Selling your business without a broker is possible, but it requires preparation and strategy. At Unbroker, we’ve seen first-time sellers succeed by understanding their valuation, organizing their finances, and marketing effectively.

DIY confidence comes from knowing exactly what your business is worth and presenting it clearly to buyers. This guide walks you through each step so you can sell on your own terms.

What Your Business Is Actually Worth

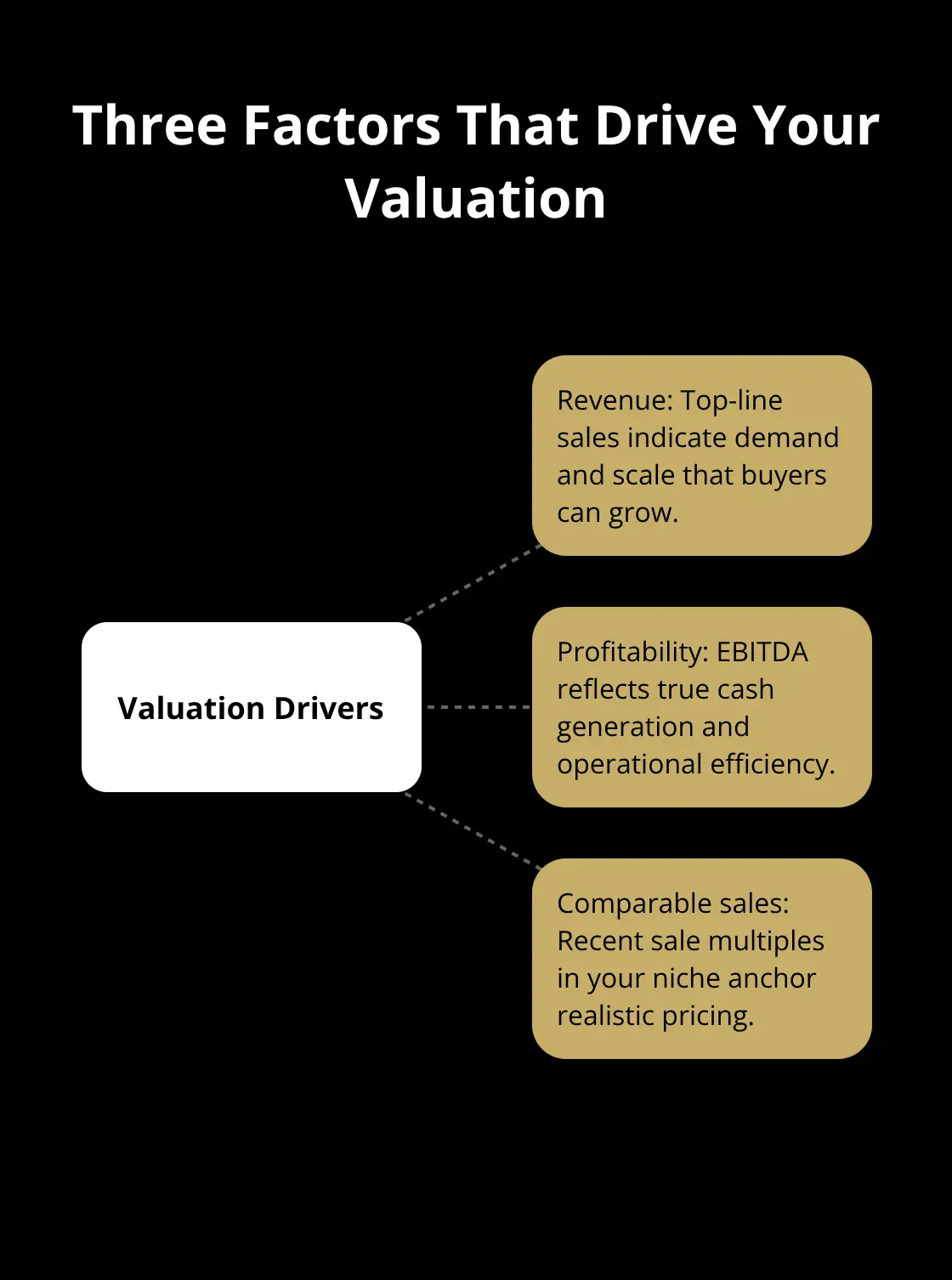

Valuation isn’t about guesswork or what you hope to get. It’s about understanding the real cash your business generates and what buyers will actually pay for it. Most first-time sellers either overprice their business by 30–40% based on emotional attachment or underprice it by accepting the first offer. Neither works. The truth is that your business value depends on three concrete factors: your revenue, your profitability, and what similar businesses in your market have sold for recently.

Calculate Your EBITDA First

Start with earnings before interest, taxes, depreciation, and amortization-EBITDA. This number strips away accounting tricks and shows what your business actually makes. If your business generates $100,000 in revenue but only $15,000 in true profit after all real expenses, your valuation starts from that $15,000 figure, not the revenue. Small DIY and craft businesses typically sell for 2 to 4 times their annual EBITDA, depending on growth rate, customer retention, and how replaceable you are.

A business that generates $20,000 in annual EBITDA with steady customers and systems that don’t depend entirely on you might sell for $50,000 to $80,000. The same business with inconsistent revenue and everything dependent on your personal effort might sell for $30,000 to $40,000. This is why organizing your financial records now matters enormously. Buyers want to see bank statements, tax returns, and expense documentation for the last three years. If your records are messy, buyers assume you’re hiding problems and they’ll either walk away or demand a steep discount.

Research Comparable Sales in Your Market

Start with your last three years of tax returns and bank statements. Add back any personal expenses that a new owner wouldn’t need to pay-your car payment if they won’t use that car, your home office rent if they’ll work elsewhere, or your personal health insurance if the business won’t provide it. This adjusted profit is your true EBITDA.

Next, research what similar businesses have sold for. Look at listings on business sale platforms, ask other business owners in your niche informally, or check industry reports for your specific market. If you sell craft products online, find comparable sales in your market and note their sale prices relative to their revenue.

Apply Your Industry Multiplier

Apply your industry multiplier for business valuation to reach a defensible price. The multiplier will depend on the size of your company, its profitability, its growth prospects, and the industry in which it works. A stable, lower-growth business commands 2 to 2.5 times EBITDA. Multiply your EBITDA by your realistic multiplier. This gives you a starting price that reflects market reality, not wishful thinking.

If you want professional validation without paying broker fees, consider a limited business valuation from an accountant or business appraiser. Many offer valuation reports for $500 to $1,500, far cheaper than broker commissions. This report becomes your negotiating anchor and proves to buyers that your price is rational and researched.

With your valuation locked in, the next step is preparing your business to actually attract those buyers. Clean financials and a clear valuation mean nothing if your operations tell a different story.

Getting Your Business Sale-Ready

Buyers don’t just evaluate what your business makes. They evaluate whether you’ve run it professionally enough to make those numbers believable. This is where most DIY sellers stumble. You’ve calculated your EBITDA and researched your valuation, but if your financial records scatter across three email accounts and a shoebox, no buyer will trust your numbers.

Organize Your Financial Records

Pull together three to five years of complete tax returns, bank statements, and profit-and-loss statements. Organize them chronologically in a single folder, either digital or physical. If you’ve claimed business expenses on personal tax returns, extract those figures and create a clear summary showing what belongs to the business.

Buyers want to see financial records consistency across documents. If your tax return shows $50,000 in revenue but your bank statements show $75,000, that discrepancy kills the deal. Reconcile everything now. Many DIY sellers have never tracked accounts receivable or inventory properly, so complete that work before buyers ask. Create a simple spreadsheet showing your top 10 customers and their purchase history over the last two years.

Show which products generate the highest margins. Show your customer retention rate if you have recurring buyers. This documentation transforms vague claims into concrete proof that your business generates predictable income.

Document Your Operations and Reduce Dependencies

Buyers inspect your actual operations. If you run an online craft business, they’ll check your production facility, your supplier relationships, and whether everything depends on you personally. Document every repeatable process you use. Write down how you source materials, produce items, handle orders, and manage customer service. If a new owner would need to hire someone to do your work, that process needs to exist on paper, not just in your head.

Reduce your personal involvement in daily tasks now. Business dependencies and key person risk significantly impact your business value. Train someone else to handle at least core operations, even if it’s part-time. This proves to buyers that the business can survive without you.

Address Legal and Financial Liabilities

Check that you’ve paid all taxes on time, that your business licenses are current, and that you have no pending lawsuits or disputes with suppliers. If you owe back taxes or have unpaid invoices from customers, resolve them. Buyers will discover these issues during due diligence anyway, and handling them upfront shows professionalism and removes negotiation ammunition from their side.

Create a one-page document listing any outstanding contracts with suppliers or customers, along with their terms and renewal dates. This transparency accelerates buyer confidence.

Build Your Business Profile

Your financial records and clean operations mean nothing if buyers don’t understand why your business matters. Create a business profile that explains what you sell, who buys it, and why customers keep coming back.

Start with a three-paragraph summary. First paragraph: what problem your business solves or what need it fills. Second paragraph: your target customer and why they choose you over competitors. Third paragraph: your growth trajectory over the last three years with specific numbers. If you’ve grown revenue 25 percent year-over-year, state that. If you have 500 active customers with a 40 percent repeat purchase rate, state that.

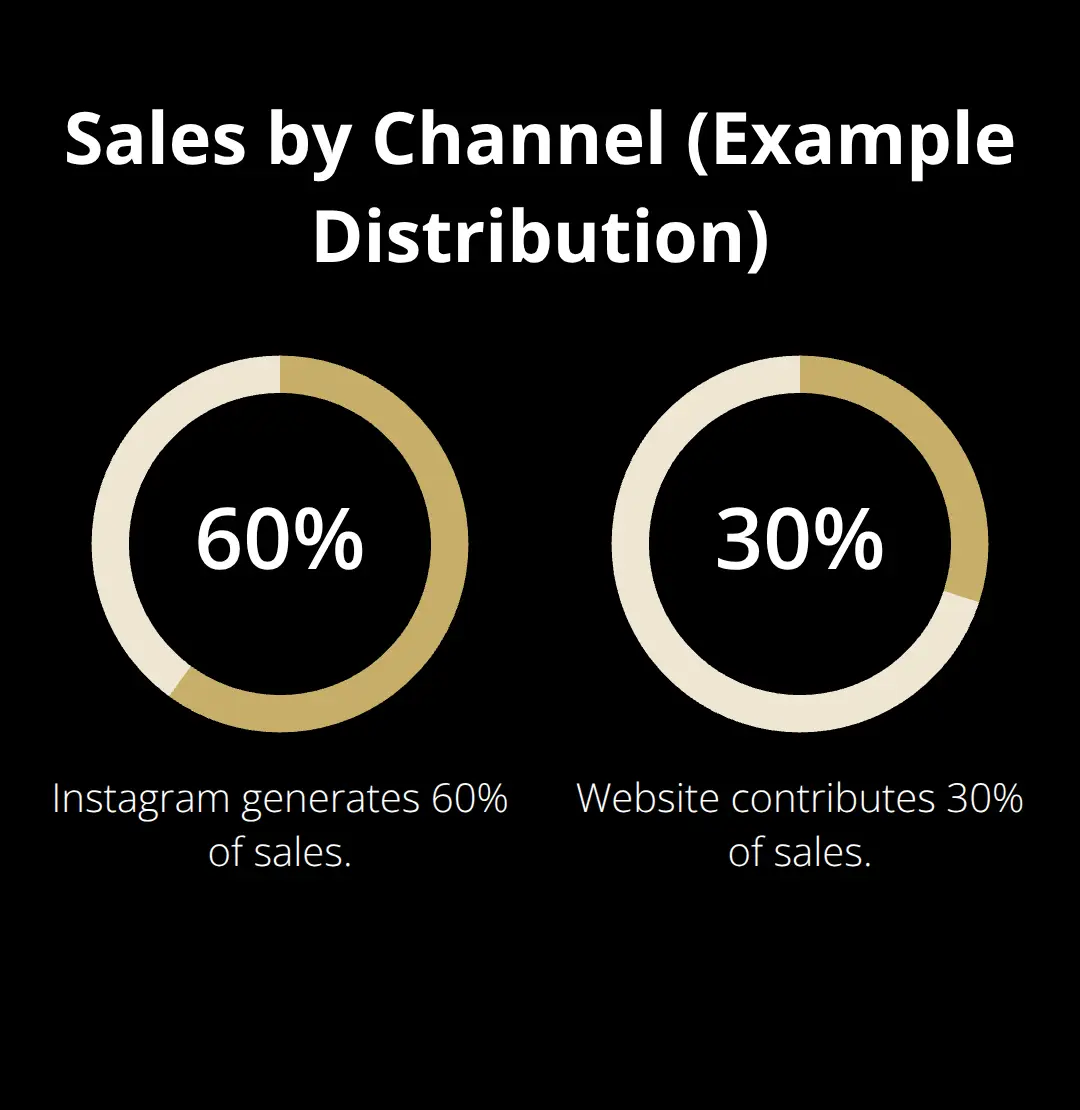

Include your marketing channels and their effectiveness. If 60 percent of sales come from Instagram and 30 percent from your website, document that. Buyers want to know where their revenue originates and whether those channels remain sustainable.

Show your pricing strategy and margins. Explain why your products command their price point. Is it because of brand positioning, quality materials, unique design, or market demand? Back this up with competitive research. If similar products sell for 20 percent less but yours sell faster, that’s valuable information.

Add customer testimonials if you have them. Screenshots of positive reviews or direct quotes from repeat customers provide social proof that buyers can’t argue with. Include your supplier relationships and costs. If you have long-term contracts with reliable suppliers at favorable rates, mention that. If you’ve built strong relationships that a new owner can leverage, document it.

The goal is to show that your business isn’t just a collection of transactions-it’s a system that generates consistent revenue from loyal customers through proven channels and processes. With your operations documented and your story told, the next step is marketing your business to the right buyers who will actually pay what it’s worth.

How to Market Your Business to the Right Buyers

Most DIY sellers make a fatal mistake: they try to sell their business the same way they sell their products. They post on Facebook, hope for the best, and wait for inquiries. This approach fails because business buyers aren’t casual shoppers scrolling social media. They’re serious investors who conduct structured searches for specific opportunities. You need to place your business where these buyers actually look.

Place Your Business on Dedicated Sale Platforms

Business sale platforms like BizBuySell and Shopify Exchange attract qualified buyers actively searching for acquisitions in your category. A featured listing costs between $200 and $500 and dramatically increases visibility compared to organic social posts. Businesses listed on dedicated sale platforms receive 5 to 10 times more qualified inquiries than those advertised only on general channels. Your network matters equally. Email your existing business contacts, industry peers, and former colleagues to announce your sale. Many acquisitions happen through warm introductions because buyers trust referrals more than cold listings. Include a one-page summary with your business profile, EBITDA, and asking price in these outreach emails so someone can forward your information easily.

Present Concrete Evidence of Your Strengths

Your unique selling points separate your business from every other craft or DIY business on the market, and transparency is how you prove those points are real. Buyers are skeptical by default, so avoid vague claims like “we have loyal customers” or “strong margins.” Instead, present concrete evidence. Show your top 10 customer names and their lifetime purchase values. Demonstrate your repeat purchase rate with actual numbers. If 45 percent of customers buy from you more than once, that’s defensible proof of customer loyalty.

Document your supplier relationships and pricing advantages. If you’ve negotiated favorable terms with three key suppliers, that competitive advantage transfers to the new owner and justifies your valuation. Create a one-page competitive analysis showing how your pricing, product quality, or customer service compares directly to three named competitors. This removes ambiguity and shows you’ve thought strategically about your market position.

Build Trust Through Honest Disclosure

Transparency also means disclosing problems upfront. If you’ve had a difficult supplier relationship or a product line that underperformed, mention it honestly with your plan for improvement. Buyers discover these issues during due diligence anyway, and addressing them first builds credibility. Sellers who lead with truth rather than spin earn stronger buyer responses.

Emphasize Predictable Revenue Streams

Your marketing should emphasize your business systems and recurring revenue streams over one-time sales spikes. Show which products or services generate predictable monthly revenue. Show which marketing channels deliver consistent customers. If 60 percent of your revenue comes from repeat customers on a monthly subscription model, that’s far more valuable than a business dependent on sporadic one-time purchases. Quantify everything you can-numbers are the language buyers speak.

Final Thoughts

Selling your business without a broker comes down to three fundamentals: knowing your real valuation, presenting a professional operation, and reaching qualified buyers with honest information. You’ve calculated your EBITDA, organized your financials, documented your processes, and marketed your business on platforms where serious buyers actually search. That foundation builds DIY confidence that translates directly into better offers and faster closings.

Your first sale won’t be perfect-you’ll face unexpected questions, uncomfortable negotiations, and moments of doubt about your asking price. What separates successful DIY sellers from those who struggle is that they’ve completed the work upfront. They know their numbers cold. They explain their business in concrete terms. They’ve reduced their personal involvement so the business stands on its own. Buyers sense this preparation immediately, and it shapes their offers.

We at Unbroker built our platform specifically for sellers like you who want to avoid broker fees without sacrificing professional guidance. Our Assisted Business Sale service provides templates, negotiation assistance, and access to a buyer network at a fraction of traditional brokerage costs. List your business on dedicated sale platforms this week, reach out to your network with your one-page summary, and prepare for buyer inquiries to arrive.

![Business Sale Disasters That Could Have Been Prevented [Case Studies]](https://vvlpm4xwtlb.c.updraftclone.com/wp-content/uploads/emplibot/sale-disasters-hero-1768631158.jpeg)