Business owners often fall victim to widespread valuation myths that can cost them thousands when selling their companies. These misconceptions lead to unrealistic price expectations and failed transactions.

We at Unbroker see sellers make the same costly mistakes repeatedly. Understanding what actually drives business value separates successful exits from disappointing outcomes.

What Valuation Myths Cost Sellers Money

High Revenue Creates False Value Expectations

Many sellers believe their million-dollar revenue automatically translates to a million-dollar business value. This misconception confuses top-line sales with actual profitability. A company that generates $2 million in revenue but spends $1.9 million on expenses offers far less value than a $500,000 revenue business with $300,000 in profit.

Smart buyers focus on free cash flow, not gross sales figures. Revenue multiples vary dramatically by industry, with software companies that command approximately 11x revenue while manufacturing businesses typically sell for under 1x revenue. Buyers purchase cash flow potential, not impressive sales numbers.

Physical Assets Mislead Modern Business Buyers

Traditional asset-based valuations work for liquidation scenarios but fail for operating businesses. A marketing agency with $50,000 in office equipment and computers isn’t worth $50,000 if it generates $200,000 annual profit. Buyers purchase future earnings potential, not depreciated furniture and technology.

Asset purchases dominate small business transactions, but the asset value calculation includes goodwill and intangible assets like customer relationships and brand recognition (not just physical inventory). Modern businesses derive value from intellectual property, customer databases, and operational systems rather than tangible equipment.

Industry Rules of Thumb Ignore Business Specifics

Restaurant owners frequently hear their business is worth 3x annual profit, while dental practices supposedly sell for 70% of annual revenue. These shortcuts ignore fundamental value drivers like location quality, lease terms, and customer concentration. A restaurant in a declining mall faces different market conditions than one in a thriving downtown district.

Professional valuators use multiple methodologies because no single rule applies universally. The discounted cash flow method remains the gold standard because it accounts for specific business risks and growth projections rather than generic industry averages.

These widespread myths explain why many sellers receive disappointing offers that fall short of their expectations. Understanding how to value a small business properly reveals what buyers truly want to purchase.

What Actually Determines Your Business Worth

Cash Flow Consistency Trumps Revenue Size

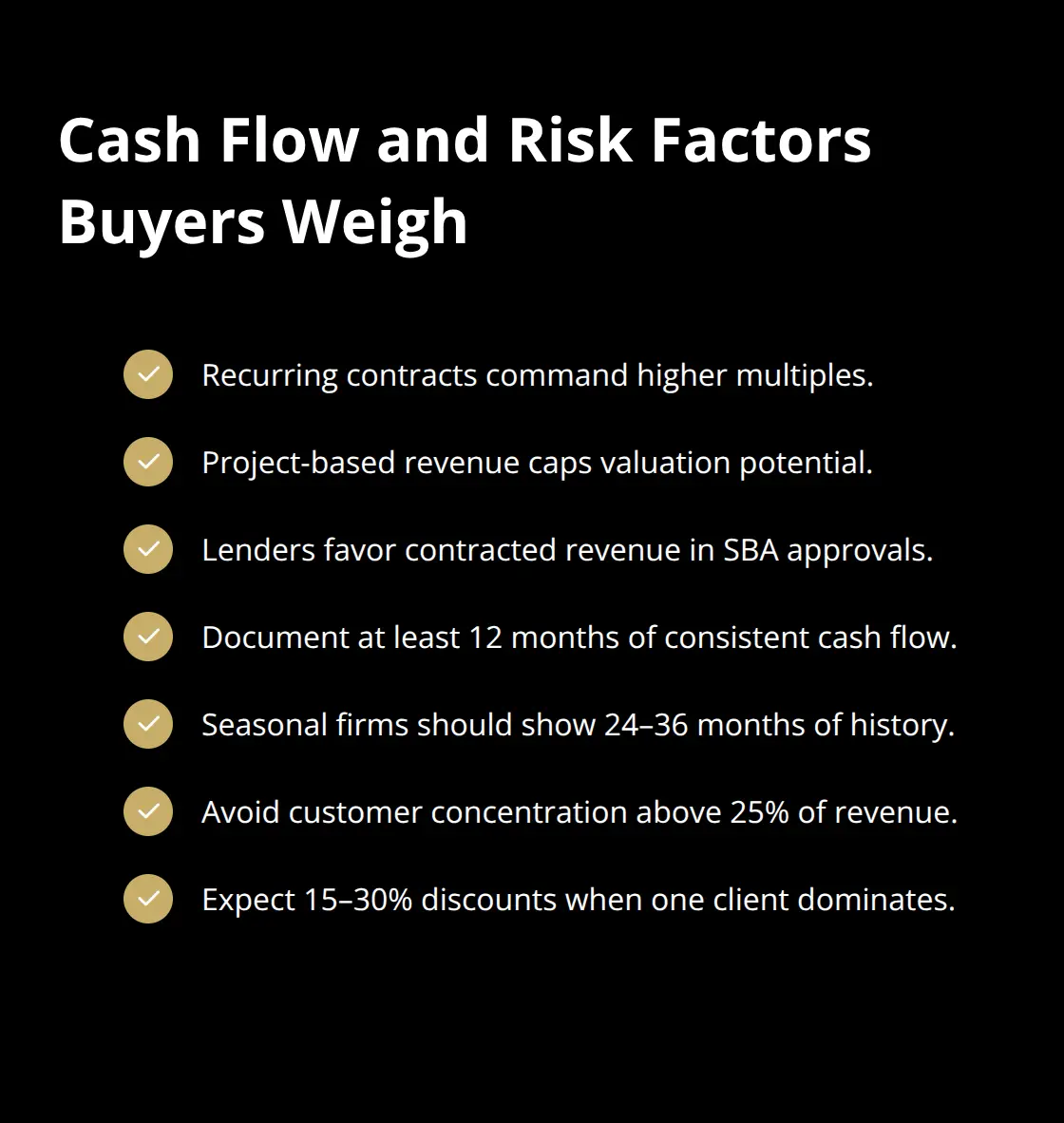

Buyers pay premium prices for predictable cash flow patterns over erratic high-revenue businesses. A pest control company with recurring monthly contracts commands higher multiples than a construction firm with identical annual revenue but project-based income. SBA data shows businesses with contracted revenue receive loan approvals at higher rates than those dependent on one-time sales.

Monthly recurring revenue businesses in the software sector trade at 8-12x annual revenue, while project-based service companies rarely exceed 2-3x revenue multiples. Buyers want to see at least 12 months of consistent cash flow documentation (with seasonal businesses needing 24-36 months to demonstrate stability patterns). Customer concentration matters equally – businesses with their largest client representing over 25% of revenue face automatic valuation discounts of 15-30%.

Market Position Creates Pricing Power

Companies that dominate local markets or serve specialized niches command significantly higher valuations than commodity providers. A plumbing company that controls 40% of commercial contracts in a mid-size city sells for higher multiples than residential plumbers who compete on price alone. Market leadership translates directly into pricing power, which buyers recognize through premium valuations.

Businesses with defensible competitive positions consistently outperform generic service providers during sales processes. These advantages include exclusive supplier relationships, proprietary technology, or regulatory barriers. Geographic monopolies in industries like waste management or specialized manufacturing create sustainable advantages that buyers pay extra to acquire. The key metric buyers examine is gross margin sustainability over 3-5 year periods (not just current profitability levels).

Growth Trajectory Influences Final Sale Price

Buyers evaluate future potential alongside current performance when they calculate purchase prices. Companies with documented growth patterns receive valuation consideration, though higher growth can lead to lower value for companies with negative spreads. Historical growth patterns matter less than sustainable growth systems and market expansion opportunities.

Professional valuation methods account for these growth factors through specific mathematical models that translate future potential into present value calculations.

Which Valuation Methods Produce Reliable Results

Discounted Cash Flow Delivers the Most Accurate Valuations

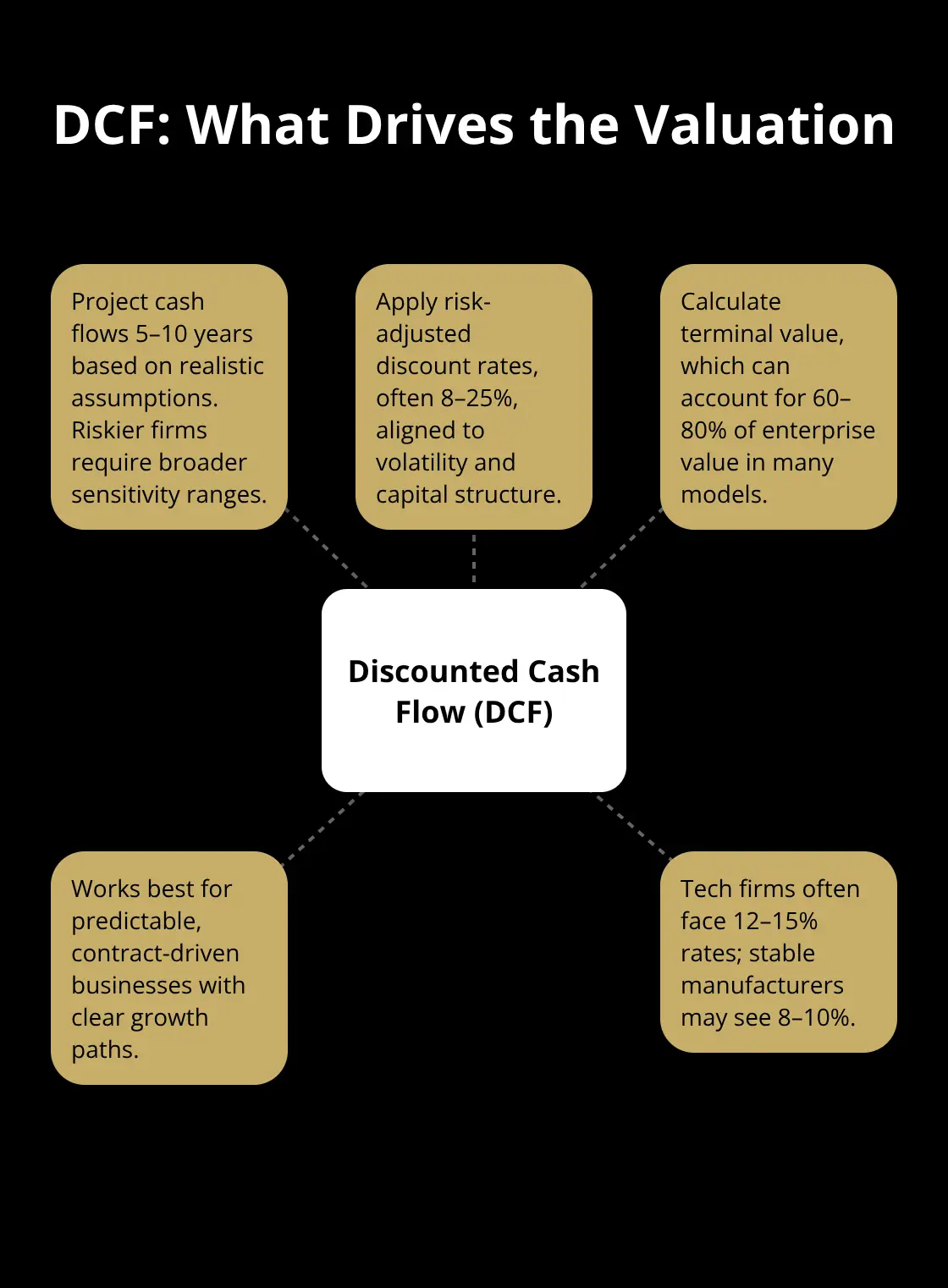

The Discounted Cash Flow method stands as the gold standard for business valuation because it estimates the value of a company based on the money, or cash flows, it’s expected to generate. Professional valuators project cash flows for 5-10 years, then apply discount rates between 8-25% based on business risk factors. Technology companies typically face 12-15% discount rates, while established manufacturers might see 8-10% rates due to lower volatility.

This method requires detailed financial projections that account for capital changes, capital expenditures, and debt service obligations. The terminal value calculation captures business worth beyond the projection period (often 60-80% of total enterprise value). DCF analysis works best for businesses with predictable cash flows and clear growth trajectories, which makes it ideal for subscription-based services, franchise operations, or companies with long-term contracts.

Market Comparison Approach Validates Realistic Sale Prices

Professional valuators use databases like DealStats to compare your business against recent transactions of similar companies. This approach analyzes businesses with revenue ranges, geographic locations, and operational characteristics that match yours rather than broad industry averages. Comparable transactions from the past 12-24 months provide the most relevant benchmarks.

The method examines multiple metrics from actual sales including revenue multiples, EBITDA multiples, and price-to-book ratios. Manufacturing businesses typically trade at 0.5-1.2x revenue multiples, while professional services command 1.5-3.0x revenue based on client retention rates and profit margins. Market data reveals that businesses with revenues under $1 million often sell at lower multiples due to limited buyer interest and finance challenges.

Asset-Based Valuation Works for Specific Business Types

Asset-based approaches suit businesses where tangible assets drive value more than operations. Equipment-heavy companies like transport firms, construction contractors, or manufacturers benefit from this method when assets represent substantial portions of enterprise value. The approach adjusts book values to reflect current market prices for machinery, real estate, and inventory.

This method fails for service businesses where intellectual property and customer relationships create most value. Professional services firms with minimal physical assets but strong client bases require income-based approaches instead. Asset-based valuations work best for liquidation scenarios or when buyers purchase businesses primarily for their physical infrastructure rather than operational cash flow potential.

Final Thoughts

Accurate business valuation protects sellers from costly mistakes that destroy transactions. Professional assessments reveal true market value while these valuation myths create unrealistic expectations that lead to failed sales. Sellers who understand their actual worth negotiate from strength rather than desperation.

Professional valuators need three years of financial statements, tax returns, and complete operational data to apply DCF analysis effectively. This preparation process often reveals opportunities to enhance value before you list your business for sale. Smart sellers gather this documentation early to avoid delays during due diligence periods.

Experienced advisors identify qualified buyers who appreciate your business model rather than bargain hunters who target distressed assets. They structure deals that maximize your after-tax proceeds while they minimize transaction risks (something most sellers overlook). We at Unbroker provide expert support throughout the sales process with transparent pricing that eliminates traditional brokerage fees.

![Business Sale Disasters That Could Have Been Prevented [Case Studies]](https://vvlpm4xwtlb.c.updraftclone.com/wp-content/uploads/emplibot/sale-disasters-hero-1768631158.jpeg)