Selling a business is one of the biggest financial decisions you’ll make. Yet many owners lose hundreds of thousands of dollars to preventable mistakes.

At Unbroker, we’ve seen countless sale disasters that could have been avoided with better planning and the right approach. This post breaks down what went wrong in real cases and how to protect yourself.

Why Traditional Brokers Cost You So Much More

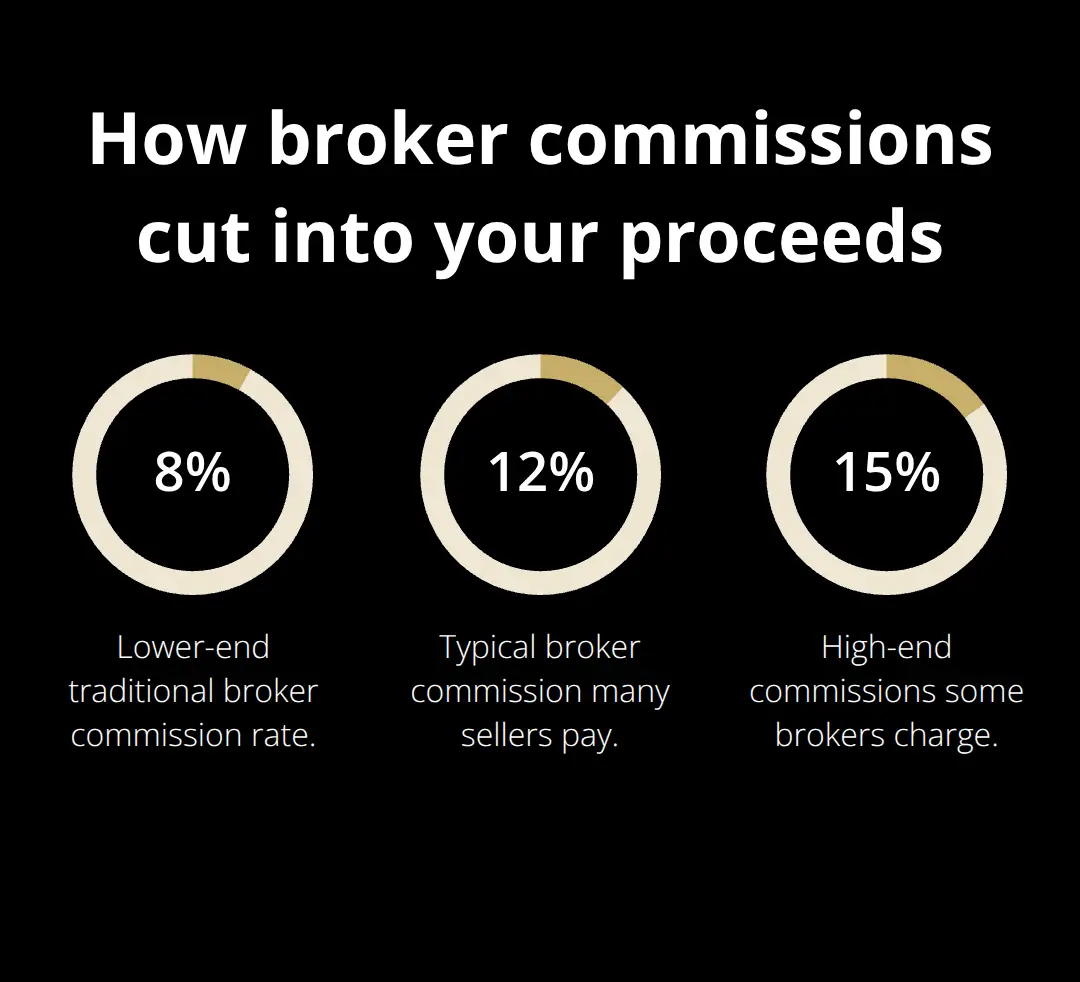

Commission Fees That Drain Your Sale Proceeds

Traditional business brokers charge 8% and 12% of your sale price, with some reaching 15%. Sell a $2 million business, and you hand over $160,000 to $300,000 in commissions alone. These fees come straight from your proceeds, reducing what you actually take home.

Hidden broker costs beyond commission fees multiply the damage. Many brokers charge success fees only if they find the buyer, yet they still bill you for market research, advertising, travel, and administrative work regardless of outcome. One business owner paid a broker $45,000 upfront for a business that never sold within the broker’s timeline-and the broker kept the full amount.

The Opacity Problem: You Don’t Know What You’re Getting

Traditional brokers rarely show you how they market your business or who they actually contact. You never learn the size of their buyer network, how many qualified prospects they’ve reached, or why certain buyers passed. This opacity makes it impossible to know if your broker truly works hard or simply waits for offers to arrive.

Brokers typically work with the same buyers repeatedly, which limits your exposure to fresh opportunities. Businesses using multiple marketing channels sold 40% faster than those relying on a single broker arrangement. Slower timelines hurt you because market conditions shift, buyer interest fluctuates, and every month of delay increases your carrying costs and weakens your negotiating position.

Misaligned Incentives That Hurt Your Bottom Line

Traditional brokers earn commission regardless of sale price, so they prioritize speed over maximum value. They control how your business gets presented to buyers, which means you have minimal influence over the narrative or which terms get discussed first. This misalignment means your broker’s interests and yours often conflict.

The broker controls the buyer relationship entirely, leaving you sidelined during critical negotiations. You lose leverage because you can’t directly shape how prospects perceive your business or respond to offers. This arrangement favors quick closings over deals that maximize your return.

A Better Path Forward

Modern platforms now offer transparent alternatives that eliminate these cost and opacity barriers. Lower fees, direct access to buyer networks, and clear visibility into your sale process change the equation entirely.

What Stops Most Business Sales From Closing

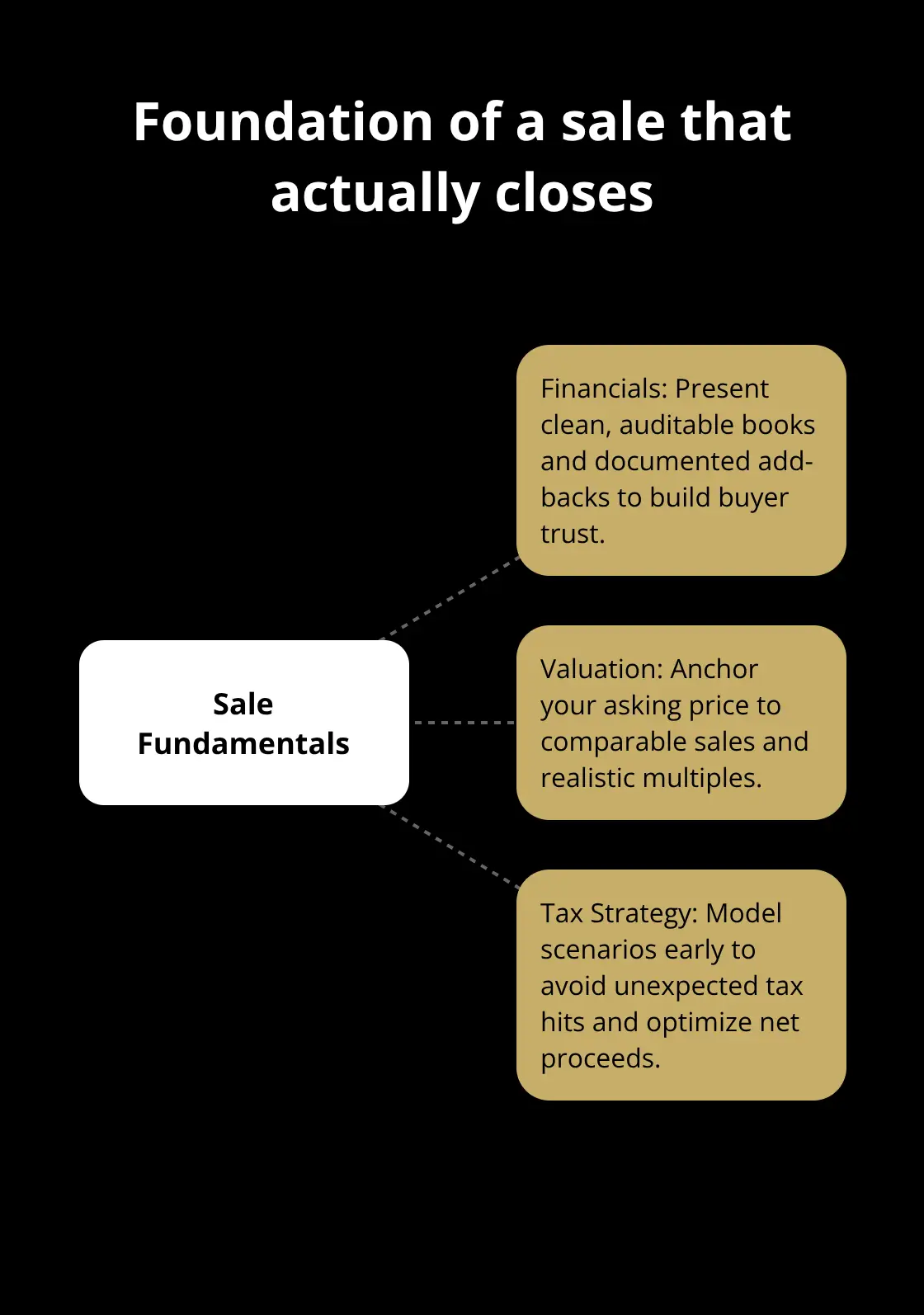

Most business sales fail not because the business lacks value, but because sellers stumble on basics. Financial records that don’t reconcile, valuations disconnected from market reality, and tax structures nobody understood until closing-these preventable mistakes cost owners millions. The difference between a smooth sale and a disaster often comes down to preparation months before you talk to a single buyer. Sellers who get their documentation tight, validate their asking price against comparable sales, and map out the tax and legal implications typically close faster and at better valuations. Those who skip these steps face buyer skepticism, renegotiations that crater deal value, or deals that collapse entirely.

Financial Records Must Tell a Bulletproof Story

Buyers demand clean, auditable financials. If your bookkeeper used multiple accounting systems, mixed personal and business expenses, or never reconciled accounts, you signal to buyers that you don’t run a professional operation. Serious buyers hire accountants to scrutinize your numbers, and discrepancies kill trust faster than anything else.

Start by hiring a professional accountant to audit your books for the past three years, not just the last year. This costs between $5,000 and $15,000 but prevents catastrophic valuation hits during buyer due diligence. Separate every personal expense from business operations-no mixed credit cards, no blurred reimbursements. Buyers will normalize your financials anyway, but if you do it first with full documentation, you control the narrative.

Document every adjustment you make: owners’ compensation, one-time expenses, add-back items like personal vehicle costs. Create a clean EBITDA calculation that shows what a new owner would actually earn. Many business owners claim add-backs that don’t hold up under scrutiny-make sure yours do. If you’ve been running off-the-books revenue, stop immediately and bring everything into your official records at least a year before sale. Buyers see right through informal cash businesses, and they’ll demand a massive discount or walk away entirely.

Valuation Without Market Proof Is Just Guessing

Too many owners anchor their asking price to what they think their business is worth or what they’d like it to be worth. This detaches you from reality and wastes months on tire-kickers who were never serious. Before you set a number, research comparable sales in your industry.

If you sell a digital marketing agency with $2 million in revenue, find out what other agencies at that revenue level sold for in the past two years. Industry databases like Pitchbook and Preqin track deal multiples by sector, and working with someone who understands your space matters enormously. Most small to mid-market businesses sell at multiples that depend on company size, profitability, growth prospects, and industry. A SaaS company with strong recurring revenue might command 8 to 10 times EBITDA, while a service business with customer churn might sell at 2 to 3 times.

Price too high and you’ll attract only low-quality offers and waste time negotiating with buyers who don’t have real conviction. Price too low and you leave money on the table that you’ll never recover. Comparable sales data should anchor your number, not your ego or financial needs. If you need a specific amount, work backward from market reality rather than forward from your requirement.

Tax Structure Surprises Will Haunt You

Most sellers never discuss their business structure’s tax implications until the final weeks before closing, and that’s when they discover they owe six figures in unexpected taxes. If you operate as an S-corp, a C-corp, an LLC taxed as a partnership, or a sole proprietorship, each structure has different tax consequences during a sale. Some structures trigger double taxation; others create built-in gains that surprise owners at closing.

Get a tax attorney and a CPA involved now, not in month nine of the sales process. They’ll model different sale scenarios, show you the net proceeds under each structure, and help you optimize before you’re locked into a deal. This costs $3,000 to $8,000 upfront but routinely saves owners $100,000 or more. Understanding tax implications of a sale helps you make informed decisions and optimize financial outcomes. If you have deferred compensation, earnouts, or seller financing on the table, model the tax impact of each scenario. Don’t let closing day be the first time you learn what you actually owe.

These three areas-financials, valuation, and tax strategy-form the foundation of a sale that actually closes. Sellers who address them early move forward with confidence, while those who ignore them face the buyer skepticism and deal collapse that plague most failed sales.

The next section shows how modern platforms help you avoid these pitfalls and connect with serious buyers who value a well-prepared business.

How Modern Platforms Eliminate Sale Disasters

The traditional broker model forces you into a box: high fees, no visibility, and zero control over how your business gets marketed. Modern platforms built a different path because too many owners hand over 8–12% in commissions while their brokers sit passively waiting for offers. The math is brutal. On a $3 million sale, that’s $240,000 to $360,000 gone before you see a penny. Modern platforms flip this entirely by stripping out unnecessary middlemen and replacing opacity with real tools that let you stay in control.

Transparent Pricing That Protects Your Proceeds

Traditional brokers hide their true cost structure behind vague success fees and expense charges that appear only at closing. Modern platforms like Unbroker built transparent pricing model in business sales because sellers deserve to know exactly what they’ll pay upfront. Full-service options cost a flat fee upfront and a modest amount after your sale closes-a fraction of what traditional brokers demand. Compare that to a broker charging 10% on a $2 million business: you’d pay $200,000 versus a few thousand dollars. That’s nearly $200,000 more in your pocket. For sellers who want to drive the process themselves, assisted options run monthly fees, giving you expert support without the crushing commission structure. No hidden fees appear at closing. No surprise charges for marketing or administrative work. You know your costs from day one, which means you can calculate your actual net proceeds before a single buyer even sees your business.

Connecting With Serious Buyers Through Better Screening

Traditional brokers work from their existing contact list-usually the same 50 to 100 buyers they’ve worked with for years. That’s a ceiling on exposure. Modern platforms use AI-driven matching to connect your business with a vastly larger buyer network, screening for real purchasing intent and financial capacity before introductions happen. This matters because tire-kickers waste your time and kill momentum.

Serious buyers with proof of funds move deals forward. The platform handles the heavy lifting of vetting, which means you spend time with prospects who can actually close. Confidentiality protections also matter-your business identity stays protected until you choose to reveal it, preventing competitors from learning about your sale or employees from panicking prematurely.

Professional Tools That Replace Expensive Advisors

You don’t need to hire a $15,000-per-month investment banker to sell your business. Modern platforms provide legal document templates, negotiation guidance, and professional marketing materials that let you present your business like a seasoned operator would. These tools handle the structural work that normally forces sellers to hire lawyers and accountants separately. A satisfaction guarantee also means if you’re not confident in your sale progress, you can reassess without losing money to sunk costs. The combination of lower fees, transparent pricing, and professional-grade support changes the entire economics of selling.

Final Thoughts

The pattern across failed business sales is clear: owners who prepare thoroughly and stay in control close better deals, while those who hand everything to a traditional broker lose money to excessive fees and waste months on slow timelines. Financial records that tell a clean story, a valuation grounded in market reality, and tax planning done months in advance separate successful sales from the disasters that collapse at the finish line. These fundamentals matter more than any broker’s promises, and when you own these pieces yourself, you move forward with confidence instead of discovering problems during buyer due diligence.

The sales method you choose determines whether you keep most of your proceeds or hand them over to intermediaries. Traditional brokers charge 8 to 12 percent of your sale price, which on a $2 million business means $160,000 to $240,000 gone before you see anything. Modern platforms shift the economics entirely by eliminating unnecessary middlemen and replacing hidden fees with transparent pricing that protects what you’ve earned.

At Unbroker, we built a different model because too many owners lose hundreds of thousands to preventable mistakes and inflated commissions. You get access to a vastly larger buyer network enhanced by AI-driven matching, professional marketing tools, legal document templates, and negotiation guidance that normally costs thousands in separate advisor fees. Start your business sale with Unbroker and keep the proceeds you’ve earned.

![Business Sale Disasters That Could Have Been Prevented [Case Studies]](https://vvlpm4xwtlb.c.updraftclone.com/wp-content/uploads/emplibot/sale-disasters-hero-1768631158.jpeg)