print

Vague language in broker contracts makes this worse. Phrases like “reasonable expenses” or “third-party costs” give brokers latitude to bill you for everything from title searches to courier fees without advance disclosure. Many sellers discover these charges only when reviewing closing documents, at which point negotiating them away becomes nearly impossible. Brokers also exploit timing-they front-load their marketing spend and then bill you for it regardless of whether their efforts actually attracted the buyer.

Percentage-Based Escalations

Some platforms add percentage-based fees that scale with sale price. The higher your business sells for, the more you pay in absolute dollars, creating a perverse incentive structure where brokers benefit from inflating valuations rather than securing fair deals for you. This misalignment means the platform’s interests diverge from yours at the moment when alignment matters most.

The Transparency Alternative

Transparent pricing removes the incentive to hide costs. Platforms that charge flat fees versus percentage-based pricing models upfront and post-sale align their success with yours. You model your true net proceeds accurately and compare offers without worrying that broker fees will consume an unexpected chunk of your return. This clarity also lets you evaluate whether the platform’s services justify their stated costs, rather than discovering hidden charges after you’ve committed.

What Sellers Should Demand

Demand platforms that disclose all fees in writing before you list. Request itemized breakdowns of any “reimbursable expenses” and ask which costs are fixed versus variable. Insist on knowing whether marketing charges, escrow fees, or document preparation costs will appear at closing. Sellers who ask these questions upfront often uncover significant savings-and platforms that resist transparency reveal their true priorities.

How Unbroker Cuts Through the Fee Maze

Flat fees eliminate the perverse incentive that plagues percentage-based models. When brokers earn more from higher sale prices, they profit regardless of whether they earned it. Traditional brokers quote a 10% commission and let sellers discover the real cost at closing. For a $1 million business, traditional brokers extract $150,000–$180,000 when you factor in escrow fees, transaction charges, and reimbursable expenses. Modern platforms operate differently by charging fixed amounts that don’t scale with your sale price. This structure immediately aligns the platform’s success with yours, not against it.

Flat Fees Reverse Misaligned Incentives

Percentage-based pricing creates misalignment at the critical moment. When a broker earns more from a higher sale price, they benefit from inflating valuations and pushing sellers toward deals that maximize their commission, not net proceeds. Flat-fee models reverse this dynamic. The platform’s success depends on moving deals efficiently and keeping your trust, not on extracting hidden costs. This matters practically because it means the platform has no financial incentive to bury expenses in fine print or bill you for vague reimbursables. You can evaluate the service on merit rather than worrying about what clause in the contract will surprise you at closing.

Transparent Pricing Lets You Model Real Proceeds

Transparent pricing lets you model your actual proceeds before you commit. If you know the full cost upfront, you can calculate net proceeds accurately and compare multiple offers without wondering if broker fees will consume an unexpected portion of your return. Many sellers who switch from traditional brokers to transparent platforms report discovering that their true cost of sale was 30–40% higher than the headline commission suggested. That discovery usually comes too late to change course. Platforms that state costs plainly and refuse to add charges later eliminate that risk entirely.

What Sellers Gain From Clarity

Sellers gain concrete advantages when they know exactly what they’ll pay. You avoid the shock of discovering hidden charges in closing documents, when negotiating them away becomes nearly impossible. You stop funding marketing reimbursements you never authorized or document preparation costs buried in fine print. You eliminate the anxiety of wondering whether “reasonable expenses” or “third-party costs” will balloon your final bill. Clear pricing also lets you compare platforms fairly-you can weigh the actual service value against the stated cost, rather than guessing what hidden fees might appear later.

The Path Forward Requires Honest Disclosure

Sellers who ask brokers upfront about all fees often uncover significant savings. Demand platforms that disclose every charge in writing before you list. Request itemized breakdowns of any reimbursable expenses and ask which costs are fixed versus variable. Insist on knowing whether marketing charges, escrow fees, or document preparation costs will appear at closing. Platforms that resist transparency reveal their true priorities. Those that embrace it signal that their business model depends on your satisfaction, not on extracting maximum fees from your transaction. This distinction shapes everything that follows-from how the platform markets your business to how it negotiates on your behalf.

What Actually Gets Billed at Closing

Escrow and Transaction Fees Shock Sellers at the End

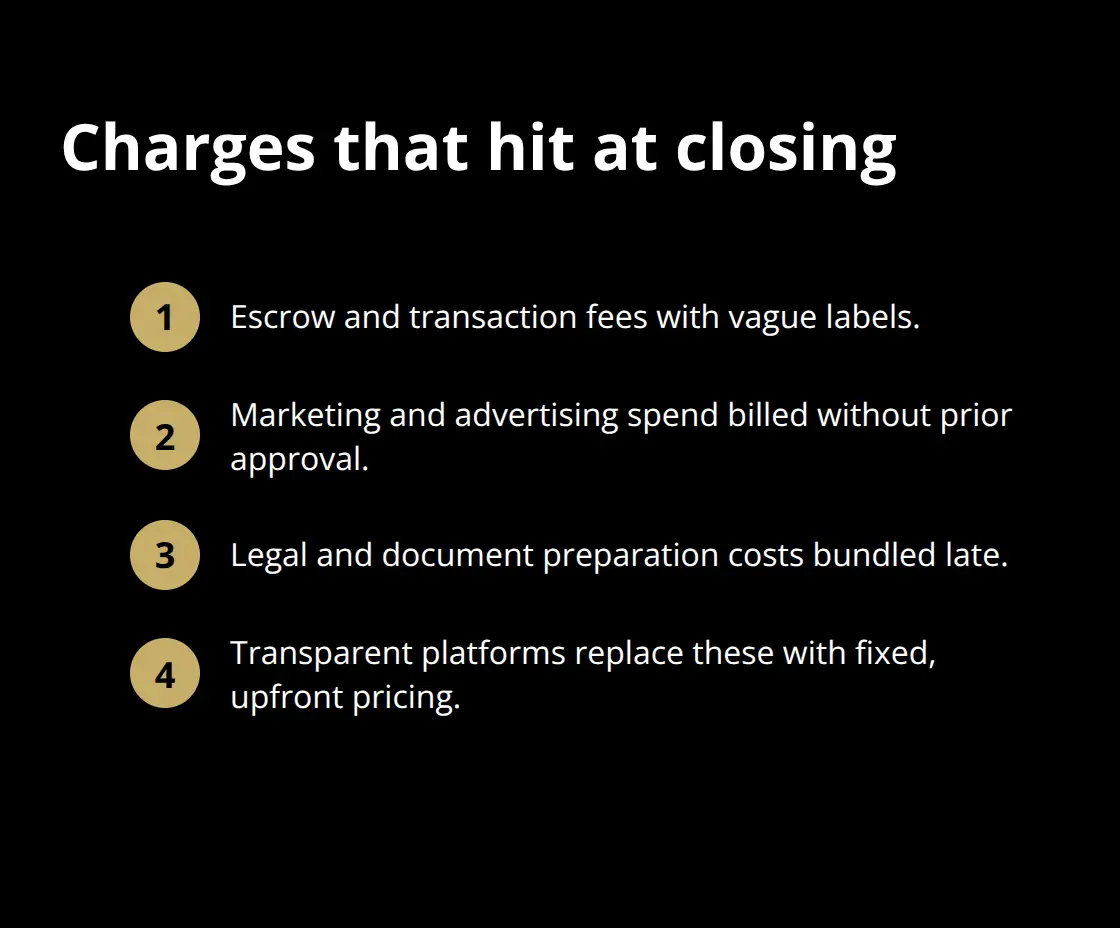

Escrow and transaction fees represent the first major shock sellers encounter when reviewing closing documents. Escrow cost is less than 1% of the purchase price, though there is a minimum fee for unusually small deals. Transaction processing fees layer on top, ranging from $500–$2,000 depending on the platform and complexity. These charges often appear as separate line items with vague descriptions like “administrative processing” or “transaction coordination,” making it difficult to understand what work actually justifies the cost.

Most sellers never ask whether these fees are negotiable because they assume they’re standard across all platforms-they’re not. Some platforms charge flat fees that eliminate this category entirely, meaning your escrow and transaction costs are known before you commit. This upfront clarity prevents the unpleasant surprise of discovering thousands in unexpected charges at closing.

Marketing Spend Accumulates Without Your Control

Marketing and advertising charges represent the second major expense sellers overlook. The average cost to sell a small business through a broker often lands between 10% and 15% of the total deal value when all costs are included. Brokers frequently bill sellers for marketing spend without advance approval, then justify the charges by claiming the exposure attracted interest.

The problem runs deeper than the dollar amount. You have no control over the spending, no receipt of an invoice before the work happens, and no ability to approve or reject the charges once they’re incurred.

This lack of transparency means you fund marketing campaigns you never authorized and cannot evaluate whether the spending actually delivered results.

Legal and Document Preparation Costs Mount Silently

Legal and document preparation costs compound the problem further. Most business brokers charge commissions in the range of 8% to 12%, though larger businesses or more complex sales may involve different fee arrangements. These charges accumulate silently throughout the process and appear as a consolidated line item at closing, when challenging them becomes nearly impossible.

The most insidious aspect of these costs is their opacity. Sellers don’t see itemized breakdowns, don’t understand what services justify each charge, and don’t realize until closing that the true cost of sale far exceeded the headline commission percentage. A $1 million sale with a quoted 10% commission can easily cost 15–18% once escrow fees, transaction charges, marketing reimbursements, and document preparation costs are added together.

Transparent Platforms Eliminate Hidden Charges

Platforms that offer transparent, fixed-fee structures eliminate this entire category of surprise charges and force clear accountability for every cost sellers incur. When you know the full cost upfront, you can calculate your actual net proceeds and compare offers without wondering what additional charges will appear at closing. This clarity transforms the selling process from a financial guessing game into a straightforward transaction where you control the outcome.

Final Thoughts

A $1 million business sale through a traditional broker costs you $150,000 to $180,000 when escrow fees, transaction charges, marketing reimbursements, and document preparation costs are factored in. That’s 15–18% of your proceeds gone before you see a dime. The same sale through a transparent platform with fixed platform costs might cost $4,500 to $5,000 total. The difference isn’t marginal-it’s the difference between walking away with $820,000 and $995,000.

Traditional brokers profit from opacity by quoting a headline commission, burying additional charges in fine print, and billing you for expenses you never approved. You discover the true cost only at closing, when negotiating becomes impossible. Transparent platforms eliminate this dynamic entirely by stating all costs upfront and refusing to add hidden charges later. Real sellers experience this difference constantly: a business owner selling for $500,000 through a traditional broker might pay $75,000 to $90,000 in total fees, while the same business sold through a transparent platform costs a fraction of that amount.

When you know your true net proceeds upfront, you can plan your next move with confidence and avoid the financial shock of hidden charges at closing. We at Unbroker built our service on this principle, offering transparent pricing so you know exactly what you’ll pay before you commit. Start your business sale with Unbroker and experience the difference that honest pricing makes.

![Business Sale Disasters That Could Have Been Prevented [Case Studies]](https://vvlpm4xwtlb.c.updraftclone.com/wp-content/uploads/emplibot/sale-disasters-hero-1768631158.jpeg)