Most business owners assume traditional sales methods offer the best returns when exiting their company. A business auction might actually deliver higher prices through competitive bidding.

We at Unbroker see growing interest in auction-based sales as entrepreneurs seek faster, more transparent exit strategies. The auction format creates urgency that often pushes final prices beyond initial expectations.

How Do Business Auctions Actually Work?

Business auctions operate through two primary channels: traditional in-person events and digital platforms. Traditional auctions require physical attendance and create intense bidding atmospheres, while online platforms like BizBuySell and BusinessBroker.net reach broader buyer pools without geographical constraints. Digital auctions now dominate the market, according to industry research from the International Business Brokers Association.

Traditional vs Online Auction Platforms

Traditional auctions demand physical presence and create high-pressure environments where bidders compete face-to-face. These events work well for unique assets but limit participation to local buyers. Online platforms eliminate geographical barriers and allow sellers to access global buyer networks. Digital auctions provide detailed documentation, secure communication channels, and automated bid tracking that streamlines the entire process.

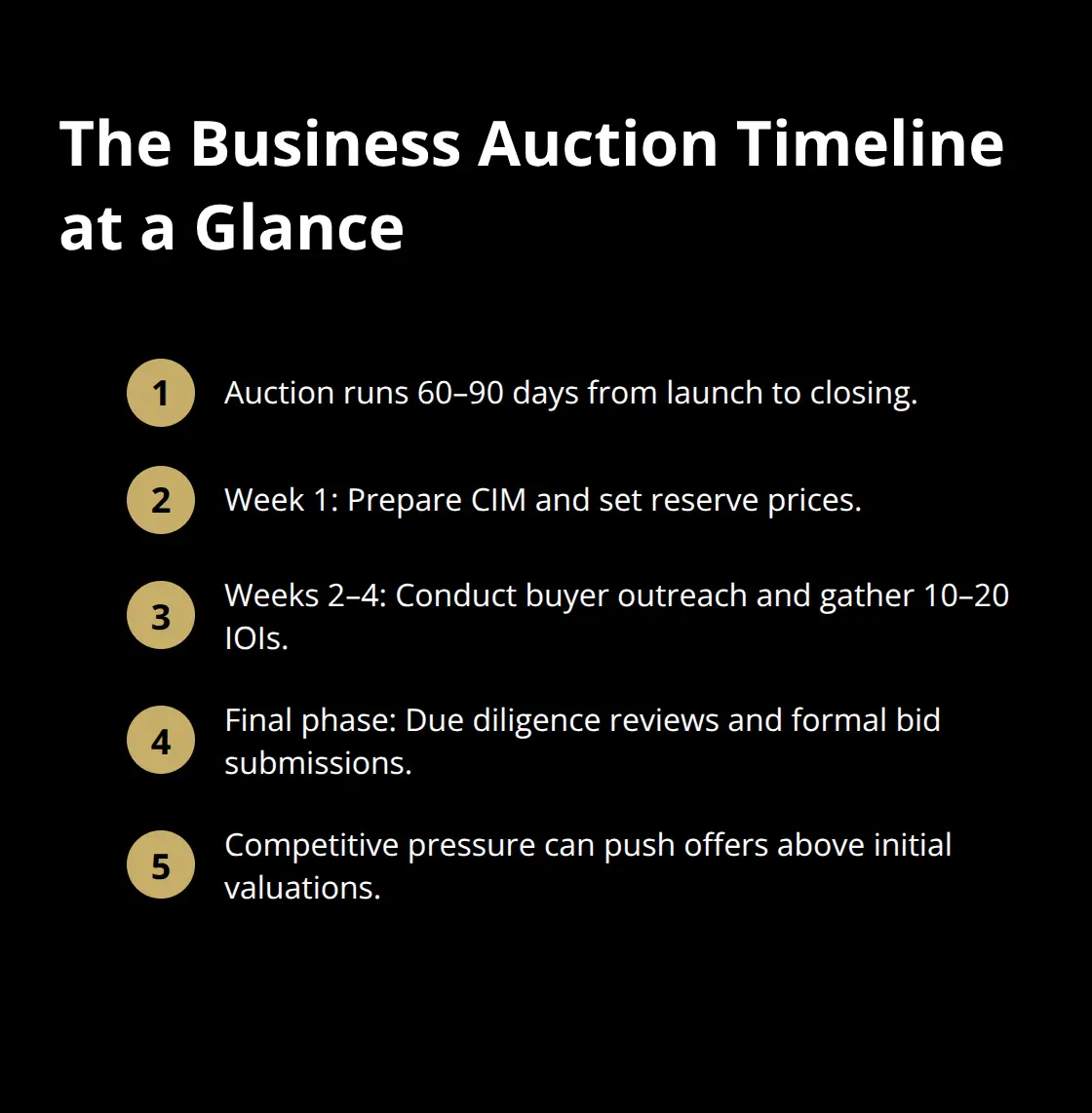

The Auction Timeline and Key Milestones

The typical business auction spans 60 to 90 days from launch to closing. Week one involves creating the Confidential Information Memorandum and setting reserve prices (minimum acceptable bids). Weeks two through four focus on buyer outreach and generating 10 to 20 Indications of Interest from qualified bidders.

The final phase includes due diligence reviews and bid submissions, with serious buyers often submitting offers above initial valuations due to competitive pressure.

Which Businesses Thrive in Auctions

Mid-market companies with annual revenues between $10 million and $1 billion perform best in auction settings. Manufacturing businesses, established service companies, and technology firms with recurring revenue attract multiple bidders. Companies that require owner involvement for daily operations struggle in auctions, while scalable businesses with strong management teams generate fierce bidding wars. Niche markets with limited buyer pools should avoid auctions entirely, as insufficient competition leads to disappointing results.

The competitive nature of auctions creates distinct advantages that traditional sales methods cannot match, particularly when multiple qualified buyers enter the bidding process. For owners considering selling your entire business, auctions provide a transparent path to maximize value through competitive bidding.

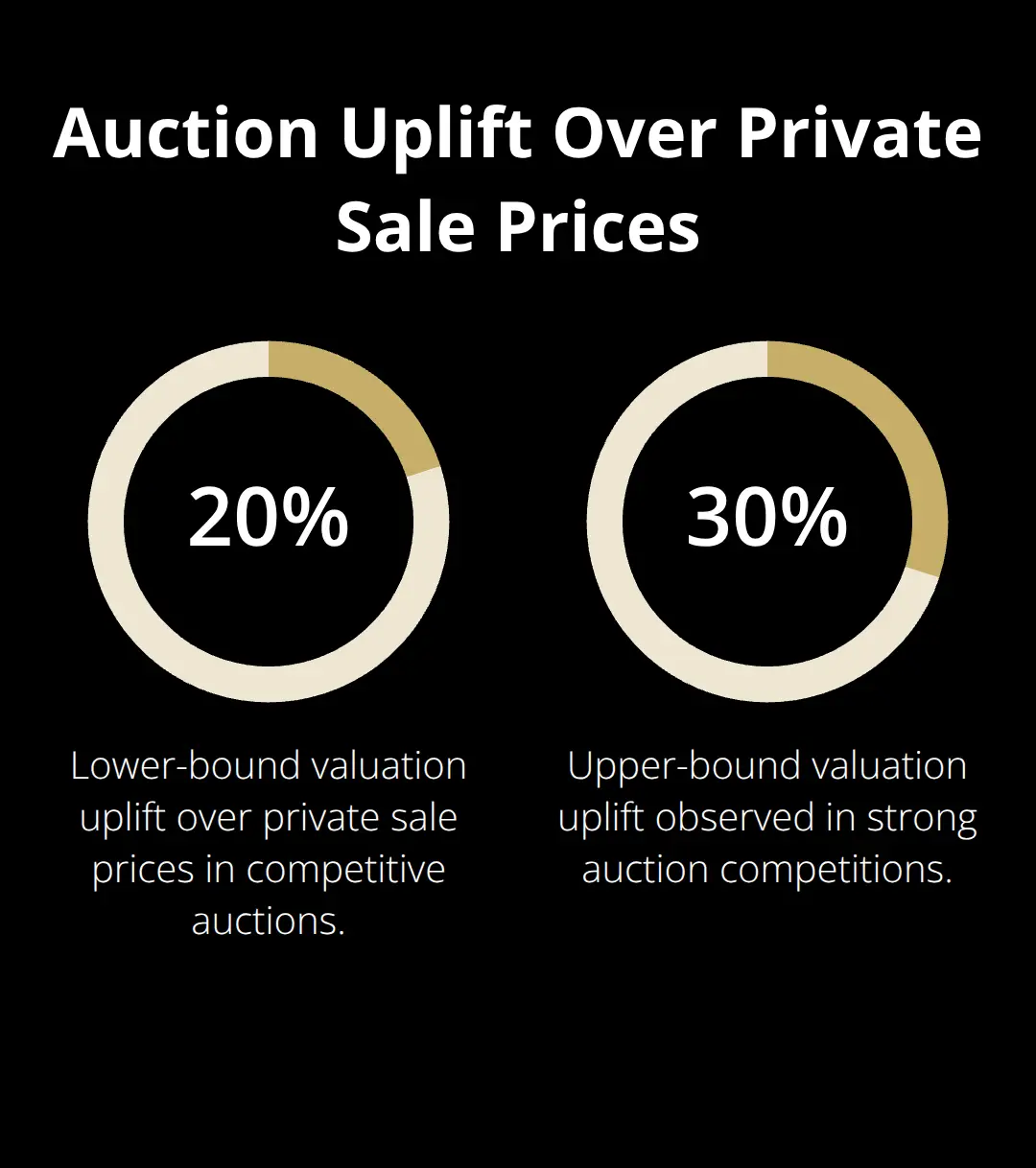

Why Auctions Generate Higher Sale Prices

Auction environments push business valuations 20 to 30 percent above private sale prices through psychological pressure and competitive dynamics. Multiple buyers compete for the same asset, and fear of missing out drives bids beyond rational financial limits.

The National Bureau of Economic Research documented that competitive bidding is associated with fixed price contracts while cost plus contracts are frequently negotiated between a buyer and contractor, showing how competitive scenarios differ from negotiated sales.

Auction Speed Beats Traditional Sales

Traditional business sales drag on for 12 to 18 months with uncertain outcomes, while auctions close within 60 to 90 days with definitive results. This compressed timeline forces serious buyers to act quickly rather than prolong negotiations that often collapse. SIGMA Auction reports that their structured process eliminates the delays that plague conventional sales, with clients like Weaver Popcorn generating over $1 million through accelerated auction timelines. The urgency creates momentum that keeps deals moving toward completion rather than stalling in endless back-and-forth discussions.

Market Validation Through Multiple Offers

Auctions provide concrete market feedback through competing bids rather than single-buyer opinions about business value. When 10 to 20 qualified buyers submit Indications of Interest, sellers gain real-time market validation of their asking price. The Federal Communications Commission raised $81 billion from spectrum auctions in 2021, demonstrating how competitive bidding reveals true market value. Multiple offers also give sellers negotiating power to select buyers based on terms beyond price, including employee retention commitments or operational continuity guarantees that protect business legacy.

Psychological Factors Drive Premium Prices

Competitive environments trigger emotional responses that push buyers beyond their initial budgets. Research shows that approximately 20% of transactions in sectors like art and real estate occur through auctions, with bidders often paying premiums due to competitive pressure. The winner’s curse phenomenon (where successful bidders overpay due to incomplete information) actually benefits sellers in business auctions. Bidders increase their offers significantly when they see other serious competitors, creating price escalation that benefits the seller.

However, auction success depends on proper execution and market conditions, which brings us to the potential risks and drawbacks that sellers must consider before choosing this path.

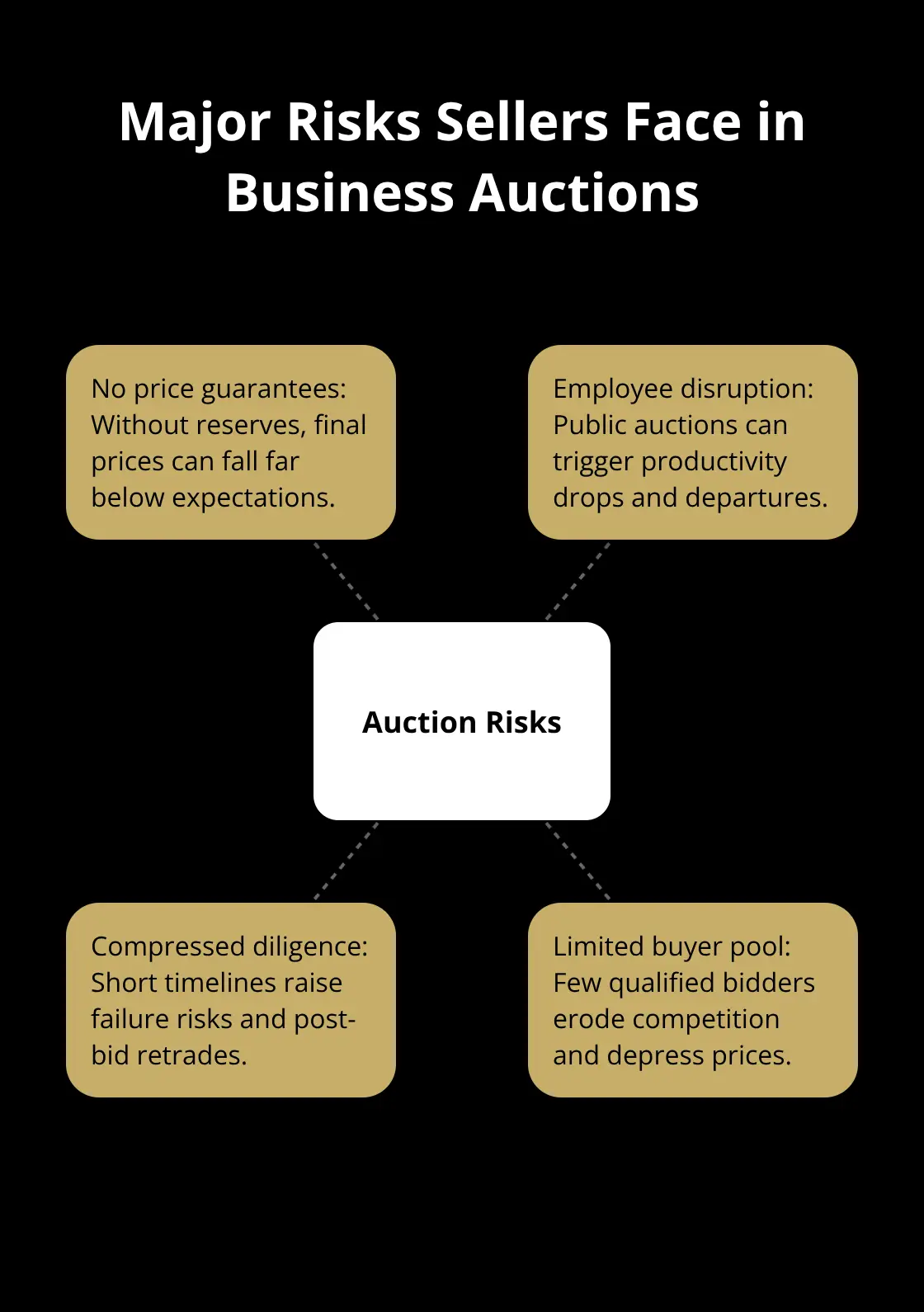

What Are the Major Risks of Business Auctions?

Business auctions carry substantial risks that can devastate unprepared sellers. The most dangerous aspect involves the absence of price guarantees or reserve prices, which means your business might sell for far less than expected. Unlike traditional sales where you control minimum acceptable offers, auction bidders set the final price through market forces.

Companies in niche markets or those that require specialized knowledge often attract only two or three serious bidders, which leads to results that fall short of private sale valuations.

Employee Disruption and Operational Damage

The public nature of business auctions creates immediate operational challenges that traditional confidential sales avoid. Employees discover the sale through auction announcements, which causes productivity drops and key talent departures before the deal closes. Customer relationships suffer when competitors learn about the auction and attempt to poach accounts during the vulnerable transition period. Suppliers may demand immediate payment or revised credit terms once they hear about the sale. SIGMA Auction acknowledges that employee morale and stakeholder confidence can decline if auction details are not handled sensitively, which potentially affects final sale outcomes. Smart sellers must prepare comprehensive communication strategies and consider retention bonuses for critical staff members.

Compressed Due Diligence Creates Deal Risks

The auction timeline forces buyers to complete due diligence reviews in compressed timeframes that increase deal failure rates. Traditional sales allow 120 to 180 days for thorough financial analysis, legal reviews, and operational assessments. Due diligence typically takes 4-8 weeks but can stretch longer for complex transactions. Rushed due diligence often reveals problems after bid submission, which leads to price reductions or deal cancellations that leave sellers without backup options. Sellers must invest heavily in pre-sale preparation and professional documentation to minimize last-minute surprises that derail transactions.

Limited Buyer Pool Reduces Competition

Auction success depends entirely on attracting multiple qualified bidders, but many businesses fail to generate sufficient interest. Complex company structures or highly specialized operations often deter potential buyers who lack industry expertise. Geographic limitations can restrict participation when businesses require local knowledge or regulatory compliance (particularly in licensed industries). Market conditions also affect buyer appetite, with economic uncertainty reducing the number of active acquirers. When only two or three serious bidders participate, the competitive advantage disappears and prices often fall below private sale expectations.

Final Thoughts

Business auctions work best for mid-market companies with annual revenues between $10 million and $1 billion that operate in competitive industries. Your business needs strong management teams, scalable operations, and minimal owner dependency to attract multiple serious bidders. Manufacturing firms, established service companies, and technology businesses with recurring revenue typically generate the most competitive interest in a business auction.

Traditional private sales remain the preferred choice for complex company structures, niche markets with limited buyer pools, or businesses that require specialized industry knowledge. Owner-dependent operations should avoid auctions entirely, as the compressed timeline and public nature create operational disruptions that reduce final valuations. Market conditions also matter – strong economic environments with active buyer markets favor auctions, while uncertain times benefit from patient private negotiations.

We at Unbroker offer modern alternatives to traditional business sales that provide transparent processes and comprehensive support for entrepreneurs. Our platform connects sellers with qualified buyers while eliminating traditional barriers that slow down the exit process. Whether you prefer hands-off assistance or DIY guidance, we support business owners throughout their transition to new ownership.

![Business Sale Disasters That Could Have Been Prevented [Case Studies]](https://vvlpm4xwtlb.c.updraftclone.com/wp-content/uploads/emplibot/sale-disasters-hero-1768631158.jpeg)